African Energy Chamber (AEC) has condemned a Federal High Court ruling against the Ministry of Petroleum Resources in favour of Eurafric Energy Limited, reversing the 2020 revocation of the Dawes Island marginal field license, which, post-revocation, has been held and developed by Petralon 54 Limited since 2022.

The ruling effectively challenges the regulator’s 2020 decision not to renew Eurafric’s license that had expired without commercial production after 17 years. An appeal has since been initiated by Petralon 54 Limited, with a stay of execution pending determination by higher courts.

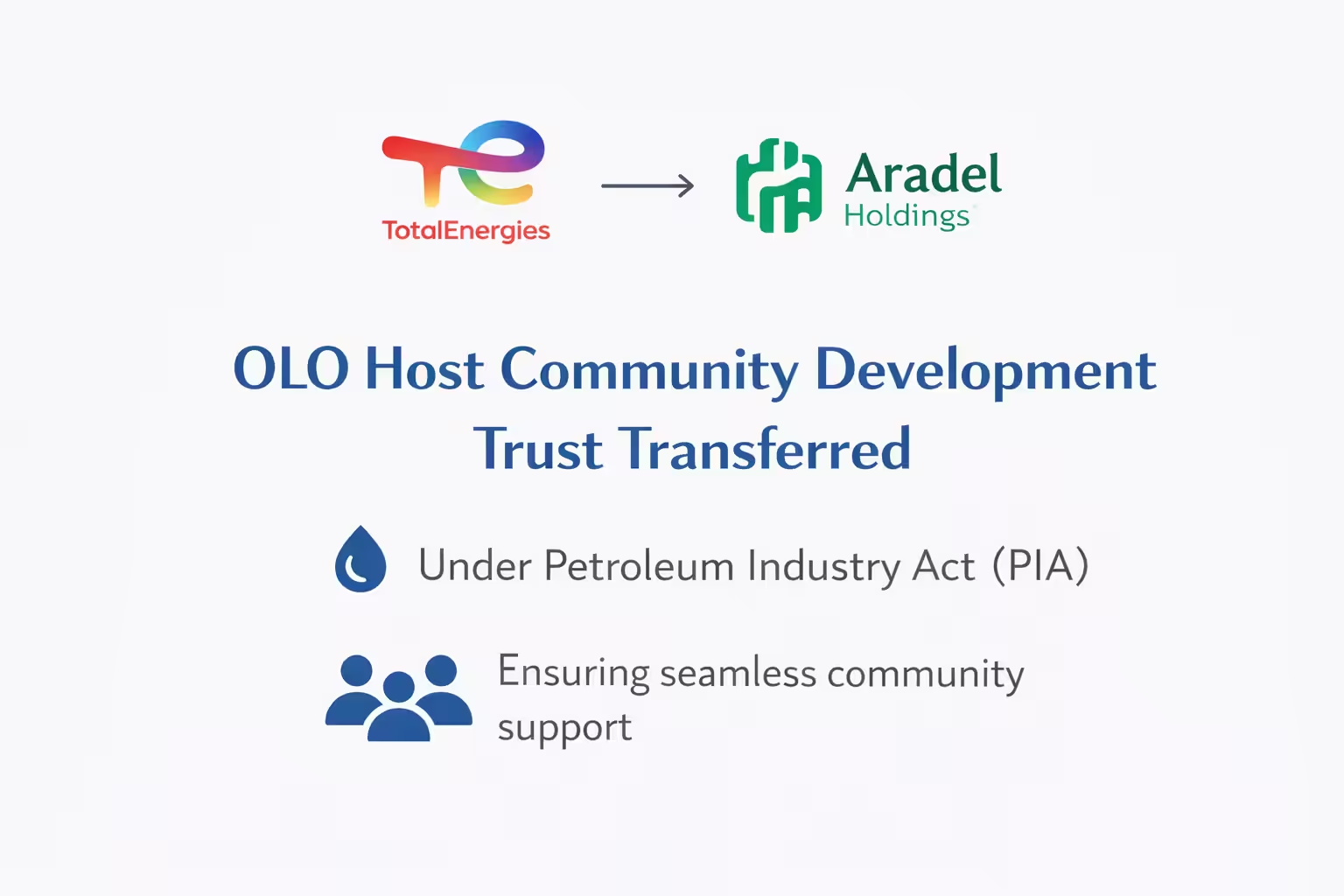

For Nigeria’s upstream sector which is already navigating production recovery and reform implementation under the Petroleum Industry Act (PIA), the implications extend far beyond a single asset.

African Energy Chamber Condemnation

The African Energy Chamber (AEC) has strongly condemned the ruling carried down against the Ministry of Petroleum Resources and Petralon, recognising it as not only an affront to Nigerian companies that are trying to develop marginal fields but also as a clear example of judicial overreach.

The AEC cited concerns over the legal reasoning underpinning the judgment. A central issue is the apparent application of provisions of the PIA – enacted on August 16, 2021 to events that occurred prior to its passage. The Dawes Island license expired in April 2019, and the regulator formally declined renewal in April 2020 – both actions taken under the legal regime in force at the time.

Petralon’s Commitment to Marginal Production

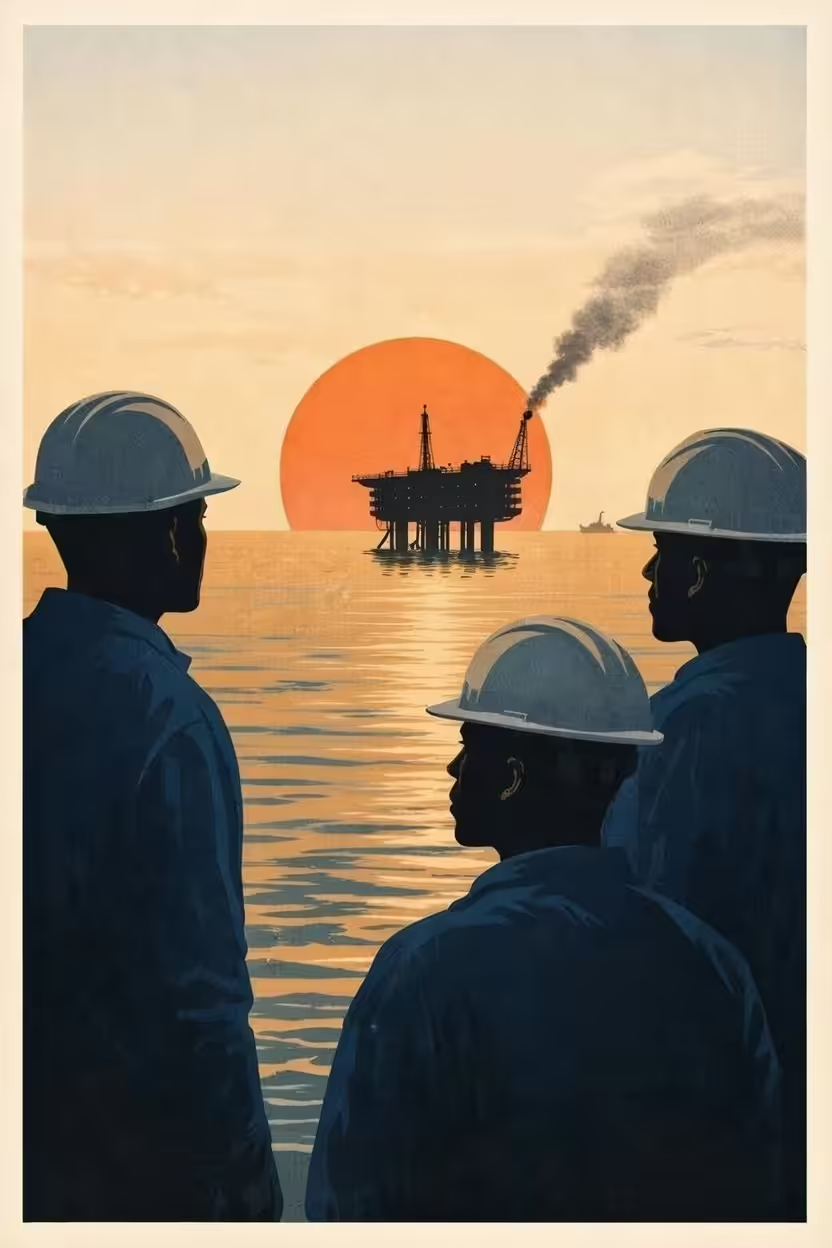

Following the designation of the asset under Petroleum Prospecting License 259 (PPL 259), Petralon moved swiftly to execute its obligations. The licence terms compel a one-well commitment, yet and the company deployed approximately $60 million to drill two new wells and put in place support facilities to commence production within a 12-month period.

More than 150,000 barrels have been produced and evacuated to the Bonny Terminal, Nigeria’s largest export terminal, and royalty payments have already commenced being remitted to the state.

The commencement of the second well was witnessed by Heineken Lokpobiri, Minister of State for Petroleum Resources (Oil) in November 2025, signaling alignment between operator and government. The company has since committed to doubling production at the asset, reaffirming its dedication to Nigeria’s oil growth.

“Petralon is a Nigerian independent that has followed every rule, complied with every regulation and worked hand-in-hand with government to increase production. They drilled, invested, paid royalties and delivered results. To come at this time and derail that progress is unjust and sends the wrong signal to the market,” states NJ Ayuk, Executive Chairman, AEC.