The naira continued its downward trajectory on Tuesday, depreciating to N1,493.2 per dollar in the official market following the Central Bank of Nigeria’s 302nd Monetary Policy Committee meeting.

This represents a further weakening from N1,491.49 on Monday and N1,488 on Friday, signaling persistent currency pressures despite policy interventions.

The parallel market mirrored the official market’s weakness, with the naira trading at N1,521.5 per dollar compared to N1,518 the previous day.

This widening spread between official and black-market rates highlights ongoing foreign exchange liquidity challenges and sustained dollar demand pressures across Nigeria’s dual exchange rate system.

External Reserves Hit Six-Year High at $42 Billion

Nigeria’s external reserves surged to $42.03 billion, marking the highest level since September 2019 and representing a significant 72-month peak.

The reserves climbed from $41.99 billion the previous day and $41.42 billion at September’s start, demonstrating the CBN’s successful accumulation strategy amid global commodity price volatility.

Consecutive Reserve Growth Shows Sustained Policy Impact

The reserve buildup reflects consistent daily gains throughout September, with 13 consecutive increases across 14 reporting sessions.

This sustained growth pattern indicates the effectiveness of Nigeria’s foreign exchange management policies and improved oil revenue inflows supporting the country’s external position.

CBN Cuts Benchmark Rate to 27%

The Monetary Policy Committee reduced the benchmark rate by 50 basis points from 27.5% to 27%, marking a significant policy shift toward monetary easing.

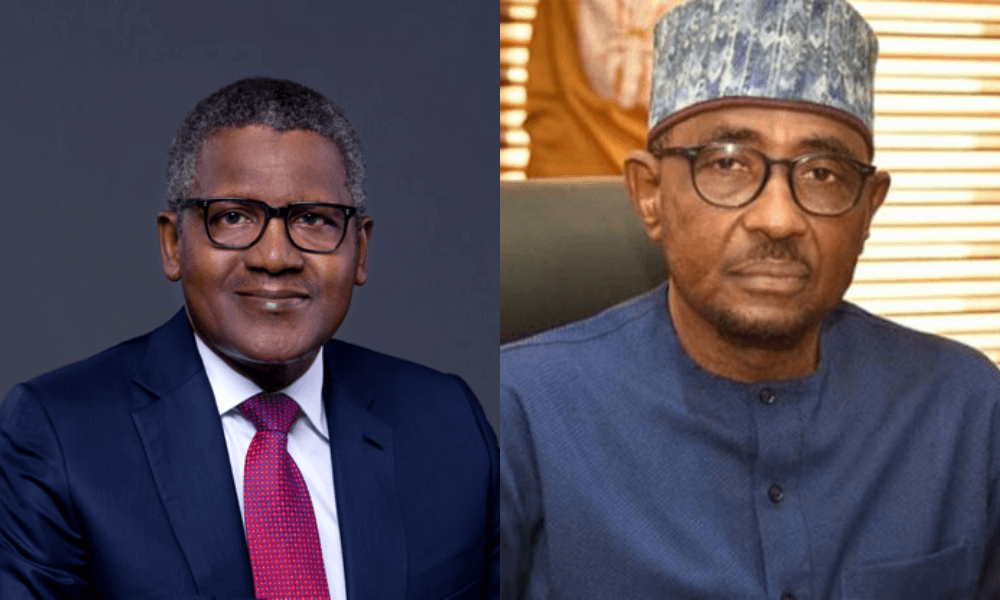

Governor Olayemi Cardoso announced the decision during Tuesday’s post-meeting briefing, citing moderating inflation trends and improving macroeconomic fundamentals as key drivers behind the adjustment.

Policy Corridor Narrowed to Support Banking Liquidity

The MPC narrowed the asymmetric corridor around the benchmark rate to +250/-250 basis points from the previous +500/-100 basis points configuration.

This technical adjustment aims to provide adequate banking sector liquidity while supporting credit expansion and economic growth within Nigeria’s evolving monetary policy framework.