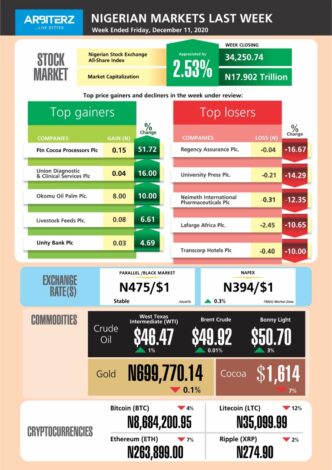

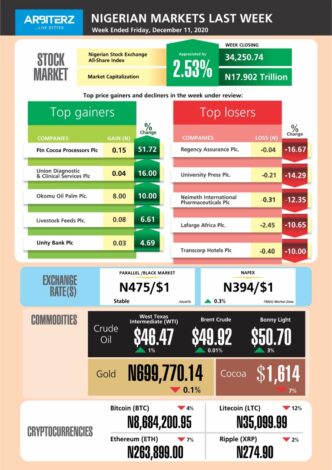

Nigerian Markets Last Week: Brent Crude Hits $50 Per Barrel As Stocks, Crypto Slump

The Nigerian Markets report for the week ended December 11, 2020.

Stock Market

The Nigerian Stock Exchange All-Share Index and Market Capitalization depreciated by 2.53% to close last week at 34,250.74 and ₦17.902 trillion, from 35,137.99 and ₦18.365 trillion, respectively. Similarly, all other indices finished lower while the NSE ASeM Index closed flat.

Exchange Rate(s)

- At the NAFEX window, the naira saw a weekly gain to close at ₦394/$1 from ₦395/$1 the previous week, according to FMDQ.

- The exchange rate in the parallel or black market – where forex is traded unofficially – closed at ₦475/$1, the same rate as the previous week, per data from AbokiFX.

Cryptocurrencies

- Bitcoin (BTC) – ₦8,684,200.95 from ₦9,086,912.98

- Ethereum (ETH) – ₦263,899.00 from ₦282,300.98

- Litecoin (LTC) – ₦35,099.99 from ₦39,743.03

- Ripple (XRP) – ₦274.90 from ₦280.00

Commodities

Crude Oil – International benchmarks West Texas Intermediate (WTI) and Brent Crude closed Friday at $46.47 and $49.92, from $45.99 and $49.05 the previous week, respectively. Nigeria’s Bonny Light closed at $50.70 from $48.94.

- Brent hit $50 per barrel on Thursday for the first time since March, edging higher on optimism surrounding vaccinations, the OPEC+ deal, plus strong demand in Asia.

- But prices eased a bit on Friday as demand in Europe and the U.S. remains subdued and Covid-19 cases continue to spread.

- The EIA also reported a surge in crude inventories for last week, up 15.2 million barrels.

Gold – The metal was in the red for the week after closing at ₦699,770.14 from ₦700,773.93.

Cocoa – Cocoa prices fell to close at $1,614 from $1,729

Economic Indicators

- Recession – The Nigerian economy is in a recession after GDP contracted for the second consecutive quarter: -3.62% in Q3 after -6.10% in Q2 2020, per data from the National Bureau of Statistics.

- Inflation – Nigeria’s annual inflation rate is currently estimated to be at 14.23% (for October 2020).

- Manufacturing –The Central Bank of Nigeria composite Purchasing Managers’ Index for the manufacturing sector rose to 50.2 in November from 49.4 in October. That indicates an expansion, above the 50 benchmark, after six consecutive months of contraction in factory activity.

- Monetary Rates – as of the last CBN Monetary Policy Committee in November: Monetary Policy Rate at 11.5%; Cash Reserve Ratio at 27.5%; Asymmetric corridor of +100/-700 basis points around the MPR; Liquidity Ratio at 30%.

One Comment