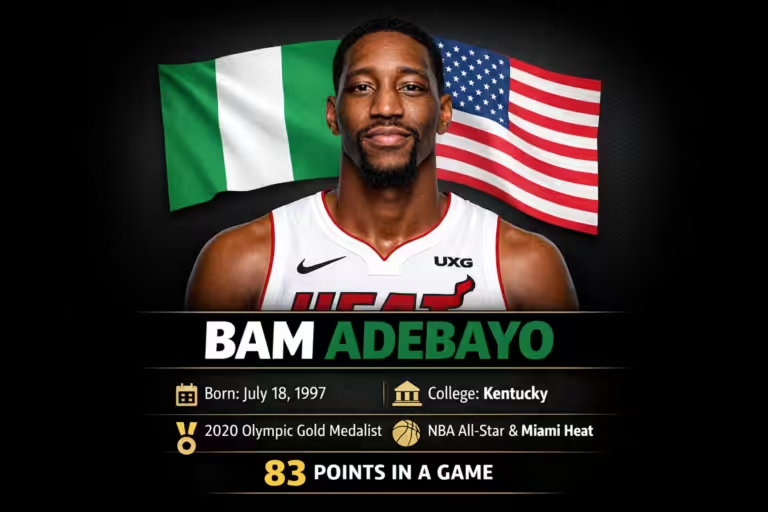

If you earn $2,000 a month coding for a U.S. startup while living in Lagos, the Nigerian taxman is coming for you. From January 2026, the Nigerian Tax Act 2026 will require remote workers and freelancers to pay income tax in Nigeria just like traditional employees.

According to a report by the TechCabal, the new law means a remote worker earning $2,000 monthly (₦2.98 million) will pay around ₦684,599 in taxes each month (₦8.2 million annually).

Income Tax in Nigeria: Lower Rates, Wider Coverage

The top tax rate is 25%, lower than South Africa (45%), Kenya (35%), Egypt (27.5%), and Algeria (35%). But Nigeria’s shift is less about competitiveness and more about widening the scope of income tax in Nigeria.

Also Read:

Signed into law in June 2025, the Nigerian Tax Act 2026 is central to the government’s effort to raise its tax-to-GDP ratio from under 10% to 18% by 2027.

Chapter Two of the law, Taxation of Income of Persons, states:

“The income, gains or profits of an individual who is a resident of Nigeria are deemed to accrue in Nigeria and are chargeable to tax in Nigeria wherever they arise.”

This provision makes the income of Nigerians working remotely for foreign companies taxable, unless protected by a double tax treaty (DTT) with countries like the UK, Canada, France, or South Africa. Taxes paid abroad can be offset against Nigerian obligations.

How Much Will Be Paid

Taxable income is calculated after deductions such as:

- Pension contributions

- National Housing Fund

- Health and life insurance premiums

- A 20% rent relief capped at ₦500,000

“Tax will be progressive,” notes accountant Adewunmi Adewole. “The first ₦800,000 is exempt. But freelancers must self-declare, since foreign employers don’t deduct withholding taxes.”

For a worker earning $2,000/month:

- Gross annual: ₦35.7 million

- Effective tax: ~23%

- Tax bill: ₦684,599 monthly

Penalties Under the Nigerian Tax Act 2026

The law creates the Nigeria Revenue Service (NRS), which replaces the FIRS from 2026. Penalties include:

- ₦50,000 fine in the first month of failing to register, then ₦25,000 monthly.

- ₦100,000 fine for not filing returns, then ₦50,000 monthly.

- Up to ₦1 million fine or three years in prison for false declarations.

Remote workers who previously earned without tax obligations will now face strict enforcement under the Nigerian Tax Act 2026.