Nigeria recorded a current account (CA) surplus of $3.7 billion in Q1 2025, a 1.8% drop quarter-on-quarter despite a modest 1.1% year-on-year rise, according to the Central Bank of Nigeria (CBN). The figure reflects a mixed performance across exports, imports, remittances, and investment income, highlighting persistent macroeconomic vulnerabilities.

The current account captures the net value of a country’s transactions involving goods, services, investment income, and current transfers. A surplus supports foreign reserves and exchange rate stability, but recent trends point to emerging cracks.

Strong Goods Trade Masks Other Weaknesses

The goods trade account expanded by 58.8% q/q to $4.2bn, powered by strong growth in non-oil exports (+30.4%), gas exports (+26.7%), and steady crude oil sales (+0.7%), with output averaging 1.67mbpd in Q1 2025. Meanwhile, total imports fell 3.0% despite a rise in petroleum product imports, thanks to a sharp 8.1% drop in non-oil imports.

Services and Primary Income Weaken Overall Balance

However, the services account deficit widened 6.0% q/q to $3.7bn, dragged by outbound travel and business services. Additionally, the primary income balance deteriorated, with investment income repatriation by offshore investors surging 15.1% q/q to $3.0bn, compared to a 23.4% rise in Nigerians’ foreign income earnings, now at $950 million. This led to a primary income deficit of $2.0bn, up from $1.8bn in the previous quarter—likely tied to better FX market liquidity and maturing external debt payments.

Remittances Dip, Raising Caution for FY Outlook

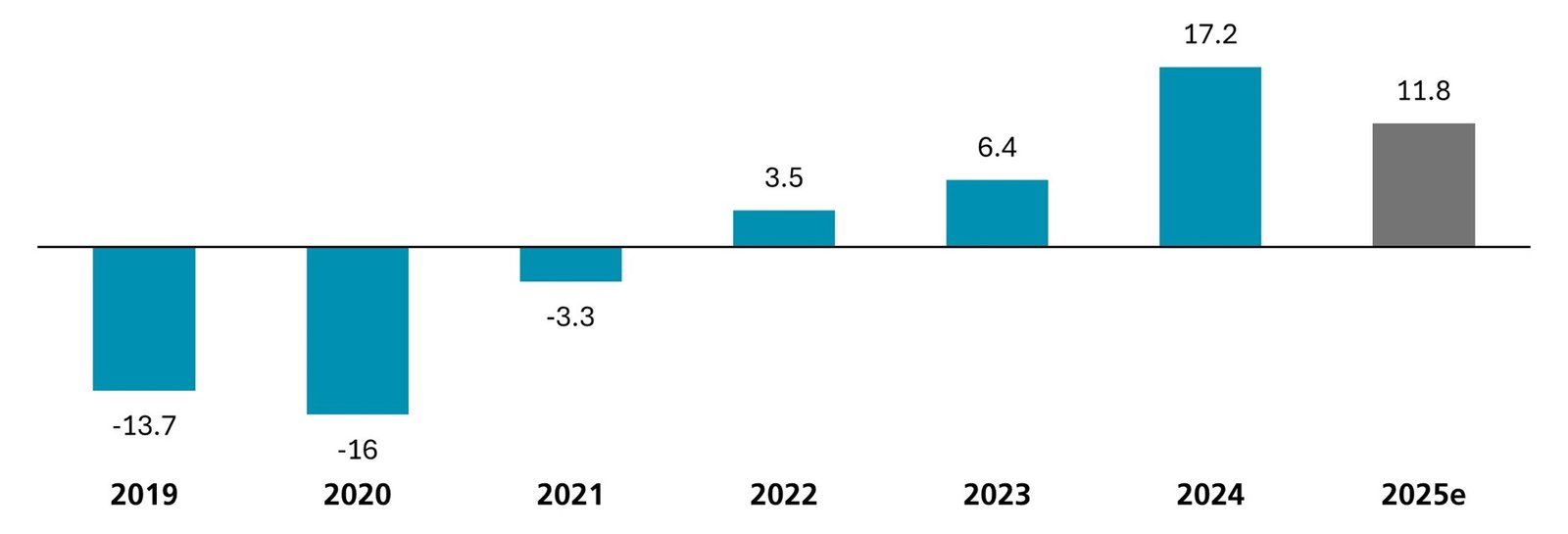

A key concern lies in the 17.9% q/q drop in secondary income surplus, mainly due to a 3.0% decline in diaspora remittances, now at $4.9bn. With sluggish growth forecasts in major diaspora economies (US: 1.8%, UK: 1.1%, Canada: 1.4%, EU: 0.8%), Nigeria may face continued pressure on remittance inflows.Afrinvest projects a full-year current account surplus of $11.8bn in 2025, well below 2024’s $17.2bn. Analysts cite lower average crude production (from 1.74mbpd in January to 1.66mbpd in May) and weaker oil prices (down from $79.99/bbl to $67.61/bbl) as significant headwinds.

Chart: Projected CA Balance for FY 2025 – $11.8bn

Source: CBN, Afrinvest Research

Nigerian Equities: Bullish Momentum Continues on NGX, ASI Up 0.8% w/w

The Nigerian Exchange (NGX) All-Share Index posted a 0.8% gain this week, closing at 120,990.27 points, pushing year-to-date (YTD) returns to 17.6%. Market capitalisation rose to ₦76.3 trillion as trading activity spiked—average volume and value traded jumped 40.0% and 5.8% respectively.

Top traded stocks by volume included ACCESSCORP (485.1m units), JAPAULGOLD (440.3m units), and OANDO (431.0m units), while value leaders were OANDO (₦21.4bn), SEPLAT (₦14.3bn), and ACCESSCORP (₦10.8bn).

Sector Performance: Gains Across the Board, Except Industrials

Insurance and Consumer Goods indices surged 5.9% and 4.1% respectively, thanks to MBENEFIT (+33.3%), CUSTODIA (+12.2%), CHAMPION (+32.0%), and HONYFLOUR (+20.8%). Oil & Gas (+0.8%) and Banking (+0.1%) recorded modest gains driven by JAPAULGOLD (+20.0%), OANDO (+5.6%), WEMABANK (+10.0%), and UBA (+3.0%). AFR-ICT rose slightly by 0.1%. However, the Industrial Goods index fell 2.1% due to selloffs in DANGCEM (-3.4%) and BUACEMENT (-3.0%).

Investor Sentiment Improves

Market breadth improved to 1.2x, with 76 gainers vs 17 losers. Weekly top gainers were MEYER (+60.1%), RTBRISCO (+50.8%), and FTNCOCOA (+40.2%), while PZ (-15.0%), JBERGER (-10.0%), and SCOA (-9.8%) led the laggards.

Outlook: Barring any macro shocks, we expect bullish sentiment to persist next week as liquidity remains strong and investor appetite for value stocks continues.