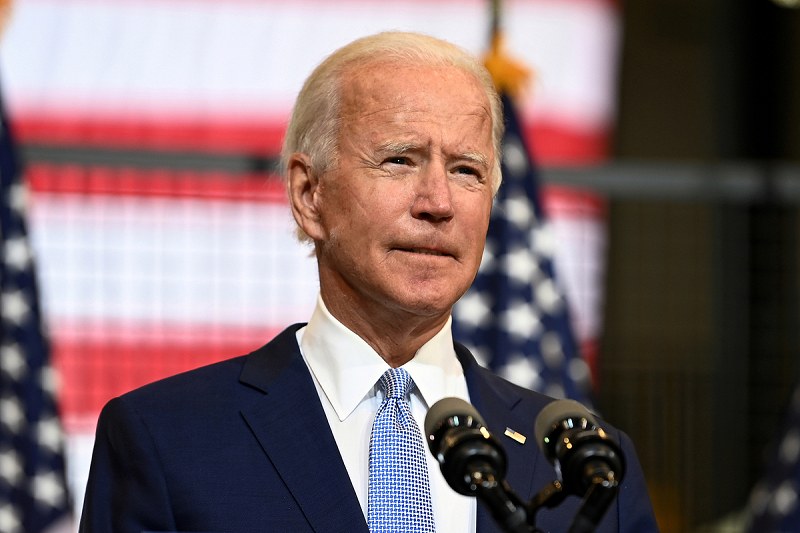

President Joe Biden received some welcome news on Wednesday as the US consumer price index (CPI) fell to 3.3 percent in October, down from 4.4 percent in September, according to the Labour Department. This was the lowest inflation rate since April and below the market expectations of 3.6 percent.

The drop in inflation was mainly driven by a slowdown in the prices of energy, transportation and food, which had surged in previous months due to supply chain disruptions and pent-up demand. The core CPI, which excludes volatile items such as food and energy, also eased to 2.6 percent in October, the lowest since March.

Also Read: Nigeria’s Inflation Rate Reaches 14.23 Percent in October, Above CBN Forecast

The lower-than-expected inflation figures eased some of the pressure on the Federal Reserve, which has been facing calls to tighten its monetary policy sooner than planned to curb the rising cost of living. The Fed has maintained that the inflation spike is transitory and will fade as the economy recovers from the pandemic.

However, not all countries are experiencing a decline in inflation. In contrast, Nigeria’s inflation rate hit a 16-year high in October. According to the latest data released by the Central Bank of Nigeria, the country’s annual inflation rate continued to climb to 27.3 percent in October 2023, the highest since August 2005, up from 26.7 percent in the prior month.

The main drivers of the inflation surge were the rising prices of food, housing, utilities, and transportation, as well as the depreciation of the naira against the dollar. The food inflation rate, which accounts for more than half of the consumer price index basket, jumped to 31.5 percent in October, the highest since August 2005, from 30.6 percent in the prior month, amid persistent security issues in food-producing regions. The core inflation rate, which excludes farm produce, rose to a record 22.7 percent in October, accelerating from September’s reading of 22.1 percent.

Also Read: Nigerians feel the pinch as food prices continue to spiral. There aren’t easy solutions

On a monthly basis, consumer prices rose by 1.7 percent in October, following a 2.1 percent surge in the prior month.

The inflationary pressures have intensified over the recent months due to the government’s elimination of fuel subsidies in May and the Central Bank’s decision to reduce interventions in the foreign exchange markets in June. The naira has lost more than 40 percent of its value against the dollar since the beginning of the year, making imports more expensive and eroding the purchasing power of consumers and businesses.