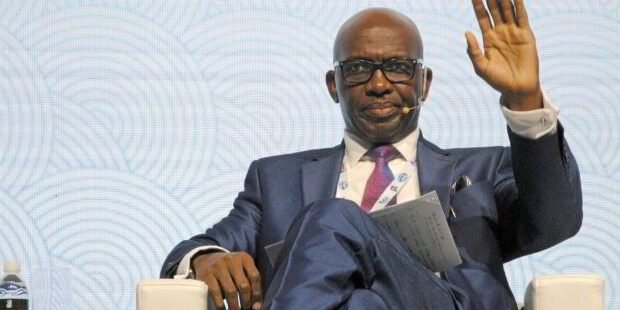

Tony Attah, the respected former CEO of Nigeria LNG and one of Africa’s most experienced energy executives, has re-emerged to lead one of the most consequential transitions in Nigeria’s oil and gas history.

Now Chief Executive Officer of Renaissance Africa Energy Company Ltd, Attah is steering the newly formed company just over 90 days after it acquired Shell Petroleum Development Company of Nigeria Ltd (SPDC) in a landmark deal.

In his first public remarks since the acquisition, Attah described the moment as “a new beginning” for African energy. “I stepped out of retirement to help shape Africa’s energy landscape, decisively tackling energy poverty in order to unlock economic prosperity for our continent,” he wrote. “I’m back—not just to lead, but to serve a purpose greater than myself.”

A Post-Shell Future for Nigeria’s Oil Industry

The transfer of SPDC to Renaissance is emblematic of the broader withdrawal by international oil majors from Nigeria’s onshore operations—a space increasingly dominated by local and regional operators. For years, Shell had sought to divest from its onshore joint venture, citing operational, regulatory, and community-related risks. The sale to Renaissance represents the culmination of a complex negotiation process involving government approvals, environmental compliance, and asset restructuring.

Renaissance now assumes responsibility for some of Nigeria’s most established yet challenging oil assets, with production, environmental remediation, and community relations high on the agenda. But under Attah’s leadership, the company is framing its mission as far more than operational continuity.

“This isn’t just a business; it’s a story of Ambition, Belief, and Courage. It’s a calling to architect a sustainable energy future for millions—creating jobs and powering communities,” he said.

Tinubu-Era Reforms and the Political Wind Behind the Deal

Attah credited Nigerian President Bola Ahmed Tinubu for enabling the transaction, calling his support “visionary leadership in approving this landmark deal against all odds.” The acquisition comes against the backdrop of a reform-driven shift in Nigeria’s energy policy under Tinubu, including the commercialisation of NNPC Ltd, new executive orders to stimulate upstream investment, and clearer fiscal terms designed to unlock long-stalled energy projects.

Taken together, these reforms are reviving investor interest and have repositioned Nigeria as a more competitive jurisdiction for energy capital. For Renaissance, that momentum has helped turn the SPDC deal from aspiration into execution.

Attah also acknowledged Renaissance’s shareholders and broader ecosystem of stakeholders, whose “courage and resilience” gave the transition credibility and speed.

Though the company is still in the early stages of post-acquisition integration, Attah cited “early wins”—including new partnerships, operational milestones, and recognition from regulators. Renaissance was recently honoured with the Nigerian Content Development and Monitoring Board’s award for International Upstream Operator of the Year, an accolade that affirms its ambition to align commercial success with local capacity development.

Tony Attah: Engineer, Executive, and Advocate for African Energy

A seasoned oil and gas executive, Attah brings over 30 years of experience to Renaissance, including senior leadership roles at Shell and as Managing Director and CEO of Nigeria LNG, one of the country’s most profitable and strategically significant enterprises. A mechanical engineer by training and alumnus of the University of Benin, he also holds a Master’s in Business Administration and has completed executive education at INSEAD and Wharton.

At NLNG, Attah oversaw the company’s Train 7 expansion project, deepening its global competitiveness and strengthening its linkages with local suppliers. His leadership style blends technical discipline with stakeholder diplomacy—skills that will be tested in his new role overseeing complex legacy assets and navigating Nigeria’s evolving energy landscape.

“We are made in Nigeria, built for Africa,” Attah declared, describing Renaissance’s culture as grounded in “CRISP” values—Collaboration, Respect, Integrity, Safety, and Performance—and a “disciplined delivery” ethos.

A Broader African Vision

While the SPDC acquisition is centred in Nigeria, Attah’s ambitions clearly stretch beyond national borders. He framed Renaissance as a pan-African energy company committed to enabling energy security and industrialisation across the continent.

“There’s no prosperity without energy,” he noted, pointing to sub-Saharan Africa’s chronic power deficit and the untapped economic potential that reliable energy access could unlock.

His rallying cry is clear: “It’s time for Africa.” And in returning from retirement to lead Renaissance, Attah appears determined to turn that vision into a scalable business model.

About Renaissance Africa Energy

Renaissance Africa Energy Company Ltd was formed as the investment vehicle to acquire Shell’s 100% shareholding in SPDC. The company is backed by a consortium of local and international investors, including ND Western, Aradel Energy, First E&P, Waltersmith Petroman, and Petrolin Group. This ownership structure brings together some of the most prominent Nigerian independents with strong technical, financial, and operational capabilities.

The acquisition includes SPDC’s 30% interest in the SPDC Joint Venture, which also comprises the Nigerian National Petroleum Company Limited (NNPC Ltd, with 55%), TotalEnergies (10%), and ENI (5%). The JV operates key onshore and shallow water assets across the Niger Delta, involving over 18 flow stations, a network of oil and gas pipelines, and substantial infrastructure including gas plants and export terminals.

The deal also includes SPDC’s interest in key gas development projects—critical to Nigeria’s aspirations for domestic energy security and gas-led industrialisation. Renaissance is expected to play a pivotal role in accelerating the development of these assets, positioning itself as a major supplier to Nigeria’s growing domestic gas market.

The consortium has committed to upholding high environmental standards and strengthening host community engagement, two areas that had drawn scrutiny during Shell’s tenure. Renaissance is also expected to deepen local content across its operations in line with Nigerian government policy.

Keywords: Tony Attah, Renaissance Africa Energy, SPDC acquisition, Shell Nigeria divestment, Tinubu oil reforms, Nigerian energy policy, local content, Nigeria LNG, upstream investment, gas development, African energy transition

Meta Description: Tony Attah returns to lead Renaissance Africa Energy after its acquisition of SPDC from Shell. Backed by local investors and Tinubu-era reforms, the company aims to reshape Nigeria’s oil and gas landscape and drive a continent-wide energy transformatio.