Union Bank of Nigeria Plc, one of the country’s oldest and most respected financial institutions, has officially completed its merger with Titan Trust Bank Limited. The Central Bank of Nigeria (CBN) recently granted final approval, bringing to a close a process that began with a Share Sale and Purchase Agreement in 2021.

Under the merger, Union Bank has absorbed Titan Trust Bank’s operations and assets. The combined institution will continue to operate under the Union Bank brand, while Titan Trust Bank, founded in 2019, will no longer exist as a separate entity.

This move blends Union Bank’s 108-year legacy with Titan Trust’s modern, technology-driven approach.

“This merger represents a transformative step for Union Bank,” said Olufunmilayo Aluko, Chief Brand and Marketing Officer. “By integrating Titan Trust’s agility with our strong reputation, we are positioned to deliver even greater value to customers and stakeholders nationwide.”

The new, enlarged Union Bank now operates over 293 service centers and 937 ATMs across Nigeria, supported by upgraded digital platforms. This expanded reach is expected to improve services for retail customers, SMEs, and corporate clients, while also advancing financial inclusion.

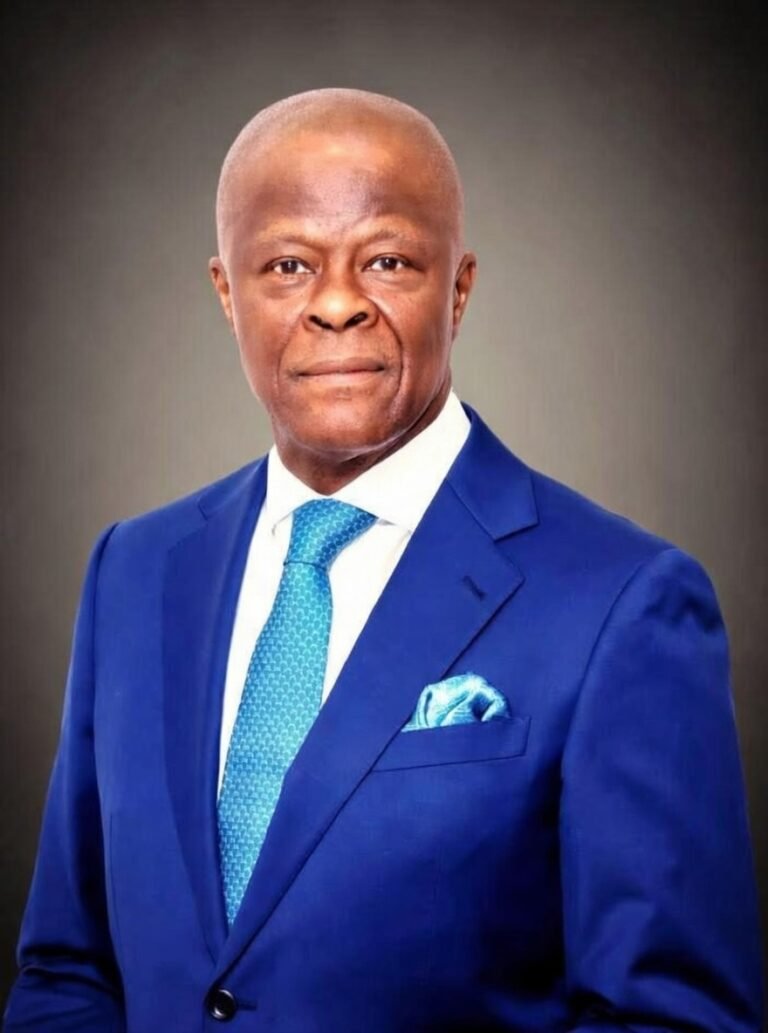

Managing Director and CEO Yetunde Oni described the deal as a turning point:

“This is a launchpad for innovation and growth. It enables us to meet the evolving needs of customers and solidify our place as a trusted financial partner.”

The merger follows Titan Trust Bank’s acquisition of a 93.41% stake in Union Bank in 2022, a deal valued at about ₦191 billion. The transaction—one of the largest in Nigeria’s banking history—was supported by global financial advisers Rothschild & Cie and Citibank, with approvals from both the CBN and the Securities and Exchange Commission (SEC).

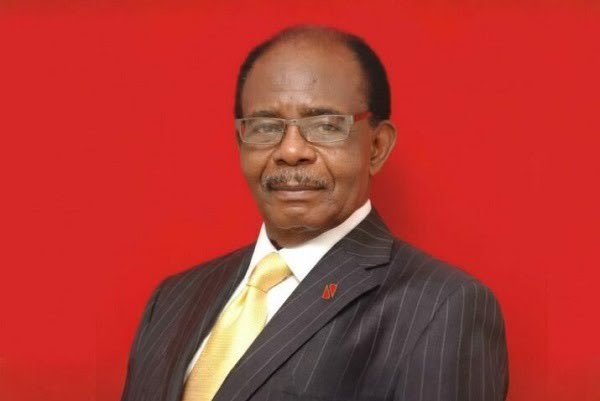

Bayo Adeleke, Chairman of Union Bank’s Board of Directors, highlighted the long-term benefits:

“This consolidation unites the strengths of both banks. It opens opportunities for collaboration, growth, and prosperity. We remain committed to financial inclusion and delivering a modern banking experience.”

For customers, Union Bank has assured a seamless transition. Account details and services will remain unchanged, while the bank invests further in digital solutions to improve user experience.

With this strengthened foundation, Union Bank is now better positioned to compete with Nigeria’s leading banks and contribute to the continued growth of the nation’s financial sector.