President Bola Ahmed Tinubu has formally codified four major tax reform instruments into Nigerian law, addressing longstanding concerns over the legal force and regulatory clarity of his administration’s earlier executive orders aimed at reviving the energy sector. The move has been welcomed as a decisive step in removing investor uncertainty and strengthening Nigeria’s investment climate.

The new laws include:

Presidential Directive 40, which provides fiscal incentives for upstream, midstream gas, and deep offshore projects;

The 2024 VAT Modification Order, which exempts Compressed Natural Gas (CNG), Liquefied Petroleum Gas (LPG), and clean energy products from VAT;

The 2025 Upstream Petroleum Cost Efficiency Order, which introduces performance-based tax incentives tied to production cost reductions.

These measures, now embedded in the Nigeria Tax Act, have already helped unlock over $6 billion in new oil and gas investments, according to Special Adviser to the President on Energy, Olu Arowolo Verheijen.

“With their codification, the administration has delivered long-term certainty and regulatory clarity, ensuring these critical incentives are protected from future policy reversals,” said Verheijen, describing the legal action as “another bold step toward sustainable growth and shared prosperity for all Nigerians.”

Responding to Legal Criticism

The codification addresses one of the key criticisms raised by top energy lawyers and industry analysts when the policies were first introduced via executive order.

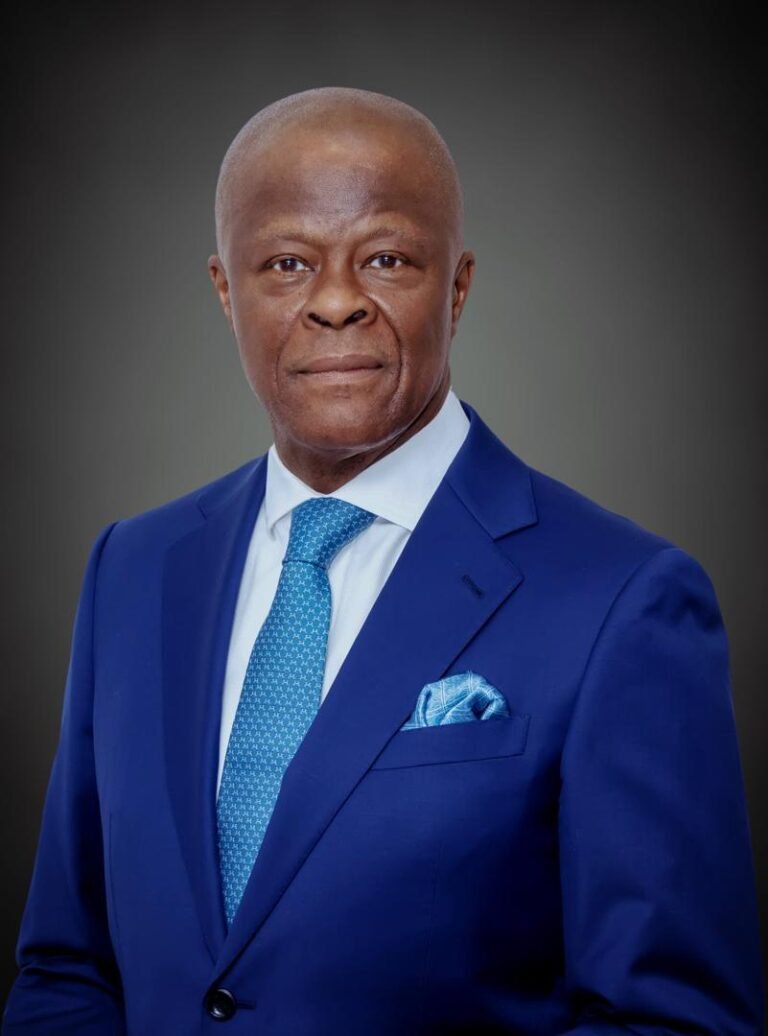

Earlier this year, Tominiyi Owolabi, Managing Partner at Olaniwun Ajayi LP, warned that Nigeria’s ambitious upstream cost-cutting order would only succeed with “legal clarity, regulatory coordination, and disciplined execution.” He cautioned that executive orders, while politically symbolic, lacked the legislative authority to compel enforcement by key institutions like the Federal Inland Revenue Service (FIRS) and the Nigerian Upstream Petroleum Regulatory Commission (NUPRC).

“Executive Orders don’t lower costs. Execution does,” Owolabi said at the time, emphasising the need for legislative backing to avoid ambiguity and institutional friction.

He further questioned whether tax incentives offered by presidential directives could override existing laws or be consistently recognised across agencies.

The codification of these fiscal measures into the Nigeria Tax Act now provides the statutory basis for implementation and removes the risk of policy reversals—a move likely to reassure both domestic operators and foreign investors.

Strengthening Investor Confidence

By embedding these reforms in national legislation, the Tinubu administration has addressed a key institutional hurdle in the drive to reform Nigeria’s oil and gas fiscal landscape: policy inconsistency. The legal upgrade of the incentive framework is expected to not only sustain current investment momentum but also attract long-term capital to Nigeria’s gas and deepwater sectors—especially in the context of rising global interest in cleaner energy and stable upstream returns.

The reforms are part of the President’s broader energy transition strategy, which positions natural gas as a bridge fuel and aims to reduce production costs, improve infrastructure, and cut emissions.