In response to the aggressive early recruitment practices of Private Equity (PE) firms, JPMorgan Chase has implemented a policy targeting incoming investment banking analysts who accept future-dated job offers from other firms, especially within the first 18 months of their association with JPMorgan.

Private equity (PE) firms are known to often secure candidates years in advance, sometimes even before they begin their roles at investment banks, a situation JPMorgan now seeks to fight against.

JPMorgan, in a memo addressed to new analysts, stated that accepting a position with another company before joining the bank or within the first 18 months would result in termination. The bank further emphasized the importance of full participation in its analyst training program, noting that any missed training sessions or obligations could result in dismissal. This, the bank says, is to ensure that analysts are fully dedicated to their roles and are not distracted by external job pursuits.

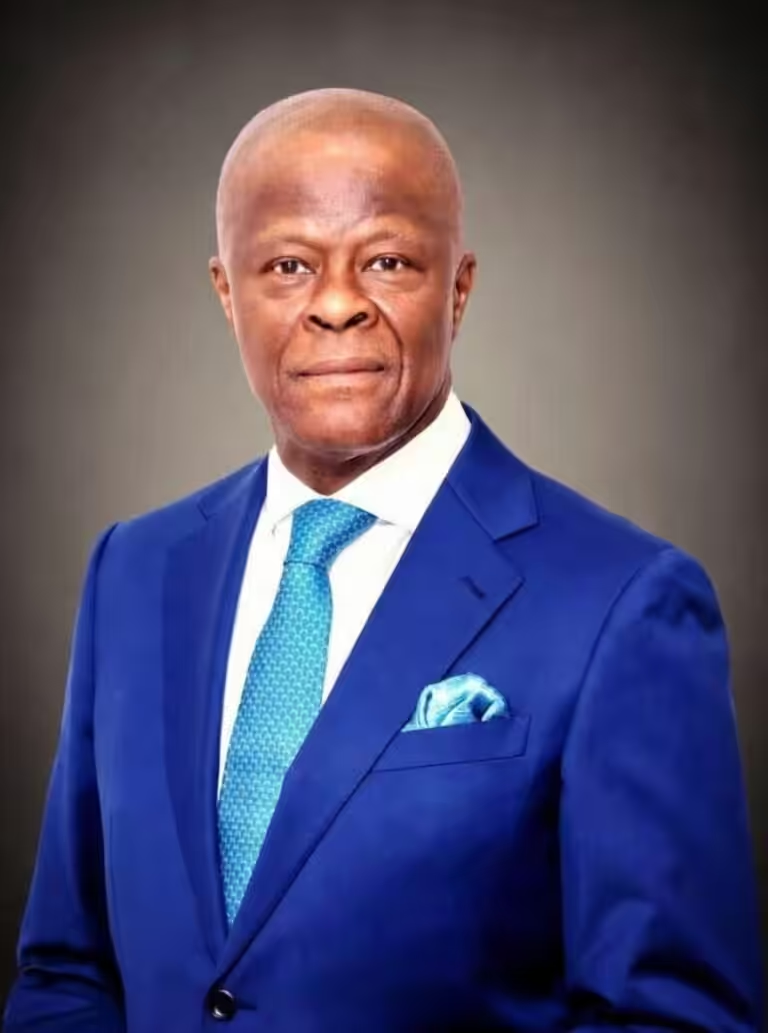

JPMorgan Chase Criticism of Private Equity Early Recruitment Practices

The bank’s CEO Jamie Dimon has publicly criticized the early recruitment tactics of PE firms, labeling them as unethical and highlighting the potential conflicts of interest they pose. He had pointed out an analyst who has accepted a future position at a PE firm might be involved in deals where that firm is a counterparty, leading to compromised decision-making .

In response, to these challenge, JPMorgan has shortened its analyst program from three years to two and a half years, allowing for earlier promotion to associate roles. This the bank has done to appeal to young professionals who might be enticed by the rapid career advancement opportunities presented by Private Equity firms.

New Policy Implementation Uncertainty

Despite JPMorgan’s belief in the expected efficacy of the new policy, industry experts have expressed skepticism about the policy’s enforceability. They note such might lead analysts to potentially conceal their future job plans to avoid repercussions .

Investment banks on Wall Street have in recent times being confronted with the challenges posed by the early recruitment practices of PE firms leading to a reevaluation of recruitment and retention strategies across the industry.