Nigerian Markets Last Week: Brent Nears $70 After OPEC+ Surprise

The Nigerian Markets report for the week ended March 5, 2021. It captures indexes that gauge performance across a number of financial markets in and outside the country as well as key economic indicators and events that give a glimpse into the state of the Nigerian economy.

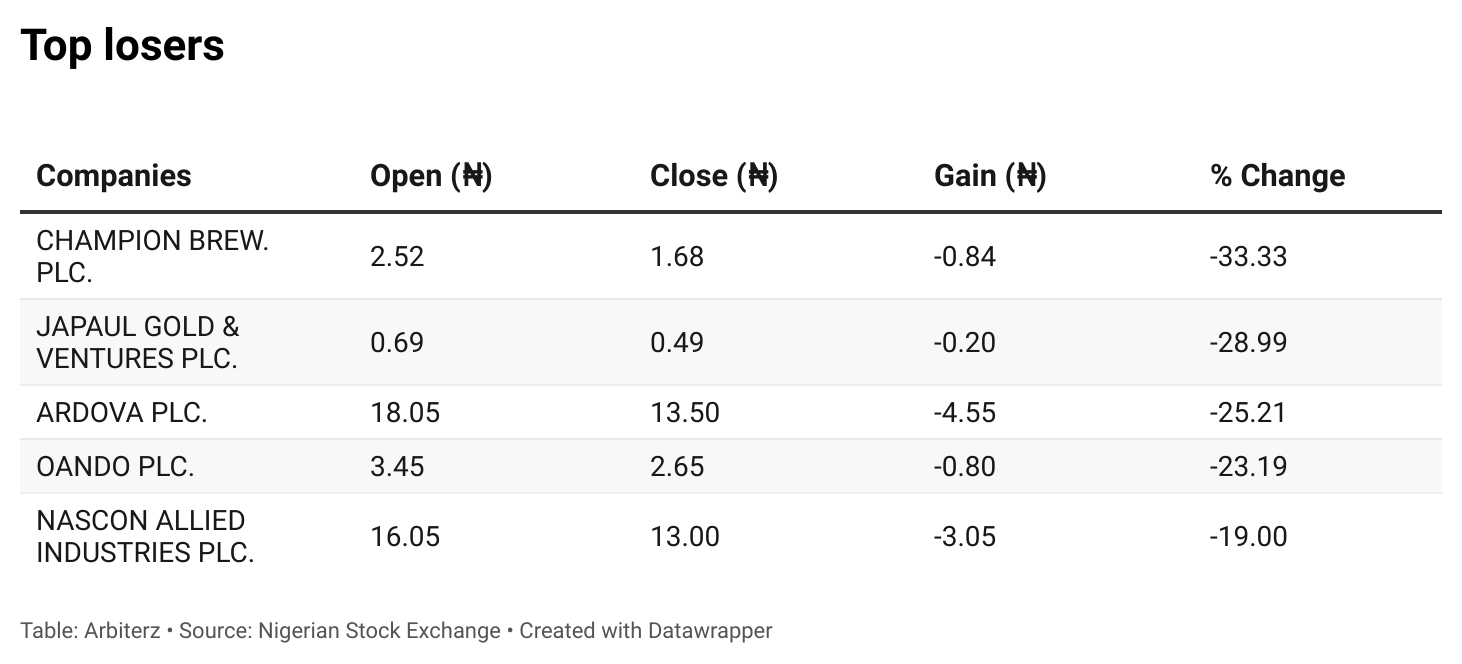

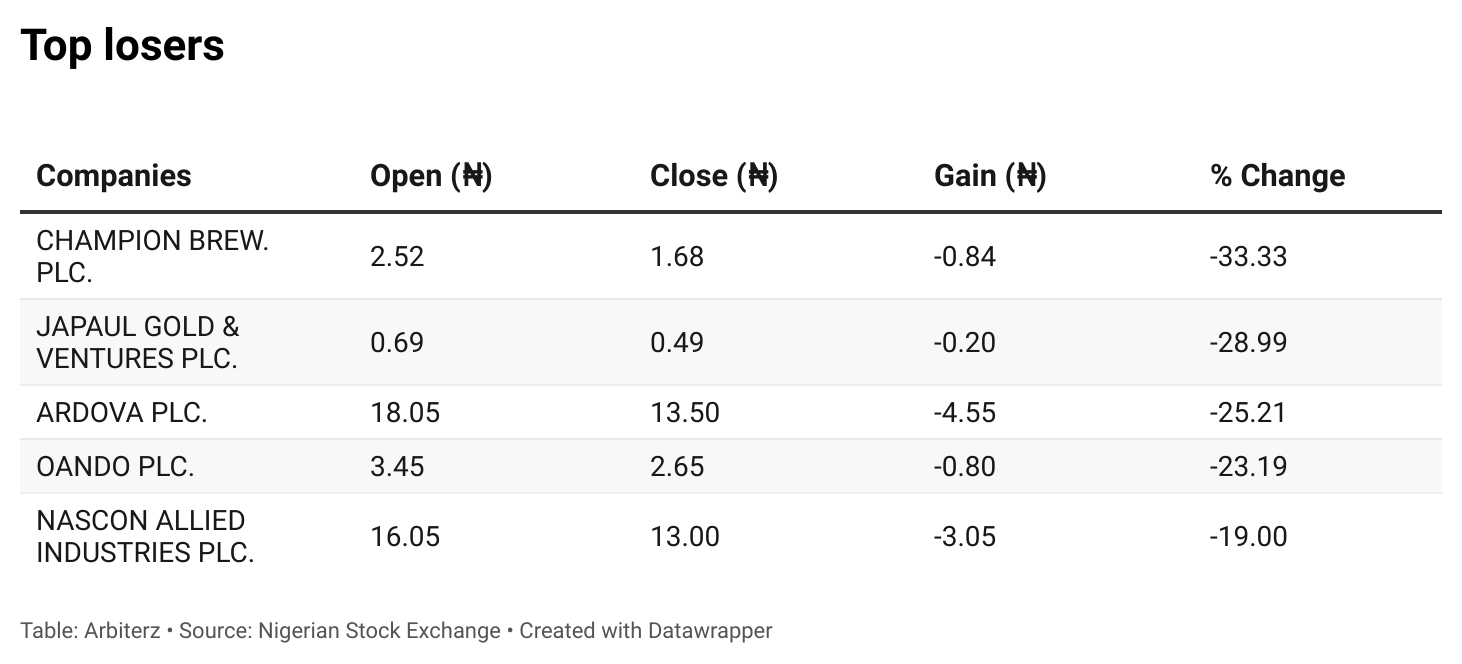

Nigerian stocks maintained a bearish trend at the end of last week with the benchmark index of the Nigerian Stock Exchange and Market Capitalisation falling at the close of the week.

All other indices finished lower with the exception of NSE Industrial Goods and NSE Sovereign Bond Indices which rose by 1.39% and 0.07% while the NSE ASeM Index closed flat. (Nigerian Stock Exchange)

Additional units of the Federal Government of Nigeria (FGN) Bonds issued in February 2021 were listed on The Nigerian Stock Exchange on Thursday, 4 March 2021.

The NSE launched its e-Filing Portal, X-Filing, on Tuesday, March 2, 2021. (NSE)

Also Read: Nigerian Markets Last Week: Oil Prices Rally Above $60

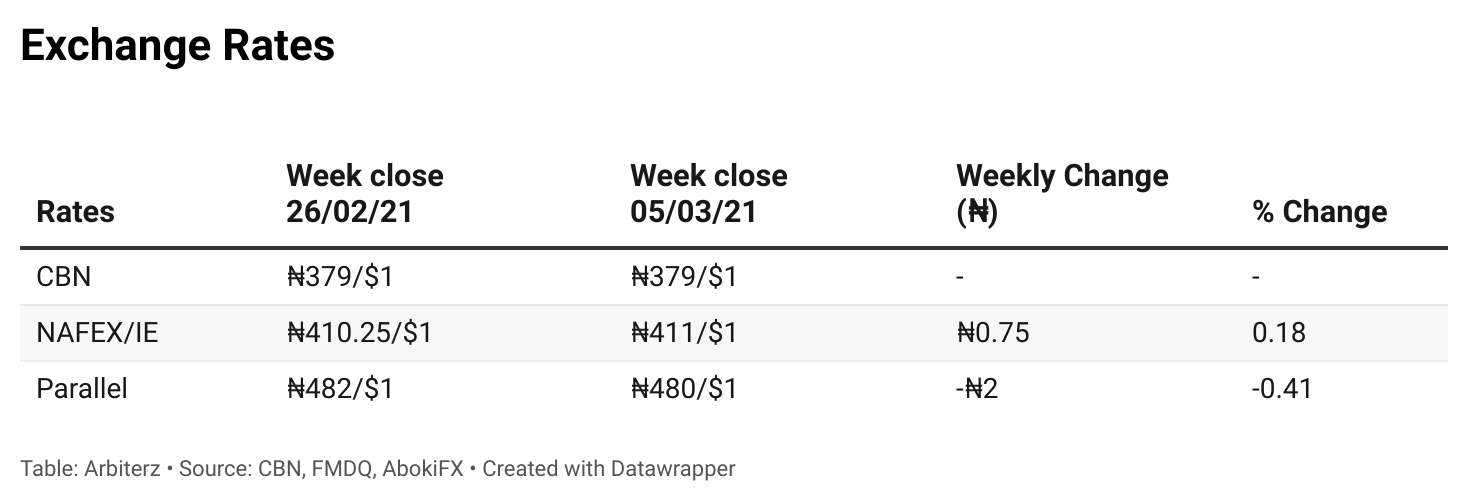

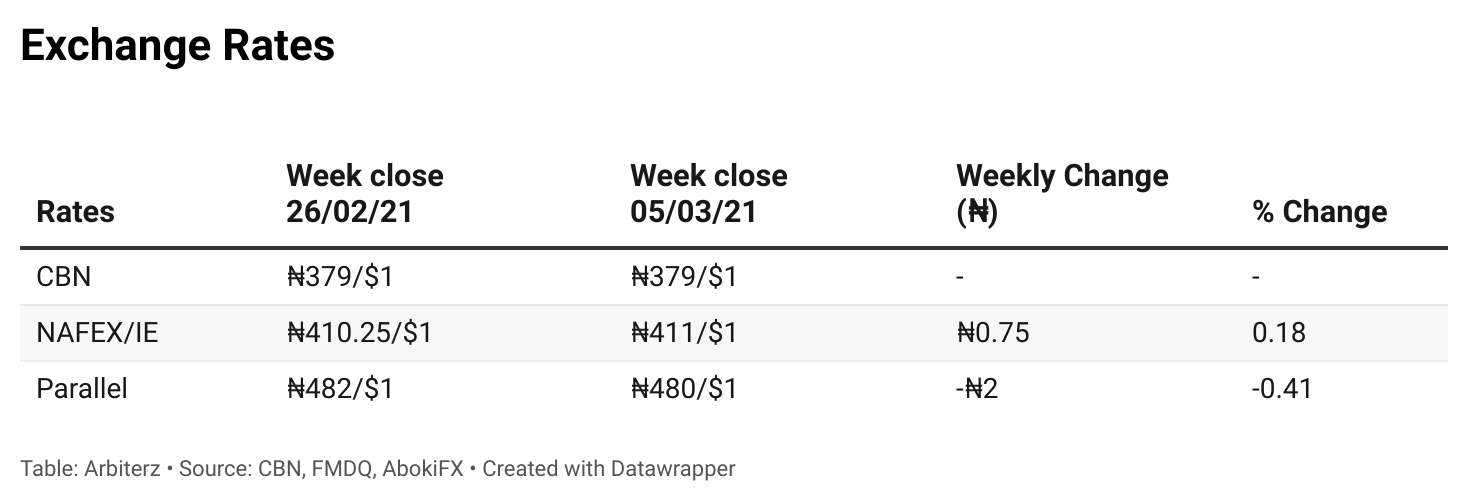

At the parallel market, the exchange rate between the naira and the U.S. dollar for last week closed at ₦480/$1, a slight appreciation of ₦2 compared to the previous week’s close. Meanwhile, the naira fell by ₦0.75 at the NAFEX or Importers & Exporters (I&E) Window compared to the previous week.

Bitcoin ended the first week of March with little fanfare as the market reset after the prior week’s 21% plunge. (Coindesk Market Wrap)

Also Read: Nigerian Markets Last Week: Bitcoin Briefly Above $56k, Nigeria Exits Recession

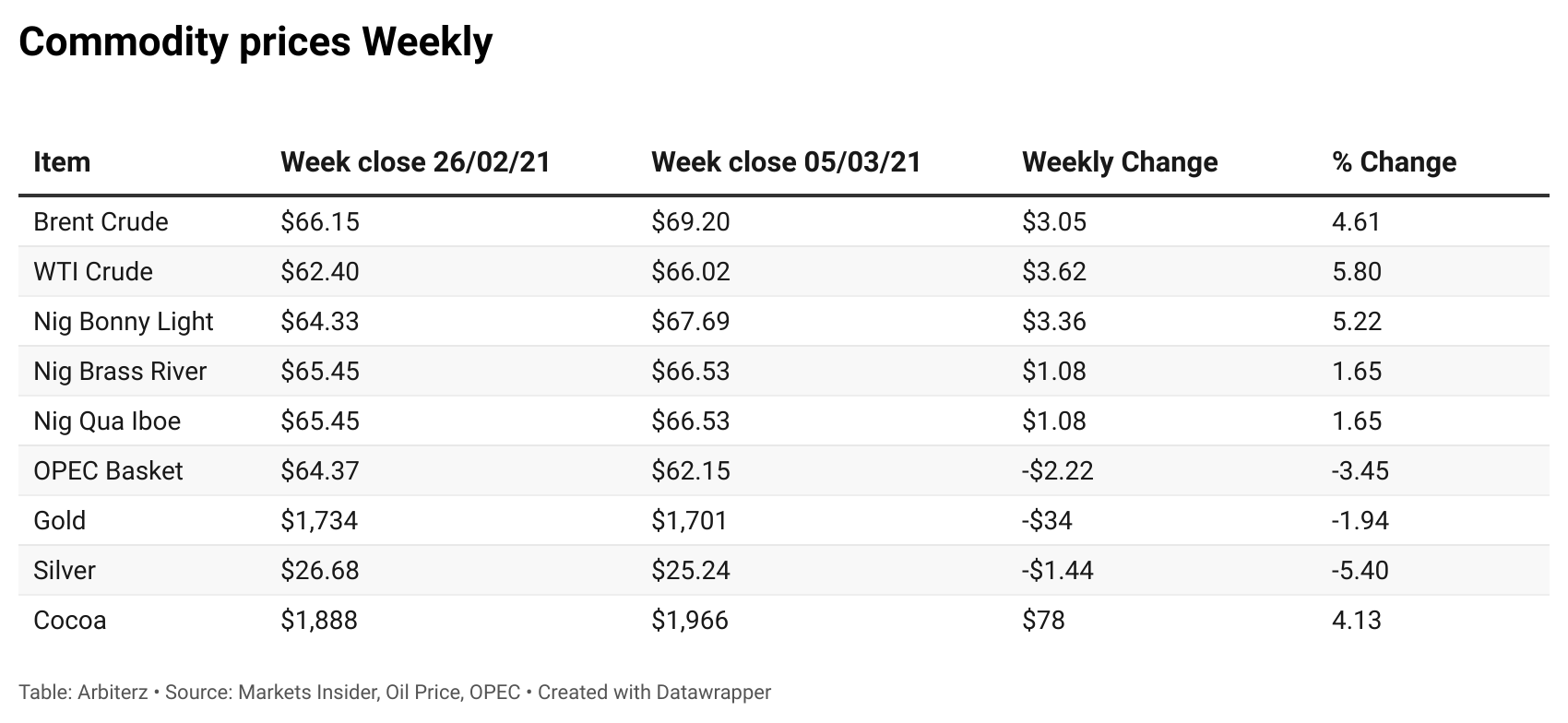

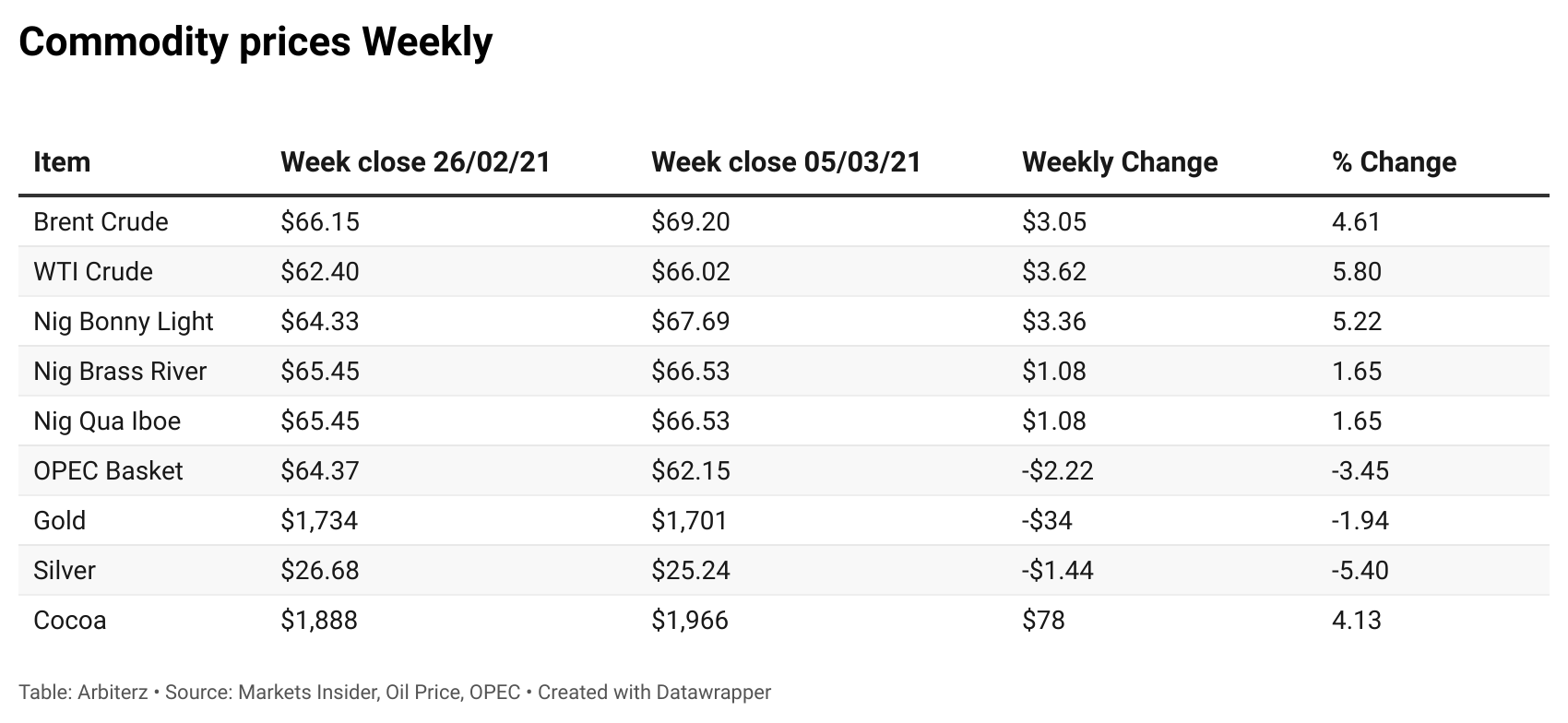

Oil skyrocketed on Thursday after OPEC+ decided to hold off on easing production cuts for another month, surprising the oil market. WTI and Brent shot up more than 4%. During early trading on Friday, Brent surpassed $69 per barrel.

OPEC+ extends cuts, surprising market. OPEC+ extended the cuts through April, aside from a slight increase allowed for Russia and Kazakhstan, due to seasonal consumption patterns. Even Saudi Arabia decided to keep its 1 mb/d of voluntary cuts in place. The surprise news led to a price surge. “One of the reasons the market is continuing to react positively today could be that OPEC’s own balances suggest very steep draws,” Rystad Energy said in a statement.

Oil majors expect record cash flow. Big Oil is looking at 2021 with increased optimism, mostly because oil prices have rallied in recent weeks. Moreover, the ultra-conservative capital spending plans and the huge cost cuts have allowed international oil companies (IOCs) to materially lower their cash flow breakevens. These factors are set to result in a record cash flow for the biggest oil firms this year if oil prices average $55 per barrel, Wood Mackenzie said in new research.

Oil market tighter with 500,000 bpd offline. Maintenance at three oil sands upgraders in Canada will take off some 500,000 bpd in production offline, helping tighten supply amid a price rally, Bloomberg reports.

IHS Markit: Shale discipline likely to stay. U.S. shale is unlikely to return to aggressive spending, but rising oil prices could tempt drillers to get off the sidelines. “At any given price growth will be less than in years past but if you get into the $70-$75 per barrel oil range, you can both return money to investors and have strong growth … so there is a point at which the temptation becomes too strong,” Raoul LeBlanc of IHS Markit said at CERAWeek (Oil Price Intel)

North America rig count. U.S. Rig Count rose by 1 from the previous week to 403 and Canada’s fell by 22 to 141. (Baker Hughes Weekly Rig Count)

Also Read: Nigerian Markets Last Week: Brent Crude Hits $50 Per Barrel As Stocks, Crypto Slump

Economic Indicators

GDP – The Nigerian economy exited recession after Gross Domestic Product grew 0.11% in the three months through December from a year earlier, per data from the National Bureau of Statistics. For the full year 2020, the economy contracted 1.92%.

Inflation – Nigeria’s annual headline inflation increased by 16.47% in January 2020, the highest recorded in over three years and 0.71% points higher than 15.75% in the previous month.

Manufacturing – The Central Bank of Nigeria composite Purchasing Managers’ Index for the manufacturing sector fell to 49.6 points in December from 50.2 in November. That indicates a contraction, below the 50 benchmark.

Monetary Rates – as of the last CBN Monetary Policy Committee in January: Monetary Policy Rate at 11.5%; Cash Reserve Ratio at 27.5%; Asymmetric corridor of +100/-700 basis points around the MPR; Liquidity Ratio at 30%.

Foreign Reserves – The country’s gross foreign exchange reserves is currently at over $35 billion as of February 15, 2021.