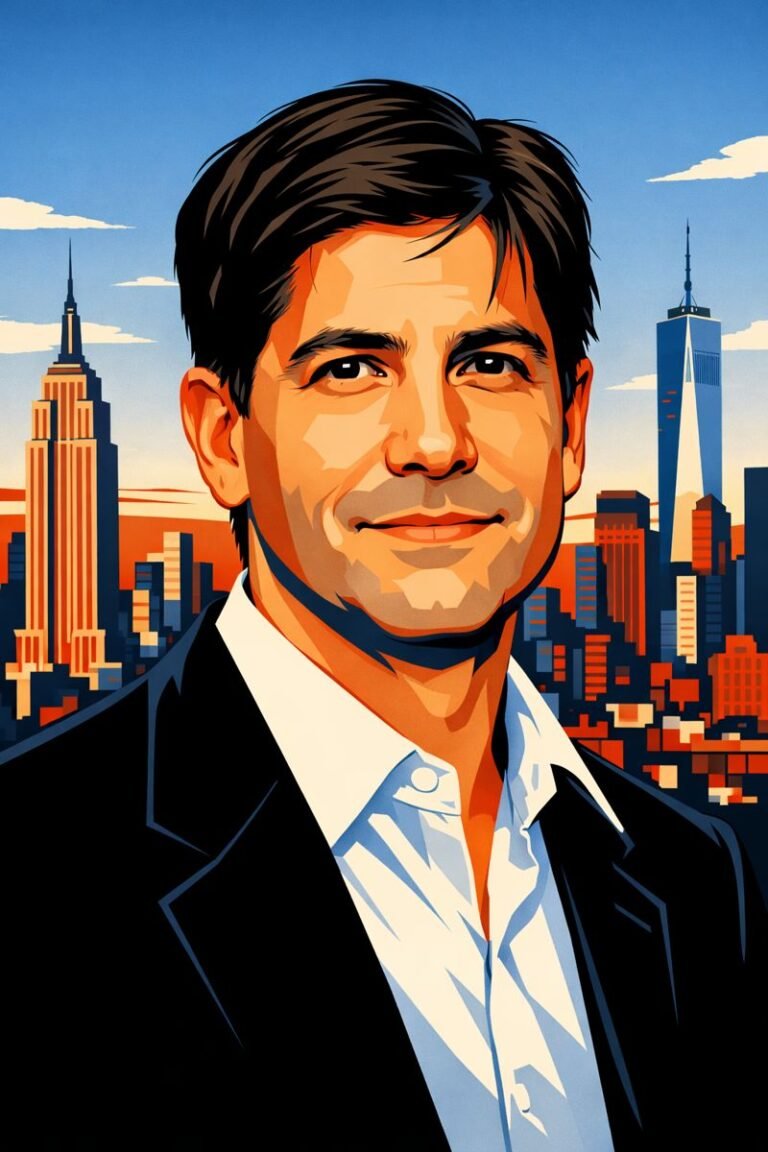

Matthew Verghis has been appointed as the World Bank’s new Country Director for Nigeria, effective July 1, 2025 replacing Ndiame Diop, who has been moved into a new position within the institution.

An Indian national with over 25 years of global experience in development economics, public finance, and policy reform, Verghis joined the World Bank in 1999 and most recently served as Regional Director for Equitable Growth, Finance and Institutions in South Asia, operating out of the Bank’s Washington, D.C. headquarters.

“This is a critical moment for Nigeria’s development journey,” Verghis said in his first public remarks since the appointment.

“There is real potential for transformative growth that can improve lives, create jobs, and expand opportunities for all. I’m honoured to take on this role and excited to experience firsthand the energy and culture of Nigeria.” He noted.

Verghis will oversee what is currently the World Bank’s largest portfolio in Africa spanning multi-billion dollar commitments and one of its biggest globally.

He will lead engagements across government, private sector, and civil society, with a mandate to accelerate inclusive growth and deepen reforms in a country grappling with structural bottlenecks.

His appointment comes as Nigeria embarks on ambitious reforms to stabilize its macroeconomic environment, restore investor confidence, and reposition its public institutions.

Nigeria’s Ongoing World Bank Relationship

Earlier this year, the World Bank approved a $2.25 billion loan package aimed at supporting fiscal and energy sector reforms. Another $65 million was cleared to scale up the SPESSE project, a human capital development initiative.

The Bank is currently working with the Infrastructure Concession Regulatory Commission (ICRC) and the International Finance Corporation (IFC), its private-sector arm, to unlock infrastructure financing through Public-Private Partnerships (PPPs).

There is also a $10.5 million grant under the Finance for Development Multi-Donor Trust Fund, intended to upgrade the Central Bank of Nigeria’s (CBN) payment systems and build institutional capacity.