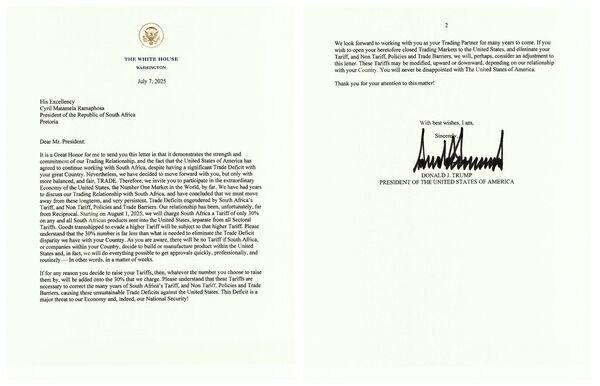

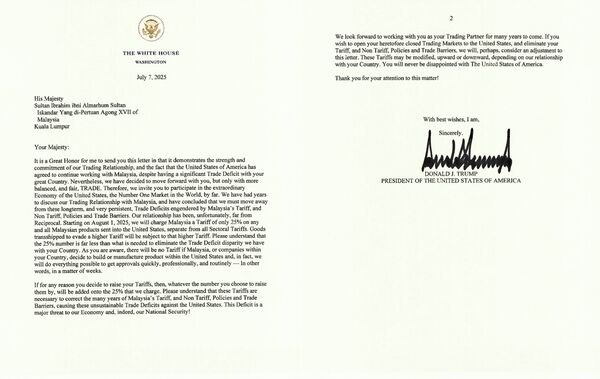

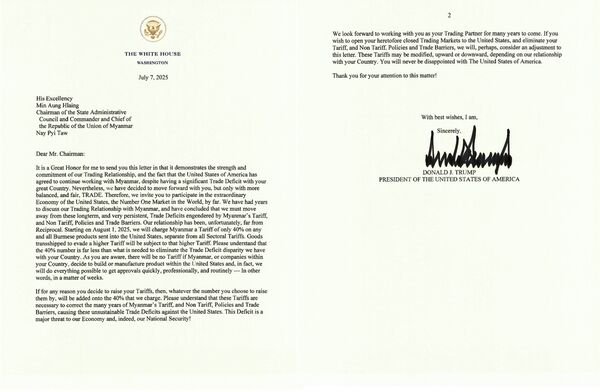

U.S. President Donald Trump escalated global trade tensions on Monday by announcing new tariffs of 25% on imports from Japan, South Korea, Malaysia, and Kazakhstan, and 30% on goods from South Africa, effective August 1. Myanmar and Laos will face even steeper duties of 40%, while the White House warned of further retaliatory actions if countries respond with countermeasures. Trump had sent out tariff letters to each country earlier today notifying them of their tariffs.

The move triggered immediate market volatility, with U.S. stocks falling to session lows and currencies such as the South Korean won, South African rand, and Japanese yen tumbling. Press Secretary Karoline Leavitt confirmed the extension of the July 9 deadline for finalizing trade pacts to August 1, offering negotiators three more weeks to hammer out agreements.

“The President’s patience is wearing thin,” Leavitt stated during Monday’s briefing, underscoring that 12 additional tariff notification letters were being sent out to countries and regions including the EU. While the EU reportedly will not receive a formal letter on tariff hikes, Leavitt maintained that “no one is exempt” if deemed in breach of fair trade practices.

The announced tariff schedule indicates consistency with or increases over previous rate threats. For instance, Japan and South Korea now face a uniform 25% rate, equal to or higher than Trump’s “Liberation Day” tariff benchmarks, dampening hopes for a softening of U.S. positions.

The White House emphasized that South Africa remains a particular focus. During a May visit by President Cyril Ramaphosa to the Oval Office, Trump played a controversial video backing discredited claims of a “genocide against White farmers.” The moment went viral after Vice President JD Vance handed Trump what he described as “evidence,” prompting the official White House X (formerly Twitter) account to post the clip with the caption: “President Trump always brings the receipts.”

On Monday, South Africa’s 30% tariff was reaffirmed, one of the few unchanged from earlier projections, while Malaysia’s rate crept up by 1 percentage point. Conversely, Kazakhstan’s tariff dropped from 27% to 25%, and Myanmar and Laos saw reductions from 44% and 48%, respectively, to 40%, reflecting what insiders describe as “strategic recalibrations.”

Despite minor fluctuations, the overarching message remains one of confrontation. Trump’s trade team appears determined to extract concessions through pressure, with tariff escalation serving as both leverage and punishment.

Investors are bracing for prolonged uncertainty. With no clarity on the timing for bilateral or sectoral deals, global markets remain jittery, and analysts warn that prolonged tension could dampen growth across emerging markets already strained by currency instability.

As the August 1 deadline approaches, all eyes will be on how targeted nations respond and whether this new round of U.S. tariffs will lead to retaliatory barriers. In the meantime, Trump’s aggressive tariff diplomacy has reinserted global trade friction as a top geopolitical risk for Q3 2025.