A Note on Access Bank’s Rapid Growth and the Valuation of Nigerian Banks

The valuation of Nigerian banks remains depressed despite fast-paced growth

The last time I analysed Nigerian banks was around this time in 2020. I have been on hiatus since but things change really fast. Some things have caught my attention of late. The first is Access Bank’s latest activities, then the current valuation of Nigerian banks. Let’s start with Access Bank.

Access Bank raised a lot of money in September 2021

It is impossible to ignore Access Bank’s recent adventure in the external debt market. The Bank issued two Eurobonds at $1bn in the space of two weeks in September 2021 — the first being a 5-year $500m issuance priced at 6.123% while the second was a callable (after 5.25 years) perpetual bond of $500m priced at 9.125%. If you are wondering why the second is priced higher, it is because it is a perpetual bond, which might not be repaid forever, with callable feature embedded (early redemption is possible).

One could argue that the rate of 9.125% is rather steep, and there is a high chance that the bank would eventually call it. That would make sense given expectations of lower for longer interest rates in developed economies. Who wants to be stuck paying 9.125% on a debt forever when there might be cheaper options?

A better question would be to ask why the Bank is even issuing debt at such a steep rate during a period of ultra-low interest rates. The world is awash with capital and it is the easiest time to borrow, so why borrow that way?

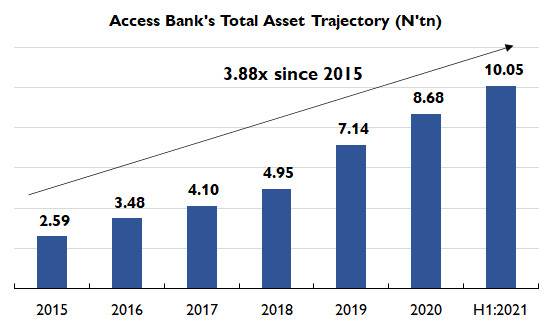

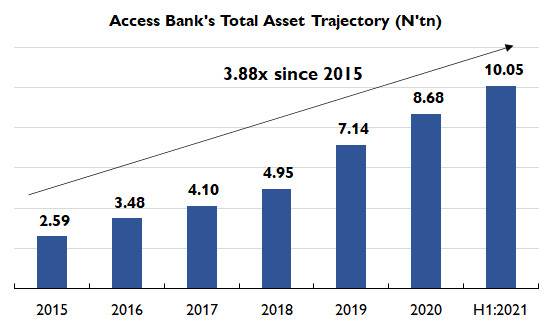

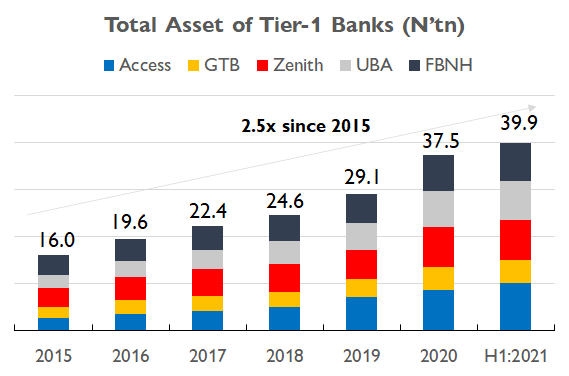

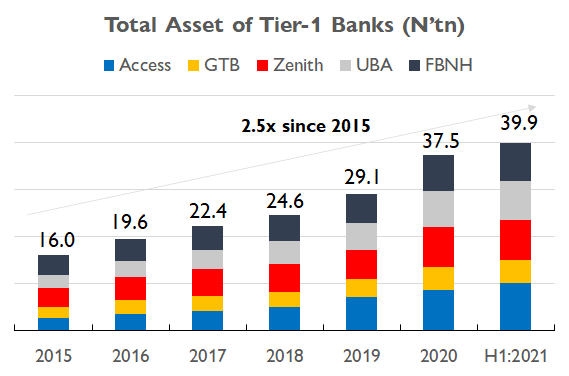

Access Bank is growing at breakneck pace

Access is reaching for the moon. Since the ‘merger’ (read acquisition) with Diamond Bank, the Bank’s balance sheet has exploded. Total assets has more than doubled from around N5.0tn in 2018 to N10.1tn as at half year 2021. The chart below shows the trajectory of the bank’s assets. The closest bank is Zenith with an asset size of N8.5tn. GTB has the lowest asset size of nigerian tier-1 banks at N5.0tn.

Source: Company Financials, Stops&Gaps

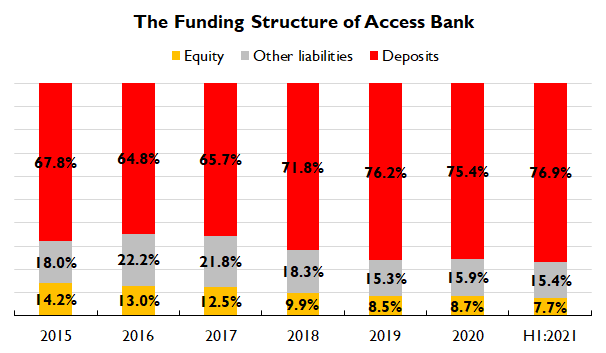

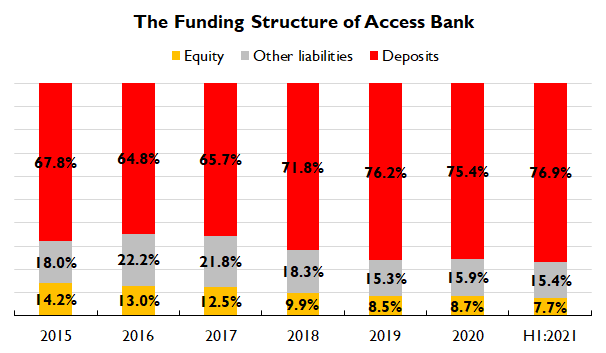

What is funding the acquisition of these assets? In the chart below, you can see that deposits and other liabilities (mostly loans), both accounting for 92.3% of total funding, are dominant. And this is where it gets serious — the portion of equity is a paltry 7.7%. This is the lowest of the big five banks with peers such as GTB (15.9%), Zenith (13.4%), FBNH (9.6%) and UBA (9.1%) doing much better.

Source: Company Financials, Stops&Gaps

Now is this funding structure a problem? Not really. In fact, the Bank has been able to improve its cost of funding by mobilising cheap deposits (current account and savings deposits). This is one of the advantages brought by the ‘merger’ with Diamond Bank. The Bank’s cost of fund (what banks pay depositors and other creditors) fell to 3.3% in 2020 from 5.5% in 2018. It was expensive prior to the ‘merger’ because their retail business was not as strong. However, much of that improvement also reflects the low interest environment brought by the CBN’s policies.

While the equity portion of funding is low, the Bank still reported a healthy Capital Adequacy Ratio (CAR) of 21.3% in H1:2021 which is above the regulatory threshold of 16% for systemically important banks (too big to fail). CAR shows us the capacity of the bank to withstand losses from its risk assets (mostly loans, which can go bad).

How much leverage is too much leverage?

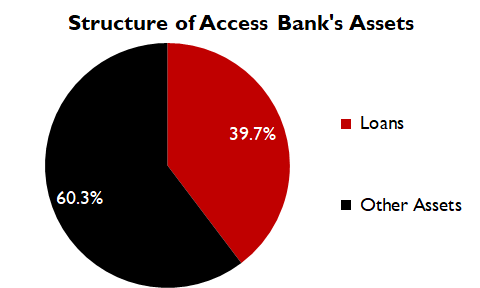

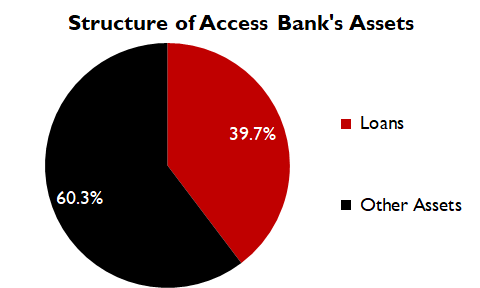

To summarise, despite having the lowest share of equity funding among peers and the largest asset in the market, Access’ CAR is still adequate and competitive. The next big question is how they have been able to achieve this. It is because the loan book of the Bank is tiny at around N4.0tn despite an asset size of N10.1tn. The Bank said some of its risk assets are neutral because they are internal and managed tightly on both ends – think of lending to internal staff that is repaid when the staff get salaries paid by the Bank. Clearly, most of the Bank’s assets — cash, reserves with the CBN and government securities — do not attract a high risk weight that could cause them to provide more capital.

Source: Company Financials, Stops&Gaps

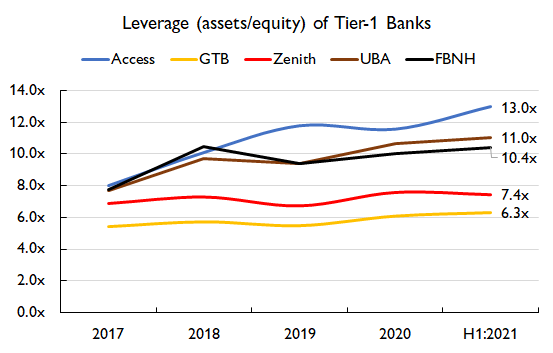

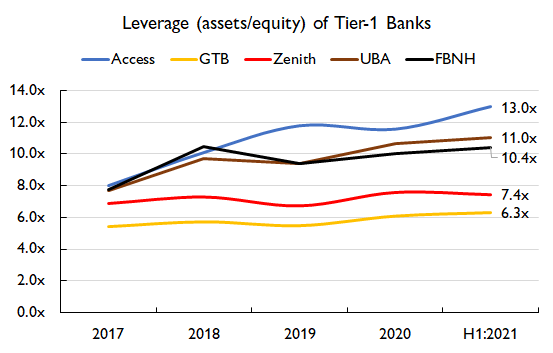

Regardless, I am still a bit worried. It is clear that to drive its expansion, the Bank’s use of leverage has grown rapidly, currently at more than twice GTCO’s levels. In fact, Access Bank has N5.0tn more assets than GTCO but N22.1bn less equity. Is GTCO too conservative or is Access Bank too aggressive? I think the latter is a better view. Another interesting trend is that the big guns — Zenith & GTCO — who create better value for investors by being more efficient and profitable have being more cautious than tier-1 laggards. I am trying not too read too much into that but please make your conclusions. Banking is a business of leverage, which is what distinguishes its operations from other sectors. But how much is too much? The truth is you never know until there is a crisis.

The largest bank in any market should have a healthy capital base, especially given Access’ recent expansion to outside markets that exposes it to a lot of risk. So, yes, the current asset allocation of the bank means they comply with regulatory guidance but they need to do more. The risk based approach to determining capital adequacy has its limitation in how risk is assessed and measured. The thing about disruptive events which carry huge systemic risk is you never see them coming and almost always, they transform our understanding of risk and its measurement.

Source: Company Financials, Stops&Gaps

The recent debt issuances support the bank’s capital base

Access Bank has big ambitions and this is obvious in their recent growth track. But these ambitions and the acquisition of banks across Africa need more leg to stand on, so more equity is needed to provide support. This is why I think the Bank issued the $500m perpetual bond which is treated like equity (tier-1 capital — core measure of financial strength), as well as the $500m subordinated debt (tier-II capital).

Part of the latter is to be used for refinancing, to replace the $300m Eurobond issued in 2016 but maturing in October 2021 (has it matured?). Tier-1 capital is the first line of defense, then subordinated debt which is classified as Tier-II capital. It means if anything goes wrong, the providers of both capital bear losses in that order. You are not expected to take a hit with depositors funds, because they are prioritised.

Improving the capital base also gives the bank comfort in growing its loan book. This is a fair assessment considering that Access has been more aggressive than peers in growing its loan book. The return on cash, reserves and government securities is not that attractive for the bank to continue with this asset allocation. If they want to be aggressive with loan growth, which would deliver more earnings, they most still raise more equity capital to be in a comfortable position. However, I hear they have a sizeable swap position that is giving them substantially more yield than can be obtained in the market. How long will that continue and is that a source of value long-term?

Also Read: Access Bank Gets CBN’s Assent to Metamorphose To a Holding Company

One might wonder why raising debt is a preferred approach than equity from the stock exchange. The market valuation is depressed right now, so that will not make as much sense. Investor appetite is not really that strong right now either. The Bank wanted to raise immediately after the ‘merger’ with Diamond Bank but they had to shelve it in favour of debt. Going forward, one can expect that retention from profits will be used to grow the capital base of the Bank.

Does size really matter?

Size matters, in a way. It means bragging rights, recognition and support, but also more scrutiny. Support in the sense that you can become a source of risk to the system, so regulators will help you if you are in trouble — too big to fail! But you attract more scrutiny because regulators do not want to see you get to that point. It will be messy. From an investor’s perspective, size only matters if it is leveraged for value creation. If your size is not creating value, then it’s really of no benefit to shareholders. In recent history, First Bank is an example of this.

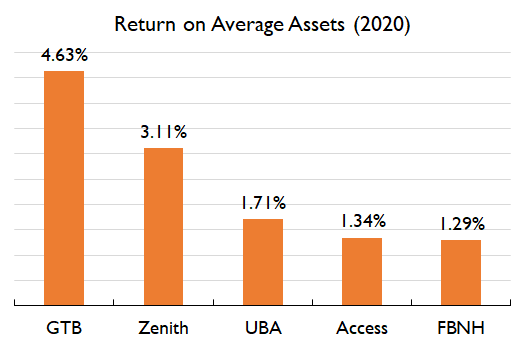

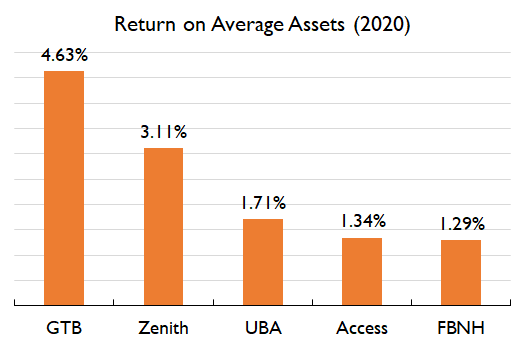

While the asset allocation of Access Bank has allowed it to be comfortable with its equity position, there is a downside. Using the return on average asset as a measure of profitability, the Bank seriously lags behind peers. This should not be surprising for a Bank that keeps over 50% of its balance sheet in low yielding assets.

Source: Company Financials, Stops&Gaps

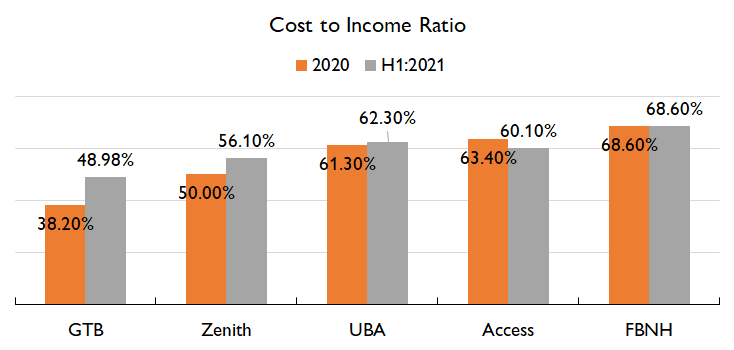

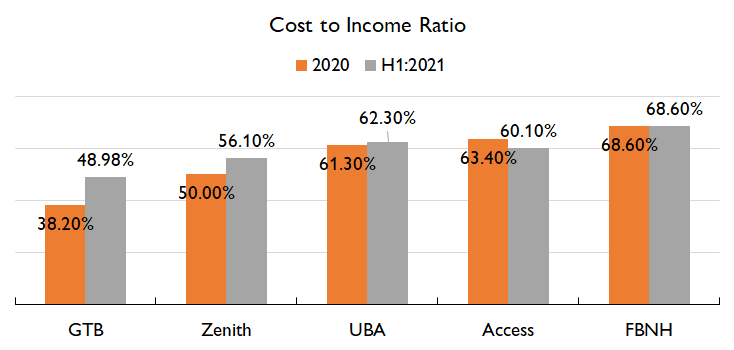

Interestingly, this asset allocation format is similar across Nigerian banks. But a major reason why Access underperforms is its poor cost structure, with cost to income ratio at around 60%+. GTCO and Zenith are doing much better, even though there has been pressure of late, driven by weak income growth.

Source: Company Financials, Stops&Gaps

Access bank’s rapid growth also comes at a cost, because regulatory costs (such as AMCON) are charged on assets. And while the Bank can boast of being the largest by asset size, the bank is still far behind GTCO and Zenith in creating value for shareholders. In 2020, GTCO with N201.4bn in profit delivered almost twice the N106.0bn profit of Access Bank despite having N3.7tn less assets. Early indications from H1:2021 results suggest that Access Bank should have a remarkable year. Interestingly, the high leverage employed is already supporting a strong return on equity (ROE). But at what cost?

A Note on Bank Valuation

The valuation of Nigerian banks remain depressed and stock price performance has been abysmal. I was surprised to discover that GTCO has barely moved of recent. The 52 week stock price range for the bank is N26.95–38.45, but the current price is N29.60.

A look at other banks reveals a similar, but somewhat better, pattern as they trade closer to their 52 week highs. Zenith Bank is currently trading at N24.95 but the 52 week range is N19.30-N28.50. Access Bank is trading near its 52 week high at N9.50 and the range is N7.05-N10.50. Even for this group, this has not been a stellar outing.

Valuations are generally poor. GTB is priced at 1.12x of its book value, which is below its historical valuation levels, but better than its peers due to its high return on equity compared to its cost of equity. Zenith is priced low at 0.68x, Access at 0.43x, and UBA at 0.39x. I have ignored FBNH at 0.57x due to the recent strong increase in its stock price, which has been driven by the acquisition of shares in the battle for the control of the company. Ordinarily, FBNH should not be trading above Access and UBA.

I recall an acquaintance calling Nigerian banks the cheapest assets on earth. With the numbers above, it is hard to argue against that claim.

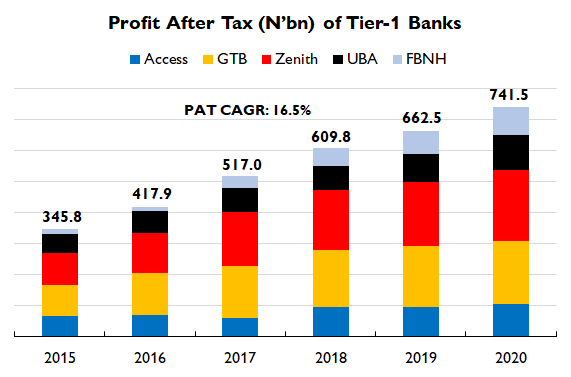

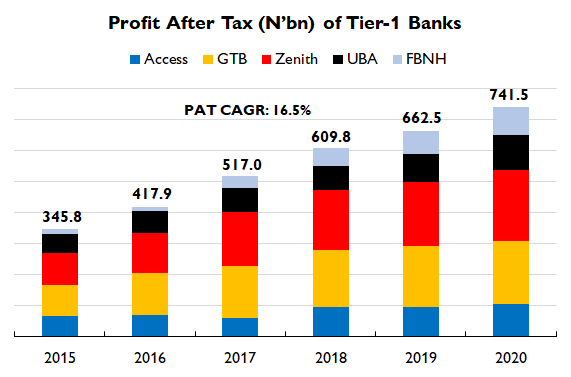

What is driving this poor pricing? Well, it is not because of weak earnings. Even though the economy was in a recession and despite Emefiele’s assault on their earnings, Nigerian banks remained profitable. They also returned a lot of earnings to their investors. At current prices, GTCO’s dividend yield is around 10%, with Zenith (12.0%) and Access (8.9%) also offering what is above the current 364 day treasury bill yield which is not up to 8.0%.

Source: Company Financials, Stops&Gaps

Measured by asset size, the size of these banks has also grown rapidly over the past 6 years. And this is not only concentrated in Nigeria, it includes the African and other regional businesses.

Source: Company Financials, Stops&Gaps

Yet despite being some of the most profitable banks in Africa, they have always been undervalued relative to peers. The macroeconomic environment has been the major culprit. If foreign investors who are the most dominant investors in the market are reluctant to come into Nigeria due to CBN’s capital controls and unfriendly policies, the pricing of Nigerian banks will be affected. Even more so than other sectors due to the banking sector’s high liquidity and their role in the portfolio of foreign investment managers.

Company specific factors also play a part. Some banks are adopting the Holdco structure, which gives them the flexibility to pursue new opportunities. Access and GTB received CBN’s permission for this in 2020. Only the latter has transitioned with the newly formed GTCO. Since its transition, investor interest in the Bank has been tepid. I hear the bank has been slow in implementing its strategy and communication has been underwhelming. Meanwhile, GTCO’s earnings has been weak of late, and this has not inspired confidence. This is not financial advice, but at current prices, GTCO looks sweet.

It is a very interesting sector to watch and I will continue to do so.