Airtel Africa Plc has continued the execution of its $100 million share buy-back programme, repurchasing 40,000 ordinary shares as part of an ongoing capital return strategy, according to regulatory disclosures published in London and on the Nigerian Exchange (NGX) on 12 January 2026.

The shares were acquired through Barclays Capital Securities Limited on 8–9 January 2026 and will be cancelled, resulting in a marginal reduction in the company’s issued share capital and voting rights.

Transaction details

According to the filing, the repurchase was executed across multiple European trading venues, including:

Also Read:

- Airtel Africa Successfully Tests Satellite Internet Speed Above Moving Train in Sub-Saharan Africa

- From ‘Africa Rising’ to Real Governance: Moghalu Says Africa Needs Strategy, Not Slogans…

- Airtel Africa Delivers 21.1% Constant Currency Revenue Growth Despite Currency Headwinds

- Airtel Africa to List Airtel Money in First Half of 2026

-

London Stock Exchange

-

BATS Europe

-

CHI-X Europe

-

Aquis Exchange

-

Turquoise

The shares were bought at prices ranging between 361.00 pence and 374.40 pence, with a volume-weighted average price (VWAP) of approximately 364–370 pence, reflecting normal intraday variation across venues.

While modest in absolute size, the transaction represents a deliberate continuation of Airtel Africa’s capital return programme rather than a symbolic or front-loaded exercise.

Updated share capital and voting rights

Following the cancellation of the repurchased shares:

-

Ordinary shares in issue: 3,655,640,539

-

Treasury shares: 7,489,044

-

Total voting rights: 3,648,151,495

Airtel Africa noted that this figure represents the voting-rights denominator shareholders should use when assessing disclosure obligations under applicable transparency and ownership notification rules.

Programme progress since inception

Since the commencement of the first tranche of the $100 million buy-back programme, announced in December 2024, Airtel Africa has now repurchased approximately 41.1 million shares in aggregate.

The cumulative volume-weighted average price since inception stands at around 153 pence per share, reflecting the fact that the programme began during a period of significantly lower market valuations.

All shares acquired under the programme are being cancelled, reinforcing management’s stated emphasis on balance-sheet discipline, capital efficiency, and long-term shareholder value enhancement.

Buyback pricing signals confidence at current valuation levels

The January 2026 transaction was executed within a relatively tight price band, suggesting management comfort with Airtel Africa’s prevailing valuation.

This confidence is underpinned by:

-

resilient operational cash flows across its African footprint,

-

continued growth in data usage, and

-

expanding mobile money penetration across key markets.

While the buyback itself is not large enough to materially move the share price, it contributes incrementally to earnings per share accretion and signals capital allocation conviction.

Capital allocation discipline amid African market volatility

For investors, the continuation of the buyback underscores Airtel Africa’s evolving capital allocation framework, which balances:

-

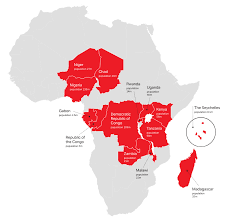

sustained network and spectrum investment across 14 African markets,

-

ongoing debt optimisation, and

-

direct capital returns to shareholders.

At a time when many emerging-market corporates remain cautious amid global interest-rate uncertainty, FX volatility, and uneven capital access, Airtel Africa’s willingness to persist with buybacks sends a signal of predictable cash generation and balance-sheet confidence.

Why this matters for investors

The strategic significance of the transaction lies less in its size and more in its consistency.

First, it confirms that the $100 million buyback programme remains active well into 2026, rather than being purely opportunistic or symbolic.

Second, it reinforces management’s view that excess capital is better returned to shareholders than retained in a low-yield environment.

For long-term investors focused on frontier and emerging markets, the discipline and regularity of execution may prove as important as the quantum of capital returned.

Explainer: Why Airtel Africa’s Share Buy-Back Notice Appears on the NGX

Although Airtel Africa is primary-listed on the London Stock Exchange, it also maintains a secondary listing on the Nigerian Exchange (NGX).

Under NGX rules, any action that alters a listed company’s share capital or voting rights qualifies as a corporate action and must be disclosed to Nigerian investors.

As a result, share buybacks that lead to the cancellation of shares—even when executed entirely outside Nigeria—must be published on the NGX.

In practical terms:

-

the January 2026 buyback did not involve purchases on the NGX,

-

it does not imply local market trading activity, and

-

the NGX publication reflects cross-listing compliance, not operational execution.

For Nigerian institutional investors and asset managers holding Airtel Africa shares via the NGX, the disclosure ensures:

-

transparency on changes to total shares outstanding,

-

clarity on voting-rights calculations, and

-

parity of information with investors in London and other markets.

Outlook: incremental signals, not dramatic shifts

Airtel Africa’s share repurchases are unlikely, on their own, to drive short-term price movements.

However, taken together with improving margins, expanding mobile money services, and disciplined capital management, they form part of a broader investment narrative focused on durability rather than exuberance.

As the $100 million programme progresses, investors will continue to watch:

-

the pace of repurchases,

-

the interaction with dividend policy, and

-

how management balances buybacks against spectrum investment and FX risk across its African operations.