The Bank of England has held interest rates at 3.75% after a knife-edge vote but has opened the door to cuts later this year.

Bank of England governor Andrew Bailey reiterated his forecast that inflation would fall close to the Bank’s 2% target from April onwards, against a previous expectation that it would hit that level in 2027.

“That’s good news,” said Bailey. “We need to make sure that inflation stays there. All going well, there should be scope for some further reduction in [the] Bank Rate this year.”

Also Read:

- UK Inflation Rate Increases Ahead of Bank of England Interest Rate Meeting

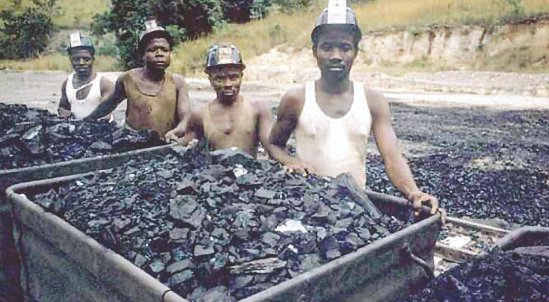

- Afua Kyei: Ghanaian-British Bank of England's CFO Named UK’s Most Influential Black Person

- Bank of England Cuts Interest Rate to 4% Amidst Inflation Fears

- Inflation to top Bank of England target until at least 2026, Goldman Sachs warn

The most recent inflation data showed the rate increased to 3.4% in December, above the Bank’s target.

However, the Bank said policies announced in the Budget, such as cuts to household energy bills, as well as lower wholesale gas prices were expected to help cut the rate.

Bank Cuts UK Economic Growth Forecast

The Bank cut its forecast for UK economic growth in 2026 from the 1.2% growth it forecast last November to 0.9%. The unemployment rate is also expected to tick higher this year, according to the Bank, up from an initial forecast of 5% to 5.3%.

The decision to hold interest rates this month was a close call, with four of the Bank’s nine-member monetary policy committee (MPC) voting for a quarter point cut which would have taken borrowing costs to 3.5%.

Announcing its latest decision, the MPC said: “On the basis of the current evidence, [the] Bank Rate is likely to be reduced further.

“Judgements around further policy easing will become a closer call. The extent and timing of further easing in monetary policy will depend on the evolution of the outlook for inflation.”