Nigeria’s persistent revenue underperformance is increasingly traceable not merely to weak tax administration, but to unrealistic oil and gas tax assumptions embedded in the federal budget. Data from the Office of the Accountant-General of the Federation (OAGF) show that between 2022 and 2025, actual federal government revenue consistently fell far short of budget targets, with 2025 performance at just 26 percent of projections. The repeated presentation of expansive budgets that the state lacks the revenue capacity to fund is not accidental: it serves a political purpose, allowing governing elites to postpone—even avoid—serious debate about the difficult task of resizing a vast, poorly funded, and inefficient public sector..

At the centre of the problem is a structural disconnect between oil and gas tax projections prepared by the Federal Inland Revenue Service (FIRS) and the significantly higher figures ultimately adopted in the Medium-Term Expenditure Framework (MTEF) and annual budgets. For 2025, Petroleum Profit Tax (PPT) and hydrocarbon tax were budgeted at ₦24.4 trillion, while FIRS itself projected only ₦5.2 trillion. Actual collections for January–September came in at ₦4.1 trillion—just 22 percent of the prorated budget benchmark.

A similar pattern is evident in Companies Income Tax (CIT) from oil and gas companies, which achieved only 32 percent performance over the same period. The result is a recurring paradox: even when FIRS meets or exceeds its own internal targets, federal revenue still records a shortfall against the official budget, because the benchmarks themselves are anchored to implausibly optimistic assumptions.

Where the Real Economic Damage Lies

The most significant economic cost of Nigeria’s oil tax forecasting problem does not lie in foregone spending or incremental borrowing—since the government cannot spend revenue that does not materialise, and would likely have borrowed regardless. Rather, the real damage is structural and cumulative.

Over-ambitious oil and gas tax forecasts delay political acceptance of fiscal limits, postpone non-oil tax reform, and perpetuate oil-centric fiscal thinking. As long as budgets embed revenue numbers that are disconnected from historical performance and production realities, policymakers are able to defer difficult but necessary trade-offs—such as aggressive broadening of the non-oil tax base, expenditure reprioritisation, explicit downsizing of the fiscal state, or a more honest recalibration of national development ambitions.

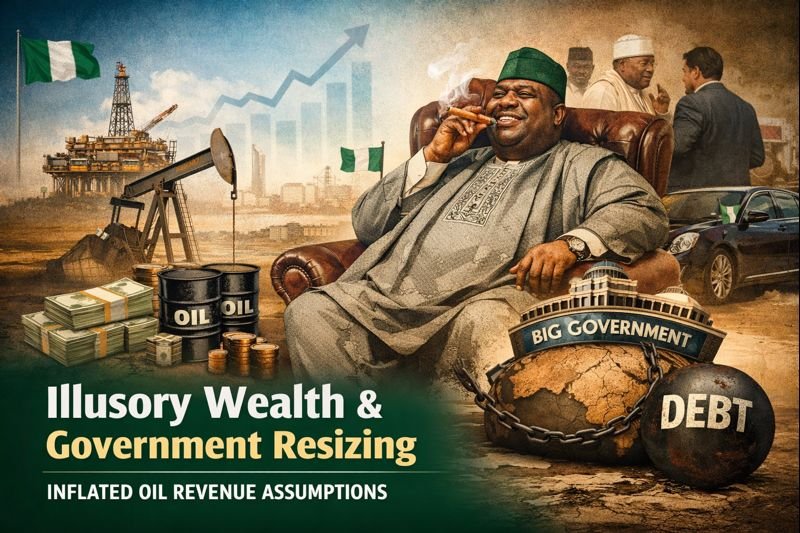

Illusory Wealth and the Size of the Nigerian State

Crucially, inflated revenue assumptions also create an illusion of national wealth that sustains an oversized and expensive state structure. Nigeria maintains a large federal bureaucracy, overlapping ministries, departments and agencies, and a complex political architecture whose recurrent costs are difficult to justify relative to actual revenue capacity.

Personnel costs, allowances, pensions, overheads, and political office entitlements consume a dominant share of federally retained revenue, leaving limited fiscal space even in years of relatively strong oil prices. Legislators and senior political office holders continue to enjoy some of the highest remuneration and benefits in Africa—often shielded from public scrutiny—while public sector efficiency remains low.

By embedding optimistic oil revenues in fiscal plans, the budgetary process implicitly postpones the political reckoning required to resize government to a level consistent with Nigeria’s true income base. The result is not an immediate fiscal crisis, but a chronic postponement of adjustment, in which the state behaves as if it is richer than it is, and reform is continually deferred to a future oil upswing.

Growth Implications

The growth cost is therefore dynamic, not static. Nigeria remains trapped in a low-productivity equilibrium in which capital formation is episodic and often donor-driven, long-term planning is repeatedly reset rather than compounded, and fiscal strategy is built around expectations of future oil windfalls rather than present constraints.

This is not ultimately about money “lost.” It is about time wasted—and the prolonged deferral of the structural adjustments required for sustainable, non-oil-led economic growth.