Nigeria’s national oil company, NNPLC is carrying crude-backed loan obligations estimated at ₦8.07tn, according to an analysis of the Nigerian National Petroleum Company Limited’s 2024 financial statements and capital-commitment disclosures.

The obligations—built around forward crude sales, gas-delivery financing and refinery rehabilitation loans—have become a defining feature of NNPCL’s fundraising strategy after years of declining production, high fiscal pressure and weak upstream investment.

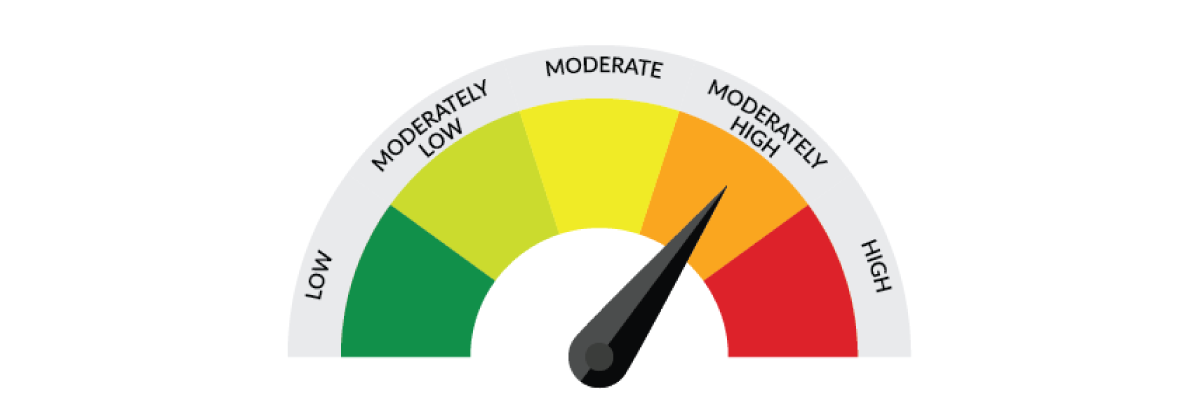

But analysts warn that the growing complexity and opacity surrounding these transactions has made it difficult for the country to track how much crude is already tied up—and how much revenue is being lost.

Eagle Funding, NLNG Gas-Delivery Loans and Refinery Debt: A Heavy Crude Burden

One of the most significant crude-backed exposures is the Eagle Export Funding arrangement, which requires NNPCL’s upstream subsidiary, NEPL, to deliver at least 1.8 million barrels per cycle. Earlier reporting shows that Eagle comprises three loan tranches:

-

$935m (2020) — 30,000 bpd, repaid by 2023

-

$635m (2020) — repaid by 2023

-

$900m (2023) — 21,000 bpd pledged; ₦1.1tn outstanding as of December 2024

NNPCL’s gas-delivery financing with Nigeria LNG (NLNG) also accounted for a sizeable obligation. NLNG advanced ₦772bn for future gas supplies; by end-2024:

-

₦535bn worth of gas delivered

-

₦312bn recovered

-

₦472bn outstanding, including financing charges

Refinery rehabilitation projects carry major crude delivery commitments

Two of the largest facilities—Project Yield and Project Leopard—are tied to refinery rehabilitation:

-

Project Yield (Port Harcourt Refinery)

-

Drawn: ₦1.4tn

-

Secured with refined-product-equivalent of 67,000 bpd

-

Repayment begins June 2025

-

-

Project Leopard

-

Outstanding: ₦1.3tn

-

Backed by 35,000 bpd

-

Repayment begins mid-2025

-

Project Gazelle: The biggest crude-for-cash facility

The single largest obligation is Project Gazelle, used to advance tax and royalty payments on key PSC assets. By December 2024:

-

₦4.9tn drawn out of ₦5.1tn

-

Only ₦991bn worth of crude delivered

-

A massive ₦3.8tn still outstanding

-

Requires sustained deliveries of 90,000 bpd

Over 213,000 Barrels Per Day Already Committed

Across four major crude-for-loan contracts, NNPCL has pledged a combined:

-

21,000 bpd — Eagle Export Funding

-

67,000 bpd — Project Yield

-

35,000 bpd — Project Leopard

-

90,000 bpd — Project Gazelle

Total: 213,000 barrels per day

This represents a significant share of Nigeria’s average 2024 production of 1.43 million bpd, reducing the volumes available for export and government revenue.

Fiscal Impact: Lower Revenue Despite Rising Output

Despite a modest 12.6% increase in production—from 392.66m barrels in 2023 to 442.21m barrels in 2024—Nigeria’s gross profit from crude and gas sales fell by 43%, dropping to ₦1.08tn from ₦1.90tn.

The country also missed its budget benchmark of 1.78 million bpd, producing only about 80% of the target.

Meanwhile, NNPCL’s remittances have been inconsistent. The World Bank stated that NNPCL remitted only ₦600bn out of ₦1.1tn in subsidy-removal revenue gains in 2024, using the remainder for unresolved arrears.

Experts Warn: “Nigeria Doesn’t Know the Full Details”

Energy analyst and CEO of AHA Strategies, Ademola Adigun, says Nigeria’s steady decline in crude earnings is partly explained by opaque loan agreements tied to oil production.

“Some of our crude is already tied up in loan agreements. The problem is that Nigeria doesn’t know the full details of these transactions because there’s little transparency around them.”

Adigun noted that major arrangements like Project Gazelle lack adequate public disclosure or parliamentary scrutiny. He urged NEITI to deepen its audits to reveal precisely how much crude is committed to loan settlements.

Development economist Dr Aliyu Ilias added that Nigeria’s oil-trading system has become too complex, involving swaps and naira-for-oil exchanges not always reflected in federal revenue projections.

Dr Muda Yusuf, Director of the Centre for the Promotion of Private Enterprise, linked much of the burden to emergency borrowings during the Godwin Emefiele era at the Central Bank:

“During the Emefiele years, Nigeria committed a lot of its crude up front. Those forward sales are still eating into our current earnings.”

Yusuf, however, acknowledged that the NNPCL management under Bayo Ojulari has shown improved professionalism, while urging the government to fully disclose the terms of all swap, prepayment and forward-sale contracts.

A System Built on Borrowed Barrels

In October 2024, it emerged that NNPCL had pledged 272,500 bpd in crude through loan arrangements totalling $8.86bn, equivalent to 8.17 million barrels diverted monthly.

Analysts say that unless the government reforms oil-trading governance, Nigeria may remain trapped in a cycle where tomorrow’s crude earnings are consistently mortgaged to finance today’s budget shortfalls.