Nigerian Markets Last Week: New Covid Vaccines Lift Oil Prices, CBN Holds Monetary Rates

The Nigerian Markets report for the week ended January 29, 2020. It captures indexes that gauge performance across a number of financial markets in and outside the country as well as key economic indicators that give a glimpse into the state of the Nigerian economy.

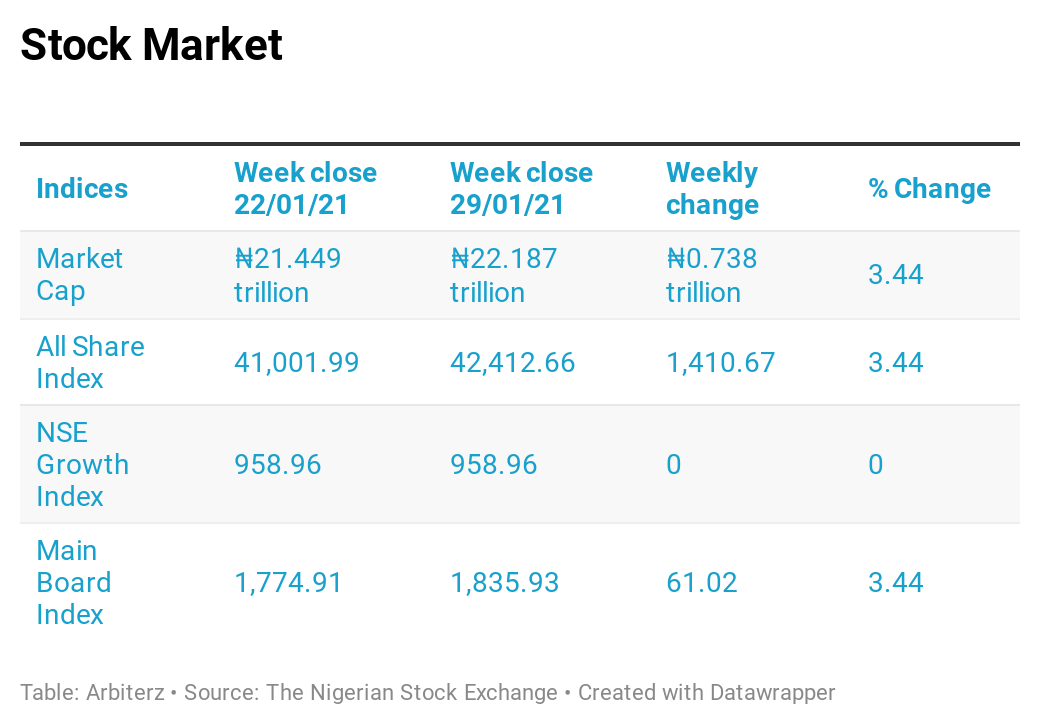

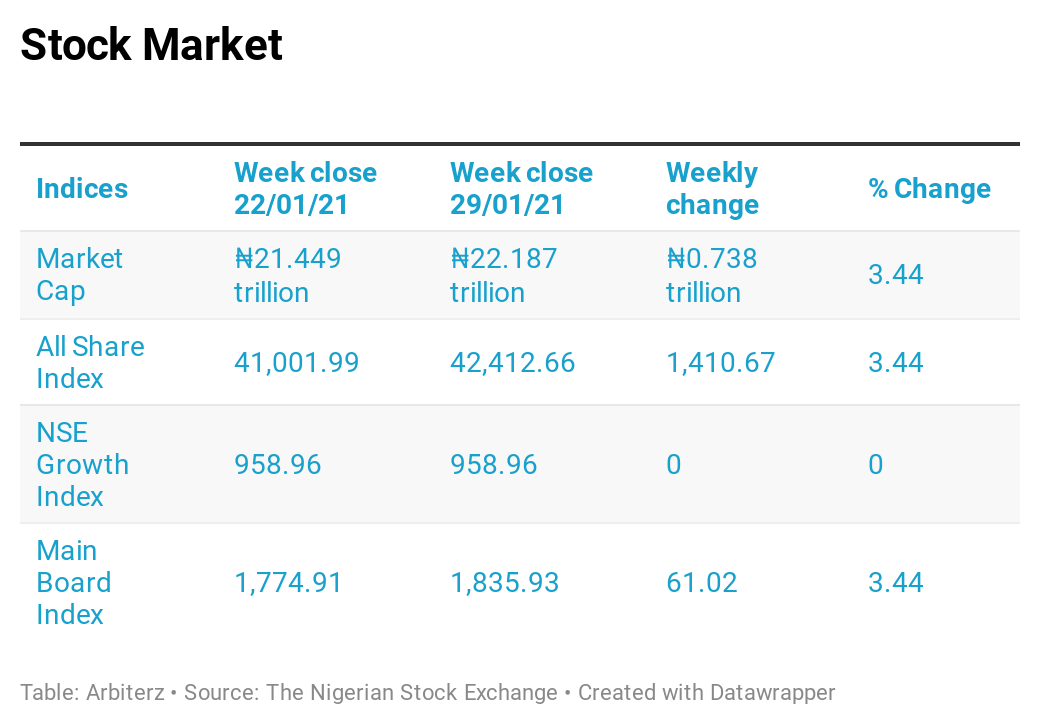

Nigerian stocks ended the last trading session of the week on a bullish note with the benchmark index of the Nigerian Stock Exchange and Market Capitalization rising at the close of the week. Similarly, all other indices finished higher with the exception of NSE Oil/Gas which depreciated by 7.25% while the NSE ASeM and NSE Growth Indices closed flat.

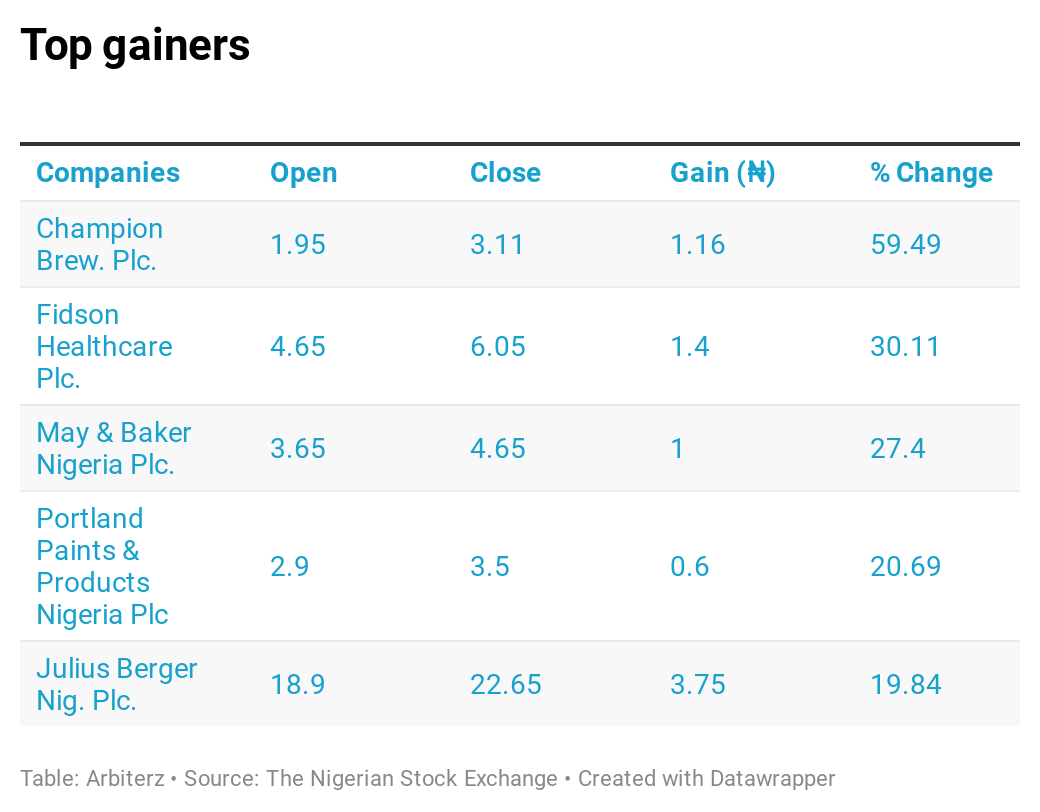

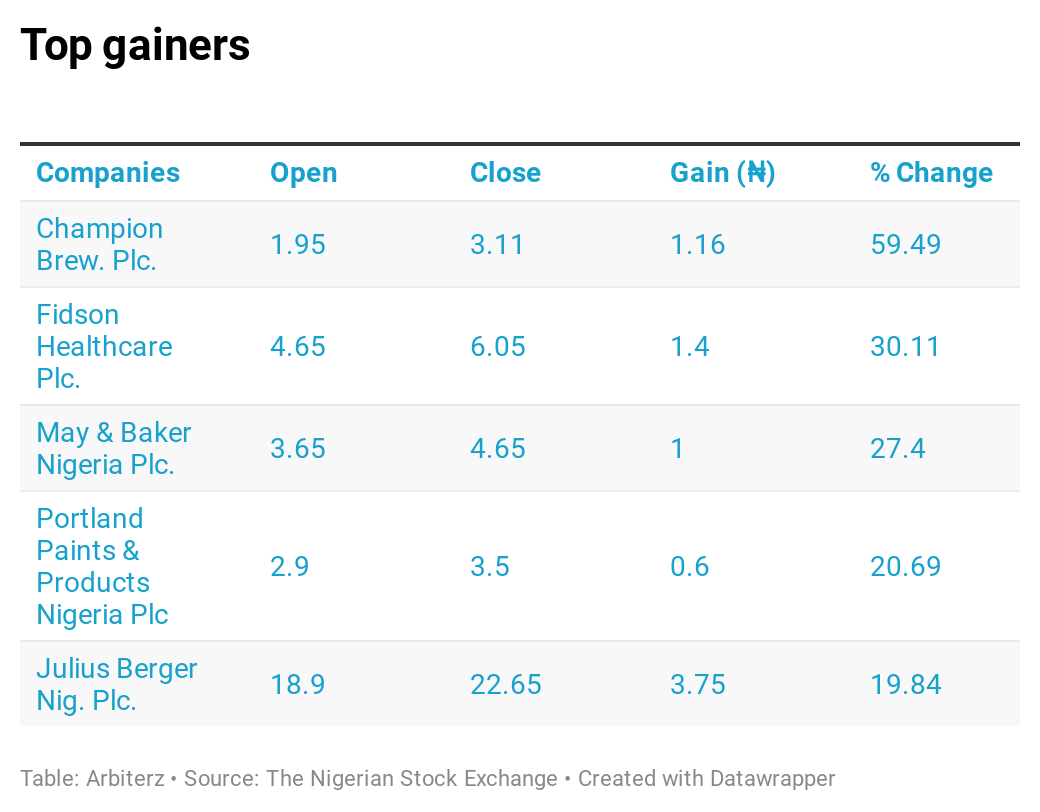

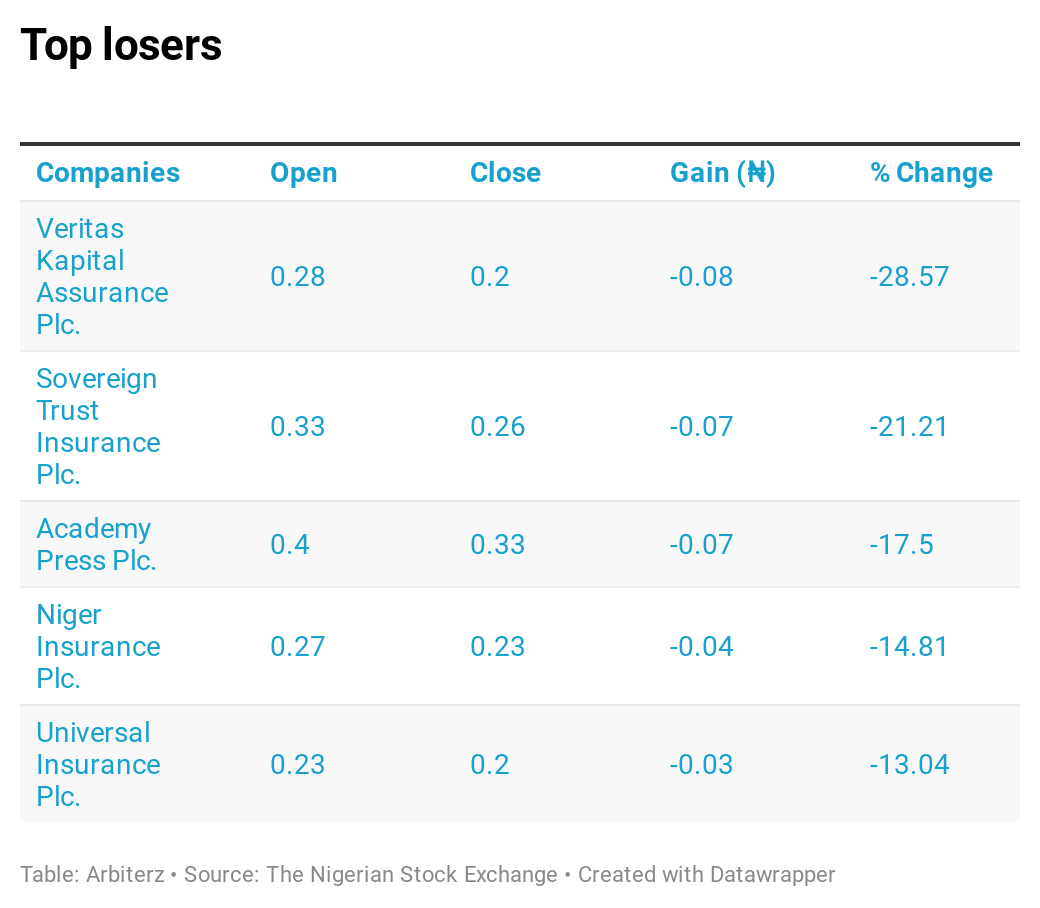

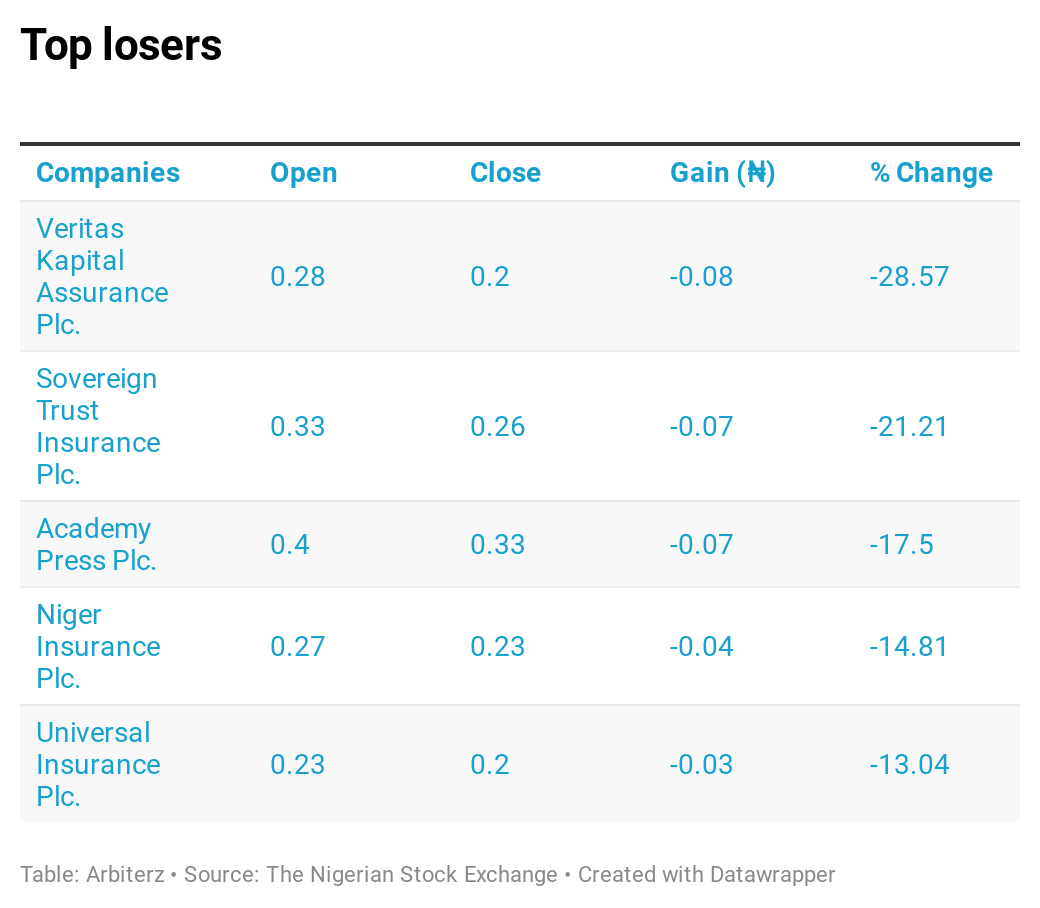

Forty-one (41) equities appreciated in price during the week, lower than Fifty-three (53) equities in the previous week. Thirty-four (34) equities depreciated in price, higher than Twenty-nine (29) equities in the previous week, while eighty-six (86) equities remained unchanged, higher than seventy-nine (79) recorded in the previous week. (Nigerian Stock Exchange)

Also Read: Nigerian Markets Last Week: Oil Plunges on New Covid Restrictions, Bitcoin Falls to 3-Week Low

The exchange rate between the naira and the U.S. dollar for last week closed at ₦480/$1 in the parallel market, falling marginally from the previous week’s close of ₦477 per dollar. Meanwhile, the rate at the NAFEX or Importers & Exporters (I&E) Window stayed constant at ₦394/$1, the same rate as a week earlier. The Central Bank of Nigeria is expected to devalue the naira by as much as 10% this year in the face of lingering dollar shortage in the country, according to a survey by Bloomberg.

- Bitcoin’s price jumped massively Friday, gaining 11% from $33,377 to $37,113 according to CoinDesk 20 data. It hit a 24-hour high of $38,566 before increased sell orders started to take over the market, with the price per 1 BTC later closing at $34,317. Analysts believe Elon Musk’s shout-out to crypto pushed bitcoin’s price upwards. (Coindesk)

- Ethereum was up as well on Friday with the second-largest cryptocurrency by market capitalization gaining by more than $100 from the previous week’s close. Monthly decentralized exchange, or DEX, volumes for major projects in the Ethereum ecosystem have eclipsed $50 billion, according to data aggregator Dune Analytics. (Coindesk)

- Institutional backing is crucial if Bitcoin price will become what Tesla, Facebook, and Google were for the last decade, according to Brett Messing, partner and chief operating officer at Skybridge Capital. (Markets Insider)

- A proposed ban on cryptocurrencies in India has investors nervous. News broke Friday that the country’s Parliament will be considering a government-backed bill that would ban “private” cryptocurrencies but provide a framework for creating an official digital currency to be issued by the Reserve Bank of India. (Coindesk)

- Payments giant Visa could use digital currencies over blockchain in the same way it processes traditional money, CEO Al Kelly said during the company’s fiscal first-quarter 2021 earnings call. The company already works with wallets and exchanges to enable crypto purchases. (Coindesk)

Also Read: Nigerian Markets Last Week: Oil Rallies on OPEC+ Agreement, Cryptocurrencies Record Weekly Gain

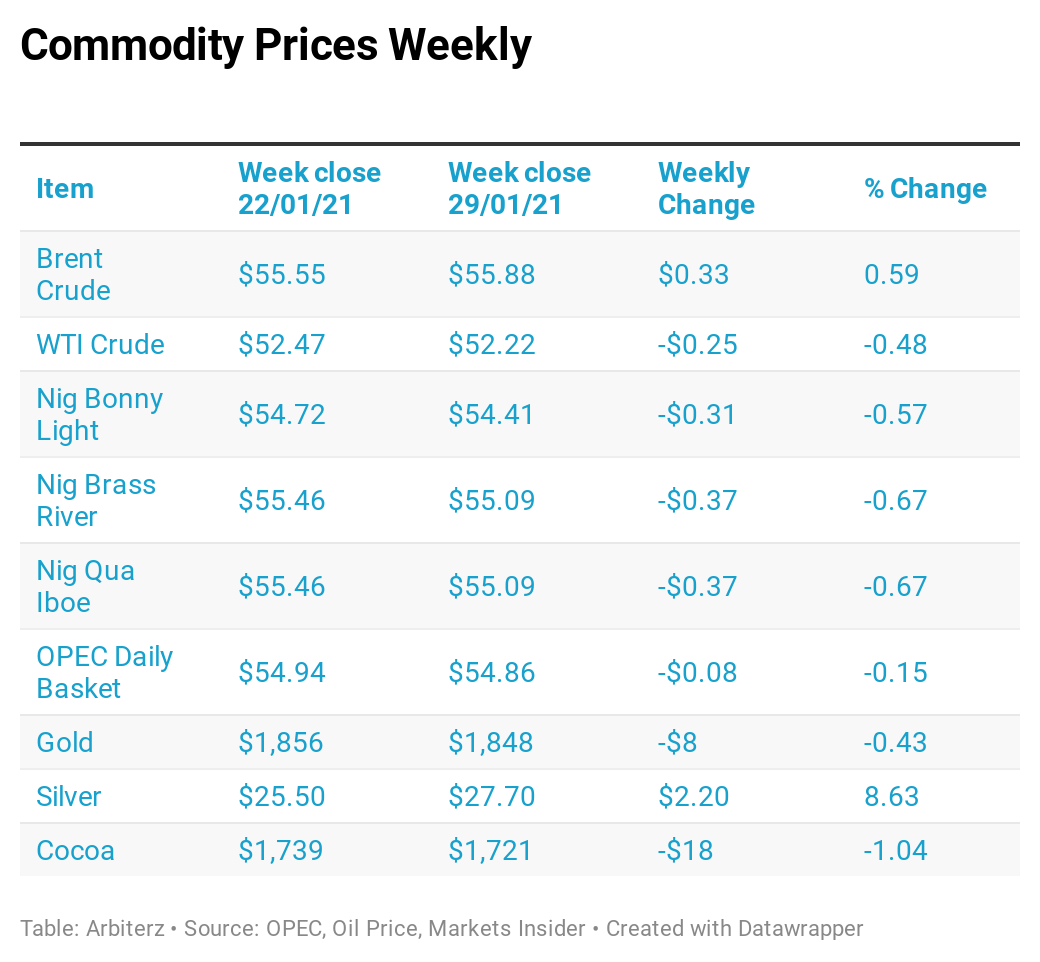

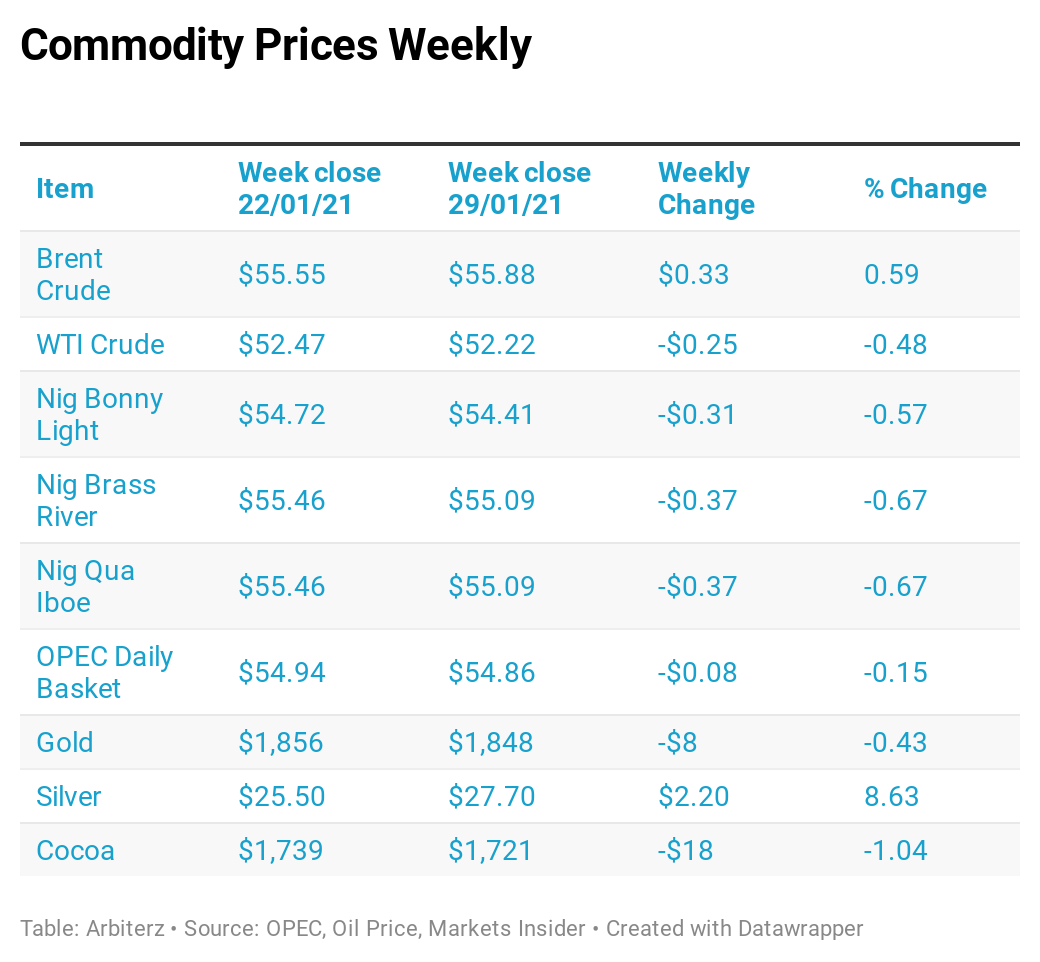

- New vaccines boost oil prices. Hopeful reports on new coronavirus vaccines from both Johnson & Johnson and Novavax added to bullish sentiment in oil markets on Friday as hopes of a return to normal grow.

- Chevron posted a surprise loss on refining hit. Chevron reported a fourth-quarter loss of $665 million, which included poor results from its downstream unit and a $120 million charge related to its takeover of Noble Energy. For the full year, the company lost $5.5 billion.

- IEA launches energy transition group. The International Energy Agency (IEA) launched a global commission to handle the impact on societies from the shift towards renewable energy. The global summit will try to address the fallout from the loss of fossil fuels.

- Biden ends overseas fossil fuel funding. Another Biden executive order seeks to end the financing of fossil fuel projects abroad. Through the Export-Import Bank, and the Development Finance Corporation, the U.S. has funneled billions of dollars to oil and gas projects in other countries in the past five years. Such projects include LNG in Mozambique, the Vaca Muerta shale in Argentina, and financial support for Pemex.

- Iran’s oil exports rose. Iran’s oil exports rose to 710,000 bpd in December, from just 490,000 bpd in November. But the U.S. is also trying to seize an Iranian oil shipment, signaling that the U.S. policy has not significantly changed yet.

- Equinor takes a $982 million write-down. Equinor (NYSE: EQNR) took a $982 million impairment related to its Tanzania LNG project.

- S&P puts oil majors on negative watch. S&P warned that it might cut the credit ratings of multiple oil majors, citing climate and “energy transition” risk. S&P Global Ratings believes the energy transition, price volatility, and weaker profitability are increasing risks for oil and gas producers,” it said in a statement on Tuesday. The warning included ExxonMobil, Royal Dutch Shell, Chevron, and Total. (Oil Price Intel)

- North America rig count up. U.S. Rig Count is up 6 from last week to 384 while Canada’s rose by 2 from last week to 174. (Baker Hughes Weekly Rig Count)

- Gold markets rally. Gold futures traded slightly higher on Friday during a volatile trading session that saw the market soar to its highest level since January 8, only to pullback to nearly unchanged later in the session. The early rally was reportedly fueled by weakness in the equity markets, doubts over European vaccine supply hurting global stocks, and new trial results from J&J’s coronavirus vaccine, which disappointed some investors. (FX Empire)

Also Read: Nigerian Markets Last Week: Oil Gains for Fourth Straight Week Ahead of OPEC+ Output Meeting

Economic Indicators

- GDP – The Nigerian economy is in a recession after gross domestic product contracted for the second consecutive quarter: -3.62% in Q3 after -6.10% in Q2 2020, per data from the National Bureau of Statistics.

- Inflation – Nigeria’s annual inflation rate increased by 15.75% in December 2020, the highest recorded in three years and 0.86% points higher than 14.89% in the previous month.

- Manufacturing –The Central Bank of Nigeria composite Purchasing Managers’ Index for the manufacturing sector fell to 49.6 points in December from 50.2 in November. That indicates a contraction, below the 50 benchmark.

- Monetary Rates – as of the last CBN Monetary Policy Committee in January: Monetary Policy Rate at 11.5%; Cash Reserve Ratio at 27.5%; Asymmetric corridor of +100/-700 basis points around the MPR; Liquidity Ratio at 30%.

- Foreign Reserves – The country’s gross foreign exchange reserves is currently at over $36 billion.