Africa Finance Corporation (AFC) has acted as Co-Financial Adviser to the Federal Government of Nigeria on the successful issuance of the inaugural ₦501 billion tranche under the Presidential Power Sector Financial Reforms Programme (PPSFRP), a landmark intervention aimed at resolving long-standing debt overhangs in the electricity industry.

The issuance represents a major milestone in the implementation of the ₦4 trillion Power Sector Bond Programme, designed to clear more than a decade of legacy receivables across Nigeria’s electricity value chain and restore financial stability to the sector.

The Programme was overseen by the Presidential Power Sector Debt Reduction Committee (PPSDRC), with technical leadership provided by the Office of the Special Adviser to the President on Energy, and implemented through Nigerian Bulk Electricity Trading Plc (NBET) via its special purpose vehicle, NBET Finance Company Plc. Proceeds from the bond will be used to settle verified and overdue receivables owed to power generation companies (GenCos) for electricity supplied between February 2015 and March 2025.

Also Read:

- Nigeria Launches ₦4 Trillion Sovereign Bond to Clear Power-Sector Debts, Revive Electricity Market

- Nigeria Seeks $15 Billion Investment in Power Sector, Retains Subsidy for Vulnerable Households

- Suspension of New Tariffs Exposes Nigeria's Power Sector to Ridicule, Sam Amadi, former NERC Boss

- Despite $1.4billion Investment in Power sector, Electricity Grid Collapses 105 Times in Ten Years

By extinguishing these legacy claims, the Programme is expected to significantly improve liquidity in the electricity supply industry, strengthen GenCos’ balance sheets, and rebuild investor confidence—both domestic and international—across the sector.

AFC Financial Advisory

Notably, the transaction mobilised substantial domestic capital, with approximately 50% of the total financing secured from pension fund administrators, underscoring growing institutional appetite for well-structured infrastructure-backed instruments in Nigeria.

AFC provided comprehensive financial advisory services on the transaction, including the design of the Programme’s negotiation strategy framework, support in negotiating and executing settlement agreements with GenCos, and structuring of the bond issuance. The Corporation worked alongside CardinalStone Partners as co-Financial Adviser.

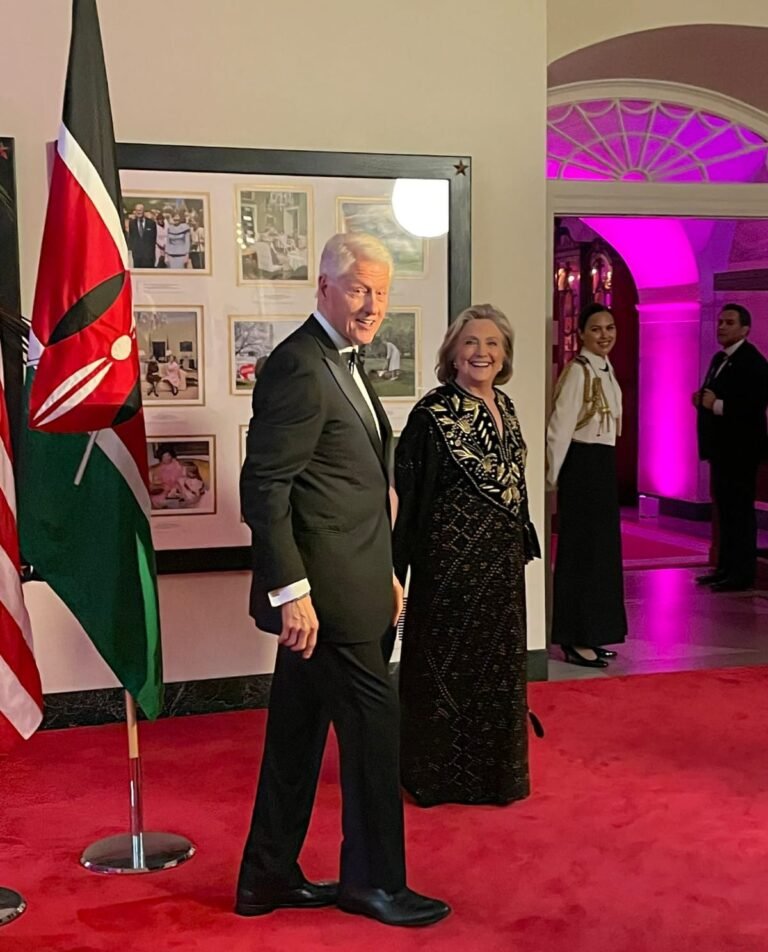

Olu Verheijen, Special Adviser to the President on Energy, said the Programme marked “a decisive reset of Nigeria’s electricity market,” noting that AFC’s sector expertise and deep local market knowledge were critical in delivering a credible outcome that supports liquidity restoration, investor confidence, and long-term sustainability.

Banji Fehintola, Executive Board Member and Head of Financial Services at AFC, said the successful issuance of the inaugural tranche underscores the Corporation’s commitment to supporting transformative reforms in Nigeria’s power sector. He added that resolving long-standing liquidity challenges lays the foundation for sustainable growth and improved electricity supply nationwide.

When fully completed, the Programme is expected to impact about 5,398MW of generation capacity across Nigerian GenCos, settle payments for approximately 290,645GWh of electricity billed since 2015, and support companies serving an estimated 12 million active registered customers. Combined with parallel reforms—including expanded metering, transmission upgrades, and a transition toward bilateral trading under market-reflective pricing—the initiative is central to Nigeria’s efforts to build a viable and sustainable electricity market capable of supporting long-term industrial growth.