#EndSARS: Insurance Firms Confront Record High Claims

Underwriters in Nigeria are battling unprecedented claims after protests against police brutality were hijacked by hoodlums and transformed into sweeping destruction and looting, Bloomberg reported on Monday.

Insurers across the country are examining business sites and verifying claims after notifications of #EndSARS-related losses from small and big businesses like retailers, banks and hotels, Chairman of Nigerian Insurers Association Ganiyu Musa said.

“The losses will certainly run into billions and billions of naira. Not sure we’ve had anything of this magnitude,” he added.

Also Read: #ENDSARS: Residents, Hoodlums Loot Stores, Warehouse, Business across Nigeria

The exponential rise in possible payouts could further delay moves to stimulate capital buffers so underwriters are better prepared for shocks. In June, the National Insurance Commission shifted a deadline for the recapitalisation of the industry by nine months to the end of September 2021 owing to the coronavirus outbreak.

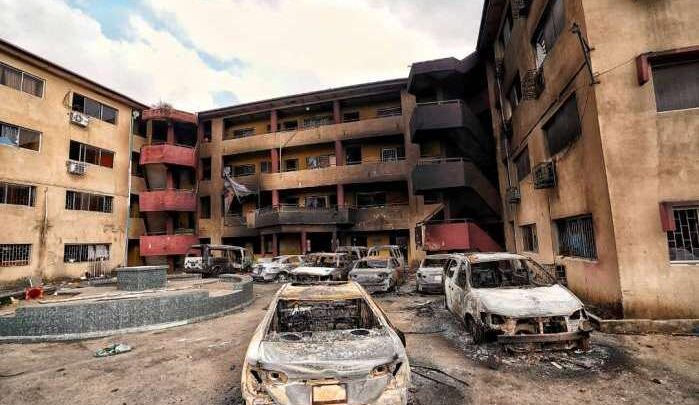

The #EndSARS protests culminated in mobs storming businesses, shopping malls and police stations, setting buildings and cars ablaze after the military and police, according to detailed investigation by Premium Times, shot at and killed tens of peaceful protesters.

It is probable total claims will surpass past payouts in Nigeria, most of which were incurred owing to fires, Musa said.

Even though claims are still being estimated, members of the industry association are optimistic they will meet their obligations by drawing from their reserves and seeking help from re-insurers, said Musa, who is also the managing director of Cornerstone Insurance.

“Typically you have 100s of claims coming out at the same time.” The precise damage will become clear “in the weeks and days ahead.”

Also Read: Lagos Govt says Looted Palliatives Delivered September 22

The latest data the regulator showed industry claims surged to N252 billion in 2018 relative to the year before.

The insurance group intends to leverage the fallout from the protests to raise awareness in about the importance of having insurance cover for assets against potential losses. It aims at deepening insurance penetration by 100 per cent in the next five years from less than 1% through improvement of the promptness of settlements, collaborating with authorities towards enforcing mandatory policies like motor insurance, the industry head said.

“There’s a lot of opportunities for growth. If you are a long term investor, the temporary challenges from Covid-19 and the protests can’t significantly affect the fundamentals of the industry because we have built sufficient reserves and have risk management in place,” he added.

2 Comments