Nigeria’s equities market fell sharply on Wednesday as renewed sell pressure wiped out another N217 billion in market value.

The Nigerian Exchange (NGX) recorded a fresh dip in investor sentiment, dragging the year-to-date return to its weakest point in November.

The All-Share Index (ASI) dropped by 340.50 basis points to close at 144,646.01, while total market capitalisation slipped to ₦92 trillion.

Also Read:

- Nigerian Stock Market Plunges as Equity Investors Lose N1.17trn

- Investors Lose N4.6 Trillion as Market Suffers Steepest One-day Fall in History

- Nigeria's Stock Market Continues its Bearish Run, as NGX All-Share Index Falls 0.73%

- Nigerian All-Share Index Breaks 150,000 Mark, Highest In Nigerian Stock Market History

The fall was driven by persistent sell-offs in medium- and large-cap stocks, worsening the negative momentum already weighing on the market.

Negative price movement hit popular counters including DANGSUGAR, CHAMS, ZENITHBANK, and ELLAHLAKES, reflecting a cautious mood among investors. The sustained sell pressure has now erased ₦1.5 trillion in market value since the start of the week.

Despite the downturn, trading activity surged, with volume and value rising by +134.12% and +40.83%, respectively. “Approximately 892.52 million units valued at ₦23,542.83 million were transacted across 20,225 deals,” Atlass Portfolio Limited said in a note to clients.

ACCESSCORP Dominates Trading

ACCESSCORP led the market in both volume and value, accounting for 54.81% of total shares traded and 44.98% of total transaction value. Other heavily traded stocks included TANTALIZER (7.96%), JAPAULGOLD (6.07%), ZENITHBANK (3.88%), and CONHALLPLC (3.51%).

On the gainers’ chart, NCR rose the highest with a +9.85% increase, closely followed by CAVERTON (+9.71%), UACN (+8.33%), MBENEFIT (+7.69%), LINKASSURE (+7.57%), and TANTALIZER (+7.36%). A total of 16 stocks closed positive for the day.

Losers Outnumber Gainers

Thirty-nine stocks closed lower, sealing a negative market breadth. UNIVINSURE led the losers with a -10.00% drop, followed by ABCTRANS (-9.95%), LIVINGTRUST (-9.92%), CHELLARAM (-9.85%), ROYALEX (-9.76%), and TRANSCORP (-8.44%).

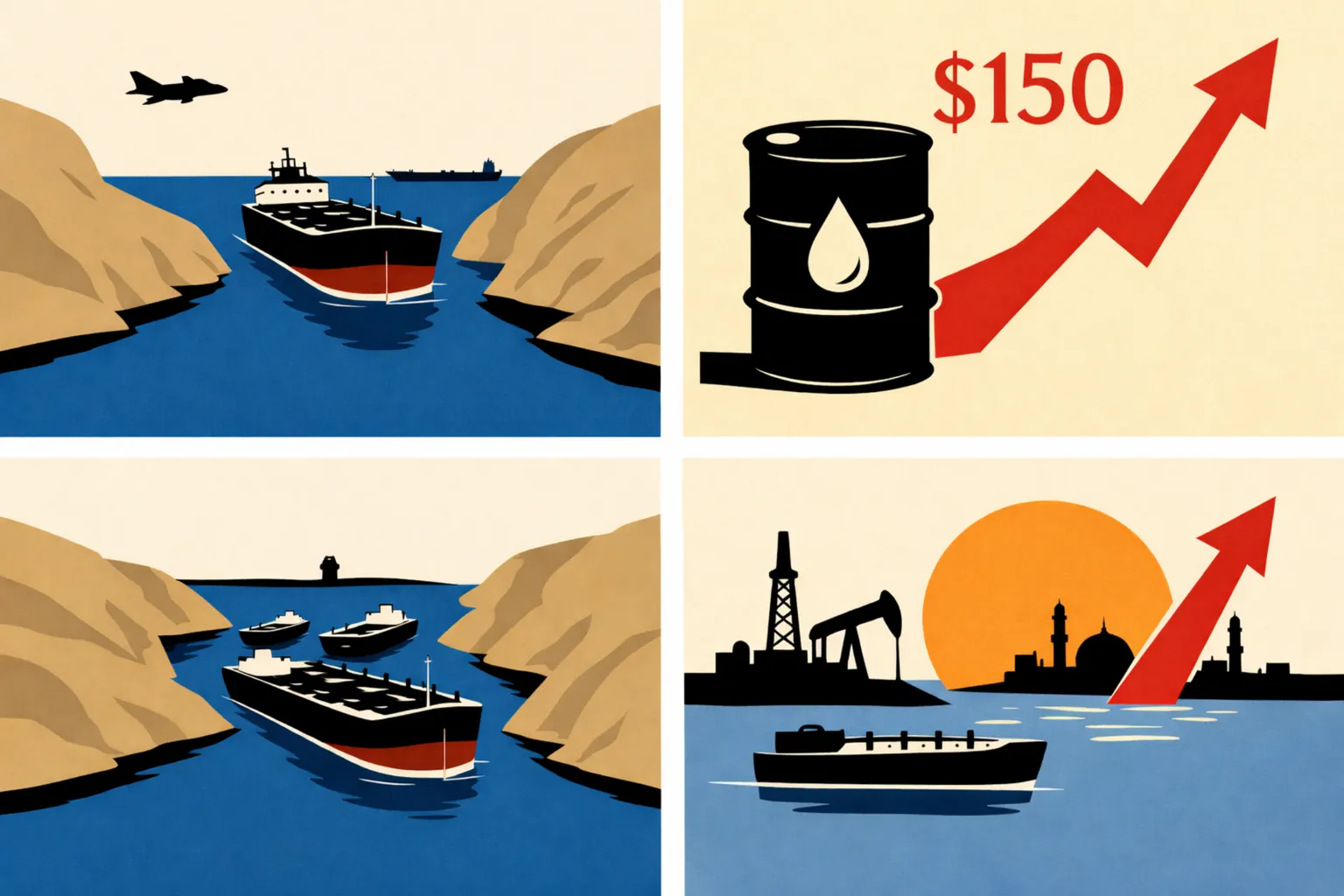

Sector performance also reflected the broader weakness, with three of the five major sectors declining. The insurance sector slid by -1.35%, banking dropped by -1.22%, and oil & gas dipped -0.18%, while consumer goods inched up by 0.09% and industrial goods ended flat.

Outlook Remains Fragile

The combination of heavy sell-offs, cautious sentiment, and weak sectoral performance shows the NGX remains under bearish pressure. With cumulative weekly losses already at ₦1.5 trillion, analysts say investors may continue to trade defensively until clearer catalysts emerge.