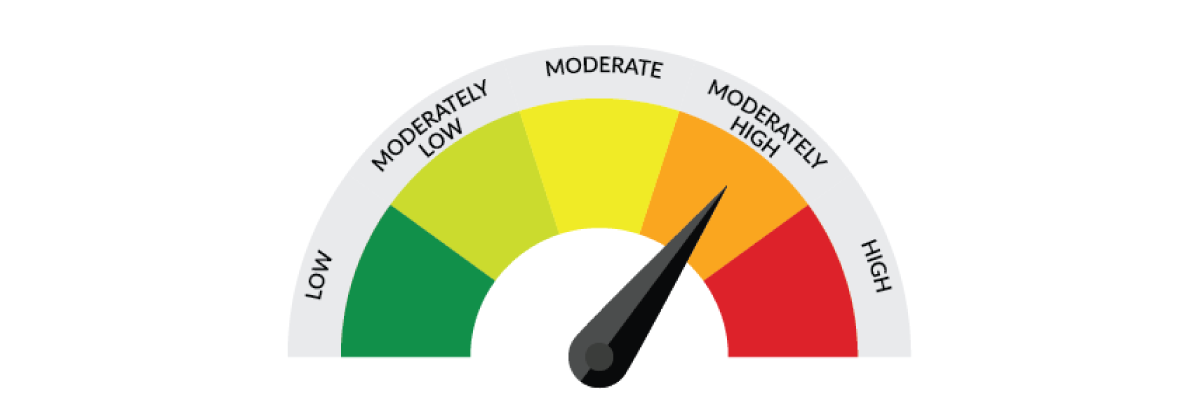

Nigeria remains one of Africa’s most closely scrutinised risk environments as daily security and political incident data continue to underline the persistence — rather than the episodic nature — of volatility in the country.

According to the Signal Room Daily Incident Report produced by Signal Risk, Nigeria consistently features among jurisdictions exposed to a dense concentration of security, political and operational risks.

The report, which tracks significant incidents across the continent on a rolling, high-frequency basis, is widely used by corporates, insurers and governments to assess evolving country risk in real time.

Also Read:

- Sophors Consulting Limited Asks CBN To Balance Support For Growth With Controlling Inflation

- Protectionist Policies Have Hobbled Growth: Reforming Nigeria's Textile and Garments…

- Full List of 82 BDC Operators Approved by CBN in Nigeria

- Tinubu Nominates Christopher Musa, Christian from Zangon Kataf, Kaduna, as Defence Minister

Analysts say Nigeria’s risk profile reflects the convergence of long-running security challenges — insurgency in the north-east, banditry and kidnapping in the north-west, and recurring communal violence in parts of the Middle Belt — alongside economic pressures that intensify social and political strain.

These risks have proved structurally embedded, rather than susceptible to short-term policy interventions.

The country’s macroeconomic backdrop has further complicated the picture.

Elevated inflation, sharp exchange-rate adjustment and tight public finances have increased operating costs and uncertainty for businesses.

As a result, security concerns are increasingly assessed alongside currency exposure, regulatory unpredictability and infrastructure constraints when firms evaluate Nigeria risk.

Nigeria’s scale amplifies the significance of these trends.

As Africa’s largest economy and most populous country, instability in Nigeria has outsized implications for regional trade, energy supply chains and capital flows.

This explains why it remains a focal point in continent-wide incident monitoring frameworks used by investment committees and corporate risk teams.

Impact on Investment and the Economy

The implications for investment are material. Persistent security incidents and elevated country risk premiums continue to weigh on foreign direct investment, particularly in capital-intensive sectors such as manufacturing, logistics, agriculture and energy infrastructure.

While portfolio investors may tolerate short-term volatility, long-term investors typically require predictability in security, regulation and macroeconomic management — conditions that remain uneven across Nigeria.

Multinationals operating in the country have responded by shortening planning horizons, restructuring supply chains, and increasing expenditure on security, insurance and compliance.

For some firms, these costs are passed on through higher prices, contributing indirectly to inflationary pressures and weakening consumer demand.

Domestic investment is also affected. Nigerian businesses face higher financing costs as lenders price in country risk, while insecurity disrupts productivity, labour mobility and distribution networks.

In agricultural belts and trade corridors, security incidents translate directly into reduced output and higher food prices, reinforcing economic fragility.

At the sovereign level, elevated country risk complicates Nigeria’s efforts to attract long-term foreign capital needed to support growth, infrastructure development and energy transition goals.

Even where reform momentum is recognised, investors increasingly differentiate between policy intent and on-the-ground risk conditions captured in daily incident reporting.

From Static Ratings to Real-Time Risk

The prominence of daily incident data reflects a broader shift in how country risk is assessed.

Rather than relying solely on annual indices or static ratings, firms are turning to high-frequency intelligence to understand how security incidents, protests, fiscal stress and political developments interact in real time.

For Nigeria, this approach reinforces a central reality: the challenge for investors is less about anticipating a single disruptive shock than about managing sustained uncertainty in a market of exceptional scale and strategic importance.

As Nigeria enters another year of reform efforts under fiscal constraint, the steady flow of incidents recorded in daily risk reports suggests that volatility will remain a defining feature of its operating environment — and a critical variable in investment decision-making.