CBN Warns Banks Use of Unaccredited Cheque Printers Could Attract ₦10m Fine

The Central Bank of Nigeria has announced stricter penalties for deposit money banks that engage unaccredited cheque printers, warning that

The Central Bank of Nigeria has announced stricter penalties for deposit money banks that engage unaccredited cheque printers, warning that

Stanbic IBTC Holdings Plc delivered a sharp earnings rebound in FY2025, with profit after tax rising to ₦102.3bn from ₦57.9bn

The unaudited full-year 2025 results of First HoldCo Plc have sparked intense scrutiny among analysts following the disclosure of a

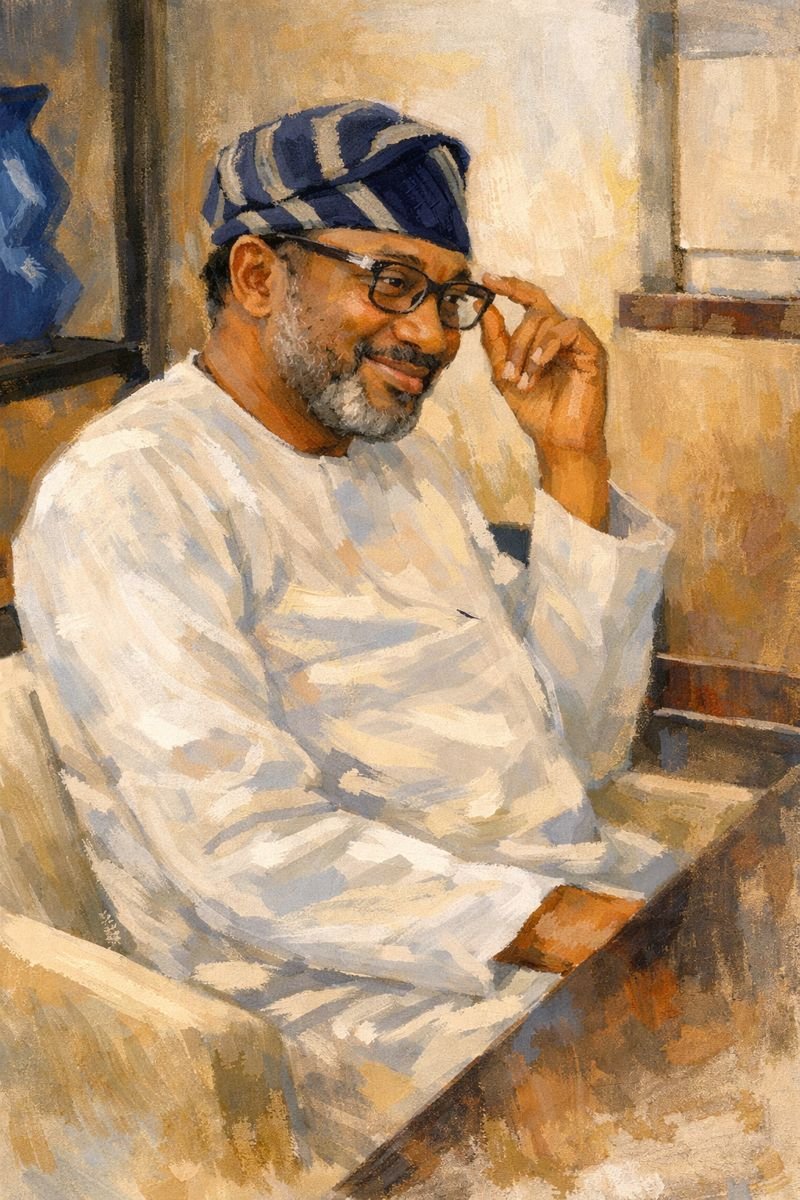

Femi Otedola has increased his ownership stake in First HoldCo Plc to 18.12%, deepening his position as the group’s most

Nigeria’s banking recapitalisation has moved from policy ambition to last-mile arithmetic. With the Central Bank of Nigeria’s March 31, 2026

Nigerian banks are entering a new phase after several years of unusually strong profits. Following large capital raises and a

By any global standard, Tony Elumelu’s 20% stake in UBA is exceptionally large. With his stake in United Bank for

Nigeria’s banking sector is in the midst of its most consequential capital-raising cycle in over a decade. With the Central

Fidelity Bank Plc has raised ₦259 billion from a recently concluded Private Placement of Ordinary Shares, significantly strengthening its balance

Guaranty Trust Bank Limited (GTBank) has announced an exchange rate of ₦1,435 per US dollar for international transactions carried out

Fidelity Bank Plc has announced the completion of the tenure of its Board Chairman, Mustafa Chike-Obi, and the appointment of

As Nigeria’s banking sector moves past what investors widely regarded as a year dominated by recapitalisation, attention is turning to

Get notified about new articles