Hedge fund Elliott Management has issued a stark warning to investors, labelling Nvidia as being in a “bubble” and critiquing the artificial intelligence (AI) technology driving the chipmaker’s soaring share price as “overhyped.”

In a recent letter to clients, the Florida-based firm, which oversees approximately $70 billion in assets, expressed skepticism about the sustained high demand for Nvidia’s graphics processing units (GPUs) from major tech companies. The letter, seen by the Financial Times, suggested that megacap technology stocks, particularly Nvidia, were entrenched in “bubble land.”

Elliott’s Critical Perspective on AI

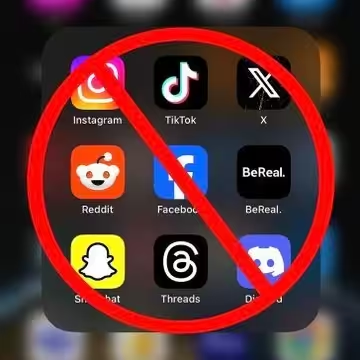

Elliott’s letter was blunt in its assessment of AI, describing many of its touted applications as “not ready for prime time.” The firm argued that several supposed uses of AI are unlikely to be cost-efficient, operationally effective, energy-efficient, or trustworthy. “AI is overhyped,” Elliott asserted, pointing to the unrealistic expectations and current limitations of the technology.

Also Read: Nvidia dethrones Microsoft, becomes world’s most valuable company

The hedge fund’s cautionary note arrives amid a broader market downturn for chip stocks. After a significant rally fuelled by investor excitement over generative AI’s potential, concerns have emerged about the sustainability of this investment trend. Following the US market close on Thursday, Intel’s shares plummeted by 20 per cent after the company announced plans to cut approximately 15,000 jobs.

The Current Market Dynamics

Nvidia has been a dominant force in the market for the advanced processors required to build and operate extensive AI systems, such as those used by OpenAI’s ChatGPT. Companies like Microsoft, Meta, and Amazon have invested tens of billions of dollars to develop AI infrastructure, directing substantial capital towards Nvidia. Despite this, many of Nvidia’s key clients are simultaneously developing their own competing chips.

Since late June, Nvidia’s stock has declined by over 20 per cent, following a period where it briefly became the world’s largest company by market capitalization, surpassing $3.3 trillion. This drop reflects growing unease on Wall Street regarding the long-term viability of AI investment. Nevertheless, Nvidia’s stock remains up about 120 per cent this year and has increased more than 600% since the start of the previous year.

Elliott’s Investment Strategy

Elliott Management informed its clients that it has generally avoided “bubble stocks” like those in the so-called Magnificent Seven. Regulatory filings indicate that at the end of March, Elliott held a small position in Nvidia worth about $4.5 million, though it is unclear how long this position was maintained. The hedge fund has also been cautious about shorting high-performing big technology stocks, labelling such actions as potentially “suicidal.”

The Productivity Question

In its letter, Elliott highlighted that AI has yet to deliver the massive productivity gains it promised. The firm noted that AI’s practical applications so far have been limited to tasks such as summarising meeting notes, generating reports, and assisting with computer coding. Despite the hype, AI has not yet provided value proportional to the excitement surrounding it.

Market Bubble Speculations

Elliott’s letter concluded with speculation on when the AI market bubble might burst, suggesting it could happen if Nvidia reports disappointing financial results and “breaks the spell.” The hedge fund’s cautious stance is underscored by its historical performance, having only lost money in two calendar years since its inception in 1977. Founded by billionaire Paul Singer, Elliott Management has maintained a reputation for prudence and strategic foresight in volatile markets.