The Nigerian All-Share Index (ASI) started the week bullish, closing Monday’s session (October 13th) in positive territory.

The benchmark index gained 729.18 points or 0.50% to close at 147,717.22, up from 146,988.04, marking a 12th consecutive day of gains and a year-to-date (YTD) return of 43.52%.

Market capitalization followed the uptrend, rising by about ₦464 billion ($318 million) to ₦93.7 trillion ($64.3 billion) from ₦93.3 trillion ($64.0 billion) previously recorded, bringing its YTD gain to 49.40%.

Also Read:

Market activity was heightened as trading volume climbed 62% to 624 million shares, compared to 386 million in the previous session.

Total value traded rose 20% to ₦13.5 billion ($9.3 million) from ₦11.3 billion ($7.8 million) previously.

The number of deals increased by 9,721 to close at 31,563, up from 21,842 in the last session.

Market breadth remained positive at 1.08, indicating more gainers than losers.

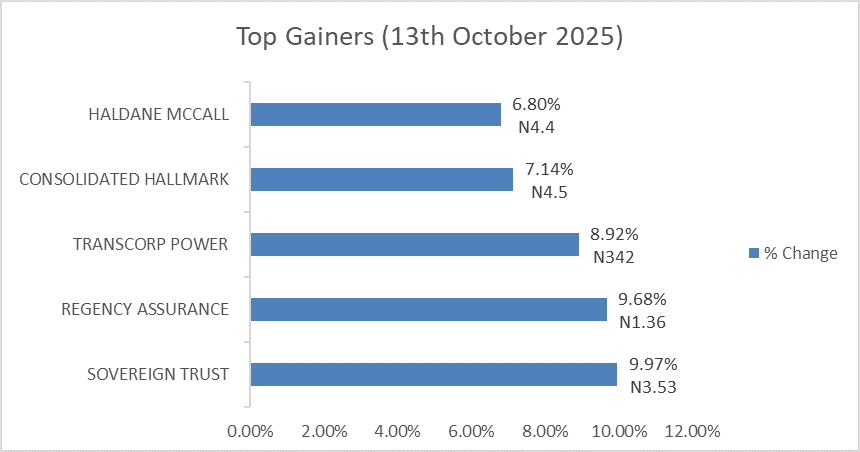

Top Gainers

Top Losers

Top Five Trades by Volume and Value

Fidelity Bank led with 47.46 million shares traded worth ₦951.81 million ($654,000), followed by Consolidated Hallmark with 210.46 million shares valued at ₦909.64 million ($625,000).

Chams exchanged 43.96 million shares worth ₦191.62 million ($132,000), Univinsure traded 29.9 million shares worth ₦32.34 million ($22,000), and Sovrenins recorded 23.25 million shares valued at ₦80.29 million ($55,000).

SWOOTs and FUGAZ Performance

Stocks Worth Over One Trillion Naira (SWOOTs) ended the session on a positive note.

Dangote Cement extended its winning streak, gaining 1.74%, while Transcorp Power surged 8.92%. MTN Nigeria and Airtel Africa remained unchanged, while Nigerian Breweries edged up 1.86%.

Among the tier-one banks (FUGAZ), performance was mixed. UBA closed flat, GTCO declined 1.05%, and AccessCorp gained 0.58%. Zenith Bank slipped 0.73%, while FBN Holdings advanced 1.61%.

Sector Performance

The Insurance sector led the gainers with a 2.11% rise, followed by the Industrial sector up 0.66%.

The Consumer Goods sector climbed 0.23%, and the Banking sector added 0.16%, while the Oil & Gas sector dipped marginally by 0.03%.

All dollar equivalents are based on current official exchange rate of ₦1,457/$1.