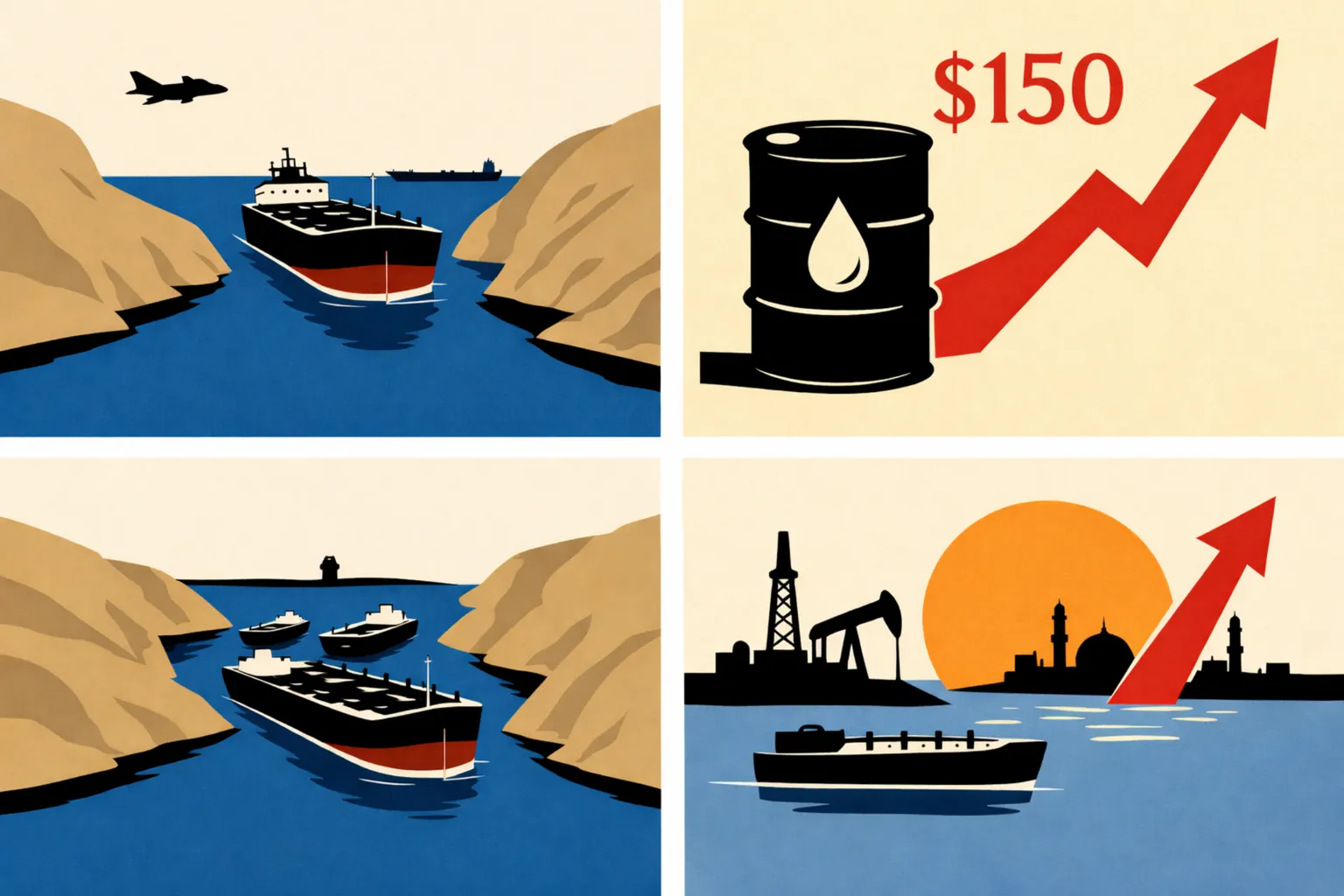

The surge of indigenous Nigerian oil firms has ignited a rare momentum in the sector, where private ambition converges with national resilience. As foreign majors gradually divest from onshore operations, homegrown firms are seizing the reins of transformation through innovation, investment, and technical audacity.

Conoil’s groundbreaking Obodo blend, with its maiden cargo shipped in May 2025, exemplifies how local operators are no longer passive participants but innovators. The introduction of the first new Nigerian crude grade in six years broadens the country’s export basket and signals a new era of market-driven independence. It also shows that independents can develop and market their blends, reducing reliance on legacy streams.

Similarly, Heirs Energies has executed a textbook brownfield revival at OML 17, doubling output to over 60,000 barrels per day after reopening 60 wells. Recognised as SAiPEC’s Independent Company of the Year in 2025, Heirs has proved the viability of Nigerian-led asset rehabilitation.

In the midstream, Seplat Energy’s commissioning of the ANOH 300 MMscf/d gas plant in May 2024 and a $320 million capex target to boost oil output to 140,000 b/d underlines the sector’s pivot to gas monetisation and domestic supply. Waltersmith Refining’s modular refinery expansion—set to quadruple capacity to 40,000 b/d by Q3 2025—cements a trend toward import substitution and value retention.

Duport Midstream’s earlier delivery of a 2,500 b/d mini-refinery and Nigeria’s first integrated gas-power hub, and Green Energy International’s Otakikpo 360,000 b/d export terminal—designed to aggregate 40 stranded fields—reaffirm that infrastructure gaps are increasingly being closed by local ingenuity.

Renaissance Africa Energy’s $15 billion bet on Shell’s divested assets is perhaps the boldest of all, signaling a generational shift in asset stewardship. But the operational challenges are real: vandalism and spills on the Trans Niger Pipeline illustrate the enduring risks—environmental, security, and reputational that still shadow Nigerian hydrocarbon ventures.

Oando PLC’s acquisition of ENI’s NAOC stake and the strategic lift of the Obodo blend further demonstrate the rise of Nigerian trading-cum-production firms, a model that could challenge traditional industry hierarchies.

Aradel Holdings, with a 40% year-on-year output surge and a pioneering privately owned refinery, and FIRST E&P’s greenfield Madu field, Nigeria’s biggest offshore start by a local firm—round out the list of 10 firms that now chart the country’s upstream trajectory.

Sourced from the African Energy Council, these milestones reflect not just company-level ambition but a broader recalibration of who leads and who benefits from the Nigerian oil and gas industry.