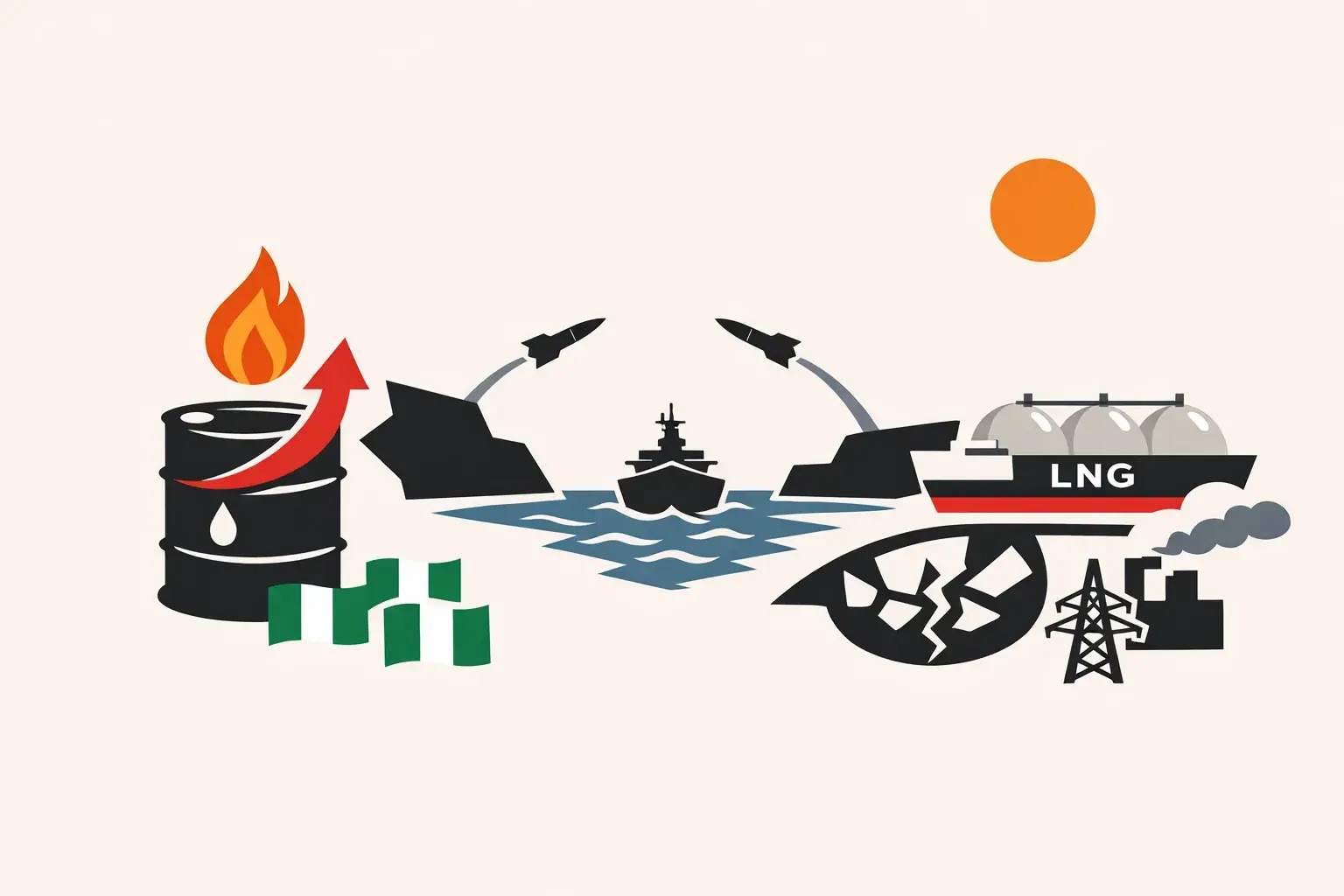

The simmering industrial dispute between the $20 billion Dangote Petroleum Refinery and the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) worsened over the weekend. On Saturday, the oil workers’ union ordered seven of its branches in upstream and midstream companies—including TotalEnergies, Chevron, Seplat, Shell Nigeria Gas, Oando, Renaissance, and the Nigerian Gas Infrastructure Company (NGIC)—to immediately cut crude oil and gas supplies to the facility.

At the heart of the crisis is the allegation that Dangote Refinery sacked about 800 Nigerian workers for joining PENGASSAN. In a letter dated September 26, the union’s General Secretary, Lumumba Okugbawa, accused management of anti-labour practices, including mass dismissals, withdrawal of staff buses, and preferential access for expatriate workers.

PENGASSAN’s Directive: “Injury to One, Injury to All”

PENGASSAN’s directive went beyond symbolic protest. It specifically instructed branch chairmen across key energy firms to:

-

Halt crude oil supply valves to the refinery

-

Cut gas supply via NGIC pipelines

-

Stop loading operations for vessels headed to the refinery

The union stressed that its solidarity action was necessary to defend constitutional rights to unionise. “They [Dangote Refinery] have gone further on a mission of misinformation and propaganda to justify this illegitimacy rather than engaging meaningfully with us to right the wrong,” the statement read.

Dangote Refinery’s Defence: Sabotage and Safety Concerns

In its response, Dangote Refinery denied mass layoffs, insisting that only “a few” employees were affected during a targeted reorganisation. The company claimed the restructuring was aimed at tackling recurring acts of sabotage within critical units—incidents it said posed risks to lives and operations.

Management stressed that over 3,000 Nigerians remain in its employ, rejecting claims of systematic exclusion of local staff.

This framing echoes Dangote’s longstanding narrative: while the refinery is designed to reduce Nigeria’s reliance on imported fuel and stabilise forex outflows, the company has consistently clashed with stakeholders over market access, pricing, and labour relations.

The Broader Context: Past Disputes and Fragile Labour Relations

This is not the first time labour unions have confronted the Dangote Group. Earlier this year, PENGASSAN accused the refinery of resisting unionisation and violating Nigeria’s labour laws—issues that analysts argued could foreshadow deeper clashes as the mega-facility scaled up operations.

In our previous Arbiterz analysis, we noted that:

-

Nigeria’s refinery workforce is politically influential. Their leverage lies not just in picketing plants but in mobilising supply shutdowns across upstream and midstream assets.

-

Dangote’s private-sector dominance complicates union relations. Unlike state-owned refineries, which historically bowed to labour demands, Dangote Refinery operates on tight financial models with global investors and creditors to satisfy.

-

Industrial disputes risk destabilising downstream reforms. The Tinubu administration has staked its energy strategy on Dangote’s output, hoping to tame petrol imports and FX pressures. Union disruption could delay this transition.

Market Implications: Refinery Operations and Petrol Supply

The timing of PENGASSAN’s escalation is critical. On Thursday, Dangote Refinery announced that it would suspend petrol sales in naira from September 28, citing the exhaustion of crude-for-naira allocations. That decision already raised concerns about currency volatility and pricing transparency.

With unions now threatening to choke off crude and gas supply, analysts warn that:

-

Refinery output could be constrained just as Nigeria struggles with FX scarcity and petrol subsidy ambiguities.

-

Prolonged disputes may force the government to intervene, either through the Ministry of Labour or the Presidency, given the refinery’s strategic role in energy security.

-

Investors watching Nigeria’s oil and gas sector may see the confrontation as another test of the country’s labour stability, regulatory predictability, and political will to balance private capital with workers’ rights.

The dispute pits Africa’s largest private industrial project against one of the country’s most powerful oil unions. PENGASSAN has drawn a red line—reverse the sackings or face supply shutdowns. Dangote, for its part, insists it cannot compromise operational safety and discipline.

The standoff underscores a deeper truth: Nigeria’s path to energy self-sufficiency and industrial growth will be shaped not only by billion-dollar projects but also by how equitably and sustainably they integrate Nigerian workers into the story.