Oil prices rallied on Tuesday as escalating tensions between Israel and Iran stoked fears of potential disruptions to Middle East crude supplies. Brent crude surged by up to 2.2%, later stabilizing near $73 per barrel, while West Texas Intermediate hovered below $72, following a dip on Monday amid hints of Iran seeking de-escalation.

President Donald Trump’s remarks amplified market unease, particularly after his Monday evening social media post urging Tehran residents to evacuate. Despite denying that his early exit from the G7 summit in Canada was linked to ceasefire efforts, Axios reports suggested possible peace negotiations, adding to the uncertainty.

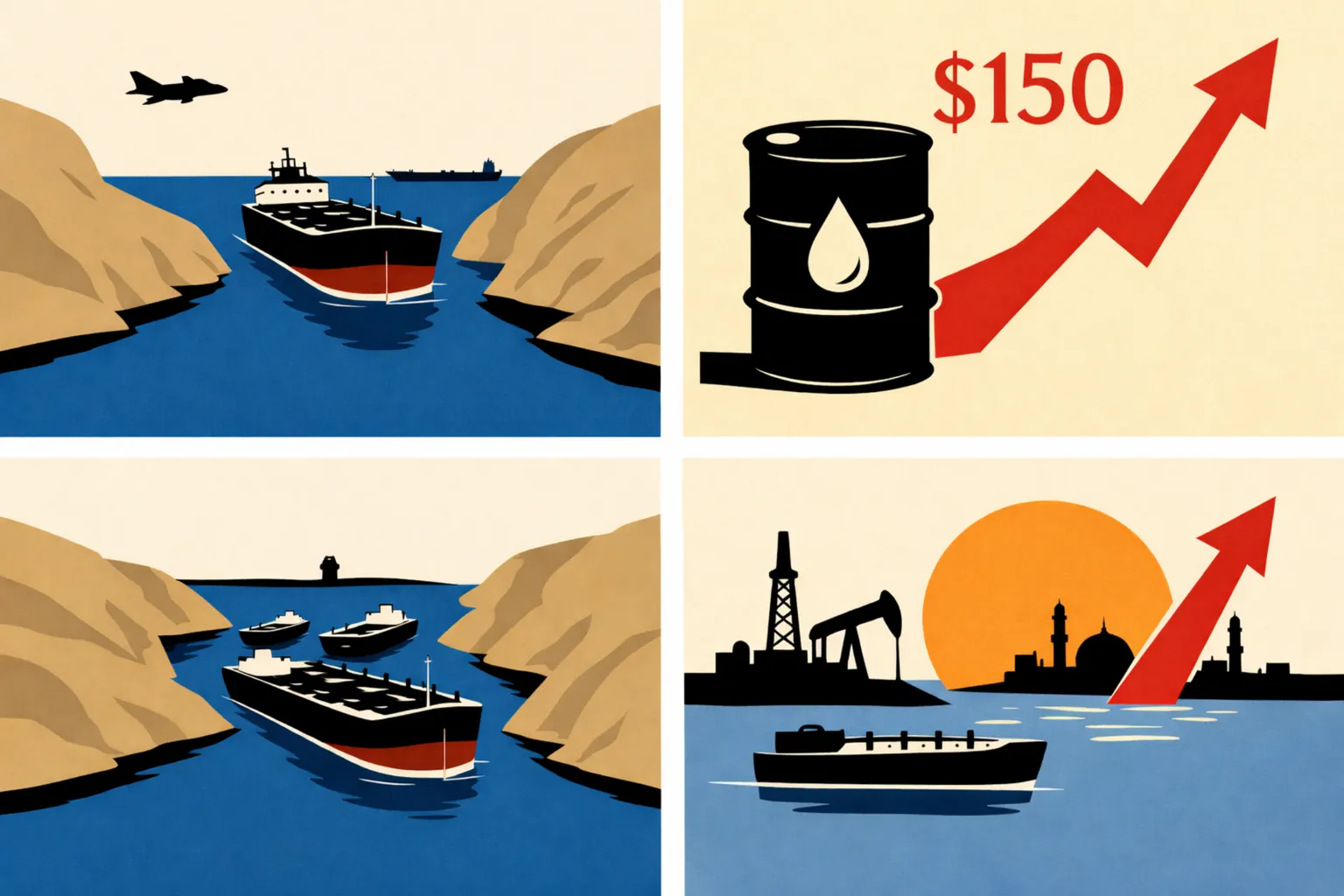

Israel’s ongoing military operations, which began Friday with strikes on Iranian nuclear sites, have so far spared Iran’s critical crude-exporting infrastructure. However, the conflict has disrupted shipping, with the UK Navy reporting increased interference in navigation signals across the Strait of Hormuz and Persian Gulf, prompting some shipowners to avoid bookings due to safety concerns.

Iran, the third-largest oil producer in OPEC, plays a pivotal role in global crude markets, raising widespread fears that its exports could be impacted. The Strait of Hormuz, a vital chokepoint for approximately 19 million barrels per day of oil and petroleum products, remains under close scrutiny as investors monitor for any signs of disrupted shipments.

The recent attacks have kept oil prices significantly elevated compared to pre-conflict levels, triggering record producer hedging and heightened trading in futures and options. Morgan Stanley recently revised its price forecasts upward, citing the mounting geopolitical risks tied to the Israel-Iran conflict.

Market volatility is expected to persist as the situation unfolds, with global investors and policymakers closely watching developments in the Middle East. Any further escalation could push oil prices higher, potentially reshaping energy markets and influencing global economic dynamics.