Inflation to top Bank of England target until at least 2026, Goldman Sachs warn

Inflation in the UK is set to top the Bank of England’s target for at least the next three years, likely forcing governor Andrew Bailey and co to tip the country into recession via yet more interest rate rises, a top Wall Street bank has warned.

Researchers at Goldman Sachs late last night hiked their forecasts for inflation over the next few years after last week’s numbers from the Office for National Statistics (ONS) revealed price pressures are going nowhere.

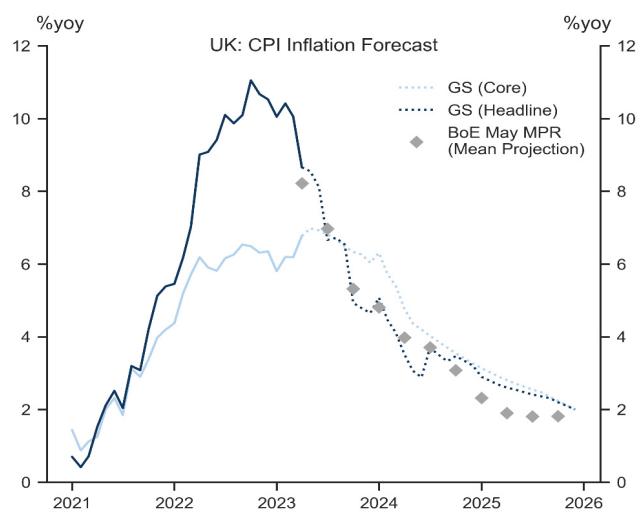

The firm suspects headline inflation, measured by the consumer price index, will still be above two per cent by 2026. It said by the end of this year, CPI will be running at 4.7 per cent and 3.2 per cent by Christmas 2024.

Core inflation – which the ONS last week calculated hit 6.8 per cent last month up from 6.2 per cent – risks staying much higher than previously thought at six per cent in six months, Goldman said.

Also Read: Goldman Sachs Raises Brent Price Forecast to $75

Economists are concerned that the Bank of England’s twelve successive interest rate rises are failing to get to the heart of the inflation surge. Borrowing costs have leapt to 4.5 per cent from 0.1 per cent and inflation is still 8.7 per cent, far above the Bank’s two per cent target.

Last month’s core inflation jump suggests the surge in international energy prices after Russia’s full-scale invasion of Ukraine that initially drove up inflation is pushing up prices across the UK economy.

That rate is poised to still be running at six per cent by the end of this year and more than three per cent by the end of 2024, Goldman said.

The Wall Street investment banking giant’s researchers also said robust wage growth caused by workers demanding pay rises to offset soaring living costs threatens to keep services inflation elevated.

Core inflation – which the ONS last week calculated hit 6.8 per cent last month up from 6.2 per cent – risks staying much higher than previously thought at six per cent in six months, Goldman said.

Economists are concerned that the Bank of England’s twelve successive interest rate rises are failing to get to the heart of the inflation surge. Borrowing costs have leapt to 4.5 per cent from 0.1 per cent and inflation is still 8.7 per cent, far above the Bank’s two per cent target.

Last month’s core inflation jump suggests the surge in international energy prices after Russia’s full-scale invasion of Ukraine that initially drove up inflation is pushing up prices across the UK economy.

That rate is poised to still be running at six per cent by the end of this year and more than three per cent by the end of 2024, Goldman said.

The Wall Street investment banking giant’s researchers also said robust wage growth caused by workers demanding pay rises to offset soaring living costs threatens to keep services inflation elevated.

“We expect services inflation to stay elevated for longer, however, largely because we remain concerned about wage growth not cooling sufficiently and sustainably over the medium term,” they said in a note to clients late last night.

Food prices climbed nearly a fifth over the last year, according to the ONS, maintaining the fastest acceleration in around four decades, although Goldman’s analysts said that speed should slow soon..

Also Read: Goldman Sachs Slashes 2021 Oil Forecast Due to Pandemic Resurgence

“Commodity and energy prices have declined, and this has been accompanied by a meaningful moderation in input PPI, suggesting that food CPI inflation should moderate going forward,” they said.

Goldman Sachs think inflation isn’t going away anytime soon

Data from the British Retail Consortium out today showed food price inflation thinned for the first time in nearly two years.

Analysts last week roundly jacked up their projections for peak UK interest rates. Deutsche Bank think they will hit 5.25 per cent, as do Japanese investment bank Nomura.

According to Britain’s yield curve – which encapsulates investors’ rate expectations – Governor Andrew Bailey and the rest of the monetary policy committee are poised to lift borrowing costs to 5.5 per cent, which would be the highest level since December 2007.

Before last Wednesday’s inflation numbers, the Bank was tipped to back just one more rate rise.

Also Read: $65 Oil: Goldman Sachs Forecasts Biden Stimulus Will Lift Oil Price

Last week, Chancellor Jeremy Hunt said he is comfortable with the Bank tipping the UK into recession if it gets inflation back down to two per cent.

Britain’s inflation rate is the highest in the G7. The Bank of England’s peers, the Federal Reserve and European Central Bank, are expected to be nearing or at the end of their tightening cycles due to inflation in the US and Europe cooling since last summer.