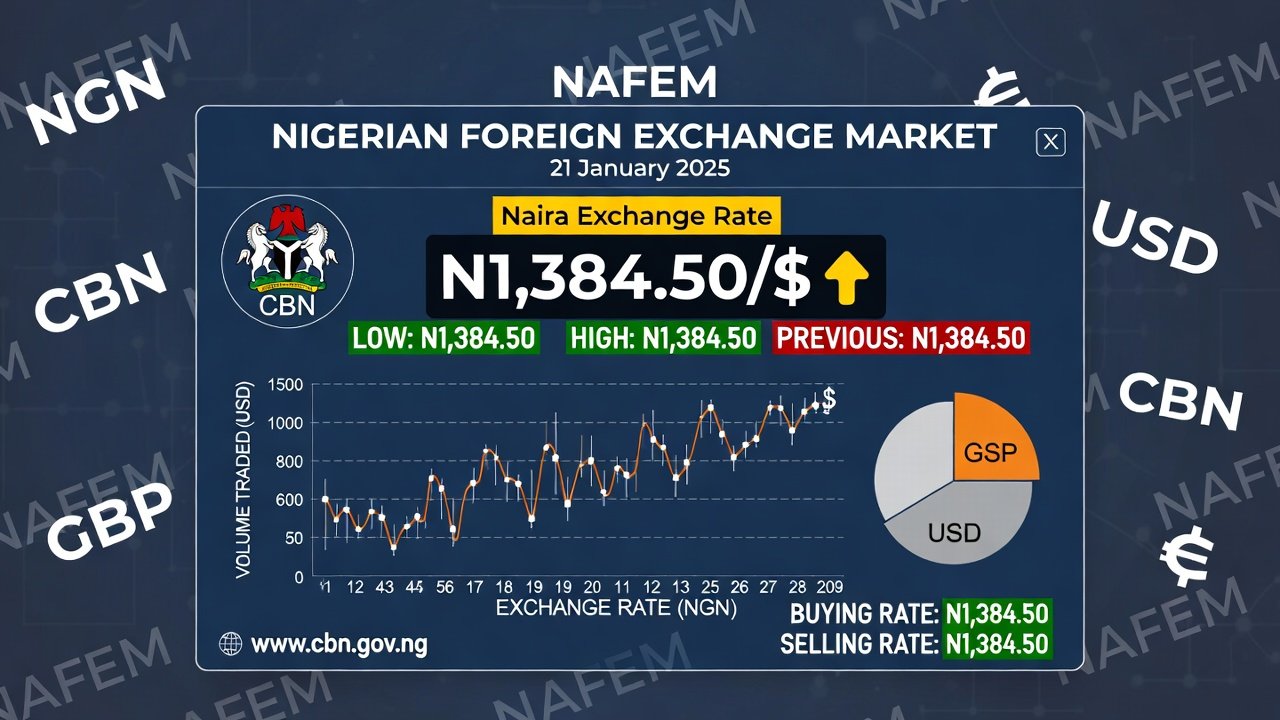

The Central Bank of Nigeria (CBN) has kept the Monetary Policy Rate (MPR) at 27%, maintaining a tight stance to drive down inflation and stabilize the economy.

The Monetary Policy Committee (MPC), meeting in Abuja, voted to keep key policy rates unchanged.

The MPR serves as the benchmark interest rate for the economy and remains elevated as part of CBN’s aggressive measures to curb rising prices and restore investor confidence.

Outcomes of the MPC Meeting

- Monetary Policy Rate (MPR) retained at 27.00%.

- Cash Reserve Ratio (CRR) retained at 45.00% for DMBs, and retained 16.00% for Merchant Banks, respectively.

- Retained 75% CRR on Non-TSA public sector deposits

- Liquidity Ratio (LR) left unchanged at 30.0%.

- Asymmetric Corridor adjusted by +50/-450 basis points around the MPR.

Why the CBN Held Rates

The MPC said the decision reflects the need to safeguard progress made in reducing inflation while allowing past rate hikes to fully transmit into the economy. According to the committee, the move was “underpinned by the need to sustain the progress made so far towards achieving low and stable inflation.”

It added that inflation is easing due to monetary tightening, a stable exchange rate, capital inflows, and a surplus current account balance. The CBN stressed that maintaining the stance will strengthen the impact of earlier policy actions amid global uncertainties.

Inflation Dynamics and Domestic Prices

Nigeria’s inflation continued to ease for the seventh straight month, with headline inflation dropping sharply to 16.05% in October 2025, from 18.02% in September.

Food inflation fell to 13.12%, supported by improved food supply, stable FX conditions, and base effects, while core inflation slowed to 18.69% due to lower household furnishing and maintenance costs.

The committee noted that despite the decline, inflation remains “high at double digits,” and needs persistent efforts to moderate further. It emphasized that the “steady deceleration in inflation across the three measures… suggests that the large impact of previous tight policy measures is expected to continue in the near term.”

Growth Momentum in Economic Indicators

Nigeria’s economic growth remained resilient, with Q2 2025 GDP rising 4.23%, up from 3.13% in Q1.

The Purchasing Managers’ Index (PMI) surged to 56.4 points in November, the highest in five years, signaling strong expansion in business activity.

Gross external reserves rose by 9.19% to $46.70 billion as of November 14, enough to cover 10.3 months of imports, supported by stable external conditions.

The MPC also highlighted the banking sector’s strong health, noting that “most financial soundness indicators remain within regulatory thresholds,” and praised the progress in the recapitalization program, with 16 banks now fully compliant.

Global Economic Backdrop

The CBN expects the global economy to recover gradually, buoyed by improved trade negotiations, accommodative monetary policy in advanced economies, and easing geopolitical risks. However, risks remain, including protectionist policies, geoeconomic fragmentation, and possible renewed trade tensions between the U.S. and key trading partners.

Global inflation is projected to continue falling into 2026, though still above pre-pandemic levels. The MPC said softening commodity prices, earlier policy tightening, and normalized supply chains will support global disinflation.

Economic Outlook

The MPC forecast sustained disinflation in the coming months, driven by the delayed effects of earlier rate hikes and continued FX market stability. It expects the harvest season to push food prices lower and support economic balance.

The committee reaffirmed its commitment to a data-driven approach, stating, “The MPC reaffirmed its commitment to evidence-based policy approach towards achieving the bank’s mandate of price and financial system stability.” The next meeting is scheduled for February 23–24, 2026.