Following a surge in staple food prices in the previous year, Nigeria’s food commodity market is now witnessing a notable decline in the prices of staples such as maize, paddy rice, sorghum and soybeans, especially in the northern part of the country. This trend is reflected in the AFEX Commodity Price Index, which has dropped by over 25% from ₦87 at the beginning of the year to ₦64 as of March 2025.

Storage Capacity

Equally critical, is Nigeria’s storage capacity — or rather, the lack of it. Inadequate storage facilities have long been a thorn in the side of Nigerian agriculture, leading to significant post-harvest losses. We at Vestance in our article, Reducing Post-Harvest Losses in Nigeria, we explored the impact of post-harvest losses, and the need for alternative infrastructure to mitigate it. Commodities are perishable, and when farmers produce a lot of food, the benefits can be lost if the produce is not stored or stored properly. Without good storage, harvested commodities cannot be stored properly to meet demand during the lean season. This loss of produce reduces the overall supply, which factors into the significant fluctuations in food prices. Estimates suggest more than 30% of harvested produce is lost due to poor storage, which not only diminishes the effective supply but also forces traders to sell off surplus at depressed prices, exacerbating the cyclical nature of market fluctuations.

Government Spending

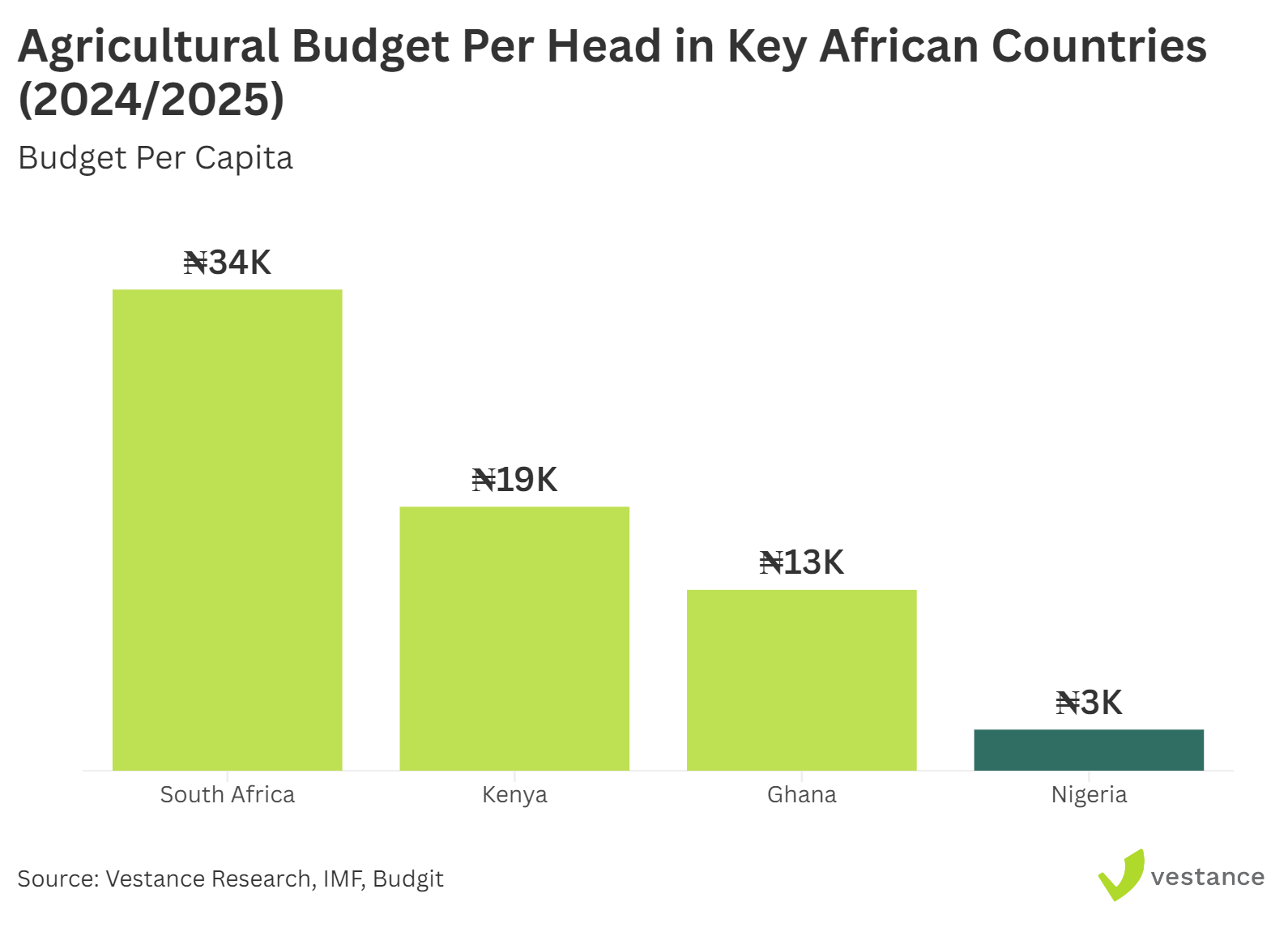

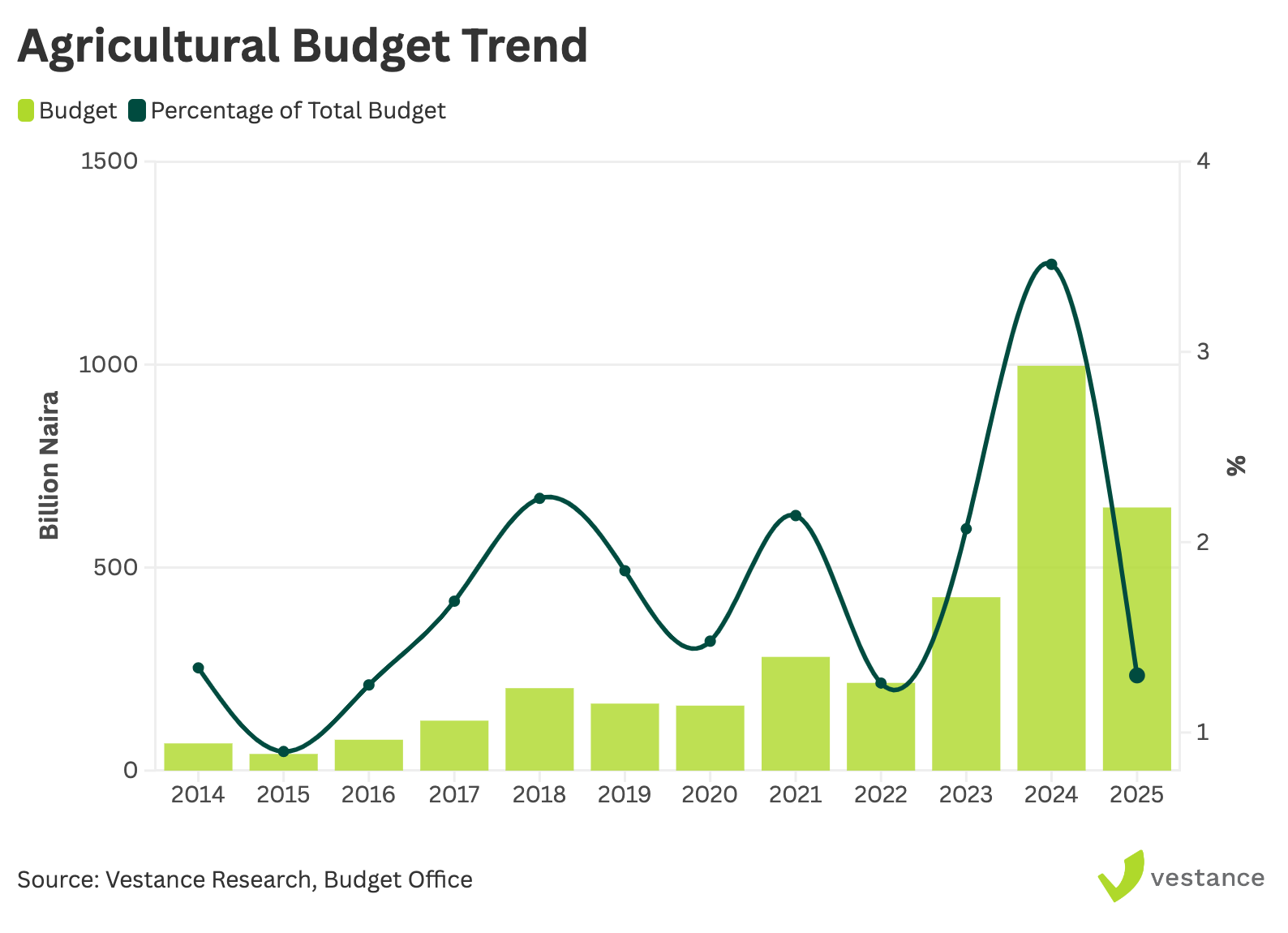

Another significant factor affecting stable prices is the level of government spending on the sector. The proposed 2025 Agricultural Budget is set at less than 1.3% of the total Federal Government budget — roughly ₦2,800 per capita. This is far below the CAADP/Malabo commitment of 10% of the national budget, highlighting a clear gap in funding.

Low agricultural spending means that critical areas such as research, infrastructure development, and farmer support programs remain underfunded. With limited financial resources, investments in inputs, and infrastructure that could boost production and reduce post-harvest losses are delayed or completely overlooked. The effect of this, given the low percentage of the budget, could be seen in low production levels across various commodities, resulting in rising prices.

International Dynamics

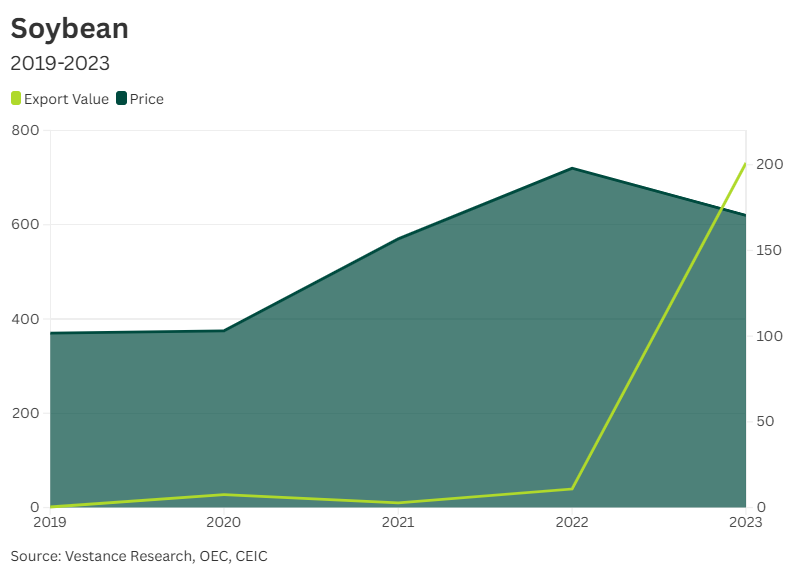

Finally, trade and international demand are a pertinent factor to fluctuating prices. A good case will be the soybean market, where import restrictions on GMO-soybeans in main importing countries during the 2023/2024 season, drove demand for non-GMO soybeans — which is majorly produced in Nigeria. As a result, Nigerian soybean exports skyrocketed by over 1,000%, leading to a sharp increase in domestic prices, trading well above international market quotes. Soybean exports increased significantly from USD 10.8M in 2022 to about USD 201M in 2023, with domestic prices in northern Nigeria surging to over ₦1M per metric ton (a 241% jump over the previous year), far exceeding the international level of around USD 395 per MT. This highlights the effects of global market trends, where policy shifts can create temporary price surges.

When we step back and look at the whole picture, the short-term drop in commodity prices in Nigeria is influenced by a mix of factors — many of which are temporary or subject to sudden change. Seasonal patterns, stable exchange rates, imports and current production surpluses are helping to keep prices low for now. However, the long-term sustainability of this price drop is highly uncertain. Suppose production falls below the level needed to meet demand, or adverse weather conditions disrupt planting and harvesting, or insecurity and exchange rate conditions worsen, the current price drop may not last.

While the current drop in commodity prices offers temporary relief for consumers, it is not a sign of long-term stability. Instead, it reflects a balance of factors that could easily shift, with the market likely seeing another price surge.

Aisosa Osaretin & Zainab Omisanya are researchers with Vestance, a Lagos-based agri-food consultancy.