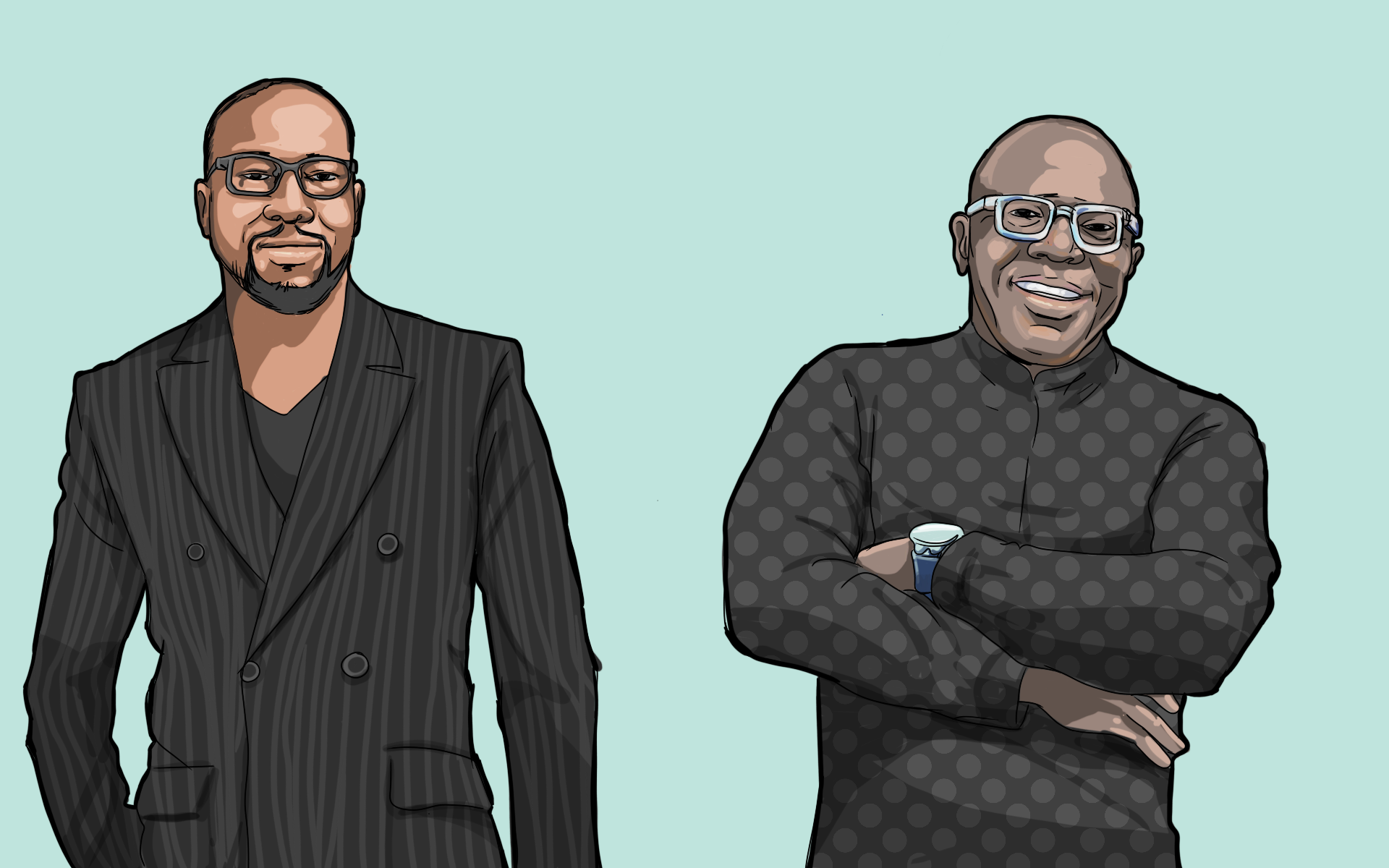

Wemimo Abbey, the Nigerian-born entrepreneur and co-founder of Esusu, has become one of the most celebrated innovators in the U.S. fintech and housing ecosystem. Alongside his co-founder, Samiir Goel, Abbey has built Esusu into a platform that tackles one of the most persistent barriers to wealth creation for immigrants and minorities in the United States: the inability to build credit from rental payments.

Esusu allows tenants to report on-time rent payments to major credit bureaus, helping them build or improve their credit scores. For landlords, the platform improves rent collection and reduces turnover. For renters—especially immigrants, African-Americans, and low-income earners—Esusu offers a pathway into mainstream financial systems that have historically excluded them.

A Mission Born From Personal Experience

Abbey’s mission was shaped by his early life in Lagos and the challenges his mother faced when they moved to the United States. Arriving in Minnesota with little savings and limited support, his family struggled to rent an apartment because they had no American credit history.

Also Read:

That struggle planted the seed for Esusu: a platform designed to break systemic barriers and democratise access to financial opportunity.

Today, the company operates in all 50 U.S. states, partnering with giant property owners such as:

-

Greystar

-

Related Companies

-

WinnResidential

-

Starwood Capital

Esusu’s footprint covers millions of rental units, making it one of the most successful minority-founded fintechs in American history.

Esusu’s Rapid Rise and Billion-Dollar Valuation

Esusu gained widespread attention in 2022 when it achieved unicorn status, becoming one of the few Black-owned startups globally to reach a valuation above $1 billion. Investors include:

-

SoftBank’s Vision Fund

-

Serena Williams’ Serena Ventures

-

Motley Fool Ventures

-

Goldman Sachs’ One Million Black Women initiative

The company also became a partner of the White House’s initiative on housing stability, reinforcing its position as a national leader in financial inclusion.

Driving Credit Inclusion for Renters

Esusu solves a long-standing flaw in the American credit system: rental payments don’t automatically count toward credit scores, even though they are the largest monthly expense for most households.

The platform reports tenants’ on-time rent payments to all major credit bureaus:

-

Equifax

-

Experian

-

TransUnion

This can raise a renter’s credit score by 40 points or more within months—unlocking access to mortgages, lower-interest loans, and employment opportunities.

Social Impact at the Centre of Esusu’s Model

Beyond credit reporting, Esusu manages a rental relief fund that provides zero-interest loans to families facing eviction risk. The company has deployed millions of dollars in rent relief, helping tenants stay housed during financial shocks.

Abbey often emphasises that wealth-building in America depends on financial tools—credit, loans, mortgages—that many minorities are shut out from. Esusu acts as a bridge, allowing households to build a financial foundation one rent payment at a time.

A New Generation of Nigerian Global Entrepreneurs

Wemimo Abbey’s success places him among the most influential Nigerian-born tech entrepreneurs abroad, alongside founders like:

-

Olugbenga Agboola (Flutterwave)

-

Shola Akinlade (Paystack)

-

Iyinoluwa Aboyeji (Andela, Flutterwave)

But Abbey stands out for building a mission-driven fintech rooted in justice, fairness, and social mobility.

His journey—from Lagos to the boardrooms of global investors—illustrates how African innovators are shaping the future of financial technology and inclusion worldwide.