BoI Secures CBN Approval to Launch Non-Interest Banking Window

The Bank of Industry (BoI) has secured regulatory approval from the Central Bank of Nigeria (CBN) to operate a Non-Interest

The Bank of Industry (BoI) has secured regulatory approval from the Central Bank of Nigeria (CBN) to operate a Non-Interest

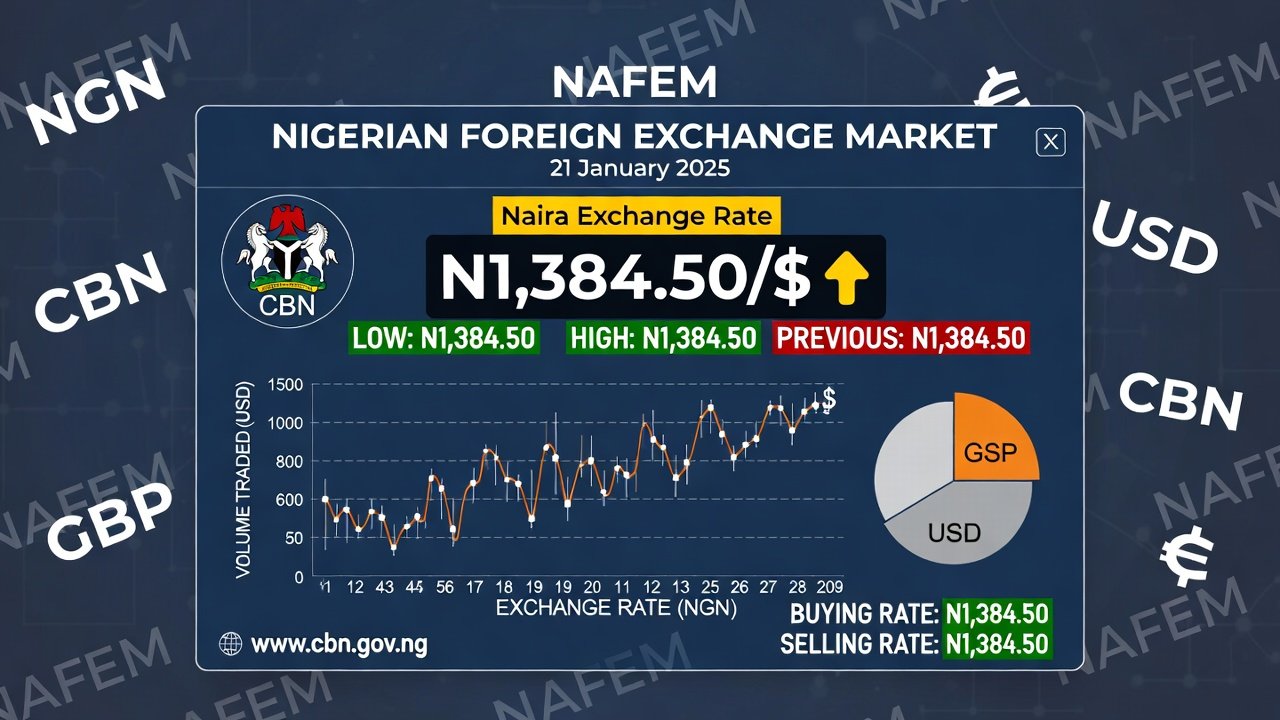

The Nigerian naira recorded a marginal appreciation at the official foreign exchange market on Thursday, February 6, 2026, supported by

The Nigerian naira posted modest gains against the US dollar at the official foreign exchange market on February 3, 2026,

The naira strengthened to ₦1,394 per dollar at Nigeria’s official foreign exchange window on Wednesday—its strongest level since May 2024—even

Nigeria’s banking recapitalisation has moved from policy ambition to last-mile arithmetic. With the Central Bank of Nigeria’s March 31, 2026

The naira recorded modest gains across official and parallel channels on Tuesday, January 7, 2026, continuing a cautious recovery trend

Fidelity Bank Plc has raised ₦259 billion from a recently concluded Private Placement of Ordinary Shares, significantly strengthening its balance

Nigeria’s naira began the 2026 trading year with a modest but symbolically important gain at the official foreign exchange market,

Major shareholder Femi Otedola has said FirstBank has already met the ₦500 billion minimum capital requirement set by the Central

Nigeria’s economy is projected to grow by 4.49% in 2026, accelerating from an estimated 3.89% in 2025. This growth is

Nigeria’s external reserves are projected to rise to $51.04 billion in 2026, up from an estimated $45.01 billion at end-2025,

Access Holdings Plc has received shareholder approval to raise up to ₦40 billion in fresh capital through a private placement,

Get notified about new articles