Kenya’s long-planned sale of its national oil-pipeline operator has gained momentum after Parliament passed the Privatisation Bill, 2025 (No. 36)—a measure that modernises the legal framework for selling public assets.

The Privatisation Commission has now invited bids for transaction-advisory services tied to the partial divestiture of the Kenya Pipeline Company (KPC), marking a concrete step toward the firm’s long-awaited initial public offering on the Nairobi Securities Exchange (NSE).

Earlier government planning documents had designated December 31, 2025 as the “sunset date” for completing the privatisation.

The Commission’s new advisory tender, however, sets a March 31, 2026 completion target—an adjustment officials say allows more time for due diligence, valuation, and regulatory clearance.

A New Legal Foundation for Privatisation

The freshly enacted Privatisation Bill, 2025 defines how Kenya will divest public holdings by clarifying the roles of the Cabinet Secretary, the Privatisation Commission, and Parliament.

It also mandates public consultation, valuation transparency and tighter oversight—elements missing from previous laws. On the same day MPs approved the bill, the Commission issued the KPC tender notice, underlining the government’s intent to move quickly once the law takes effect.

Sessional Paper No. 2 of 2025 authorises the State to sell up to 65 percent of its shareholding in KPC while retaining at least 35 percent, ensuring continued public influence over a strategic national asset. Officials estimate the sale could raise about KSh 100 billion ($769 million), part of a wider Treasury plan to mobilise roughly KSh 130 billion from upcoming privatisations.

The proceeds are expected to fund infrastructure projects and reduce budget-deficit pressures.

The Backbone of Kenya’s Petroleum Supply

Incorporated in 1973 and operational since 1978, KPC operates more than 1,340 kilometres of pipelines linking Mombasa to Nairobi, Eldoret, Nakuru and Kisumu.

The company transports and stores refined fuels—petrol, diesel, kerosene and jet A-1—serving both domestic consumers and neighbouring Uganda, Rwanda, South Sudan and DR Congo.

The Energy and Petroleum Regulatory Authority (EPRA) reports that Kenya’s fuel consumption now exceeds 14 billion litres annually, keeping KPC’s network central to the economy.

Its Kipevu and Changamwe depots provide roughly 326,000 m³ of storage before fuel moves inland.

Reform Momentum and Market Expectations

Privatising KPC anchors President William Ruto’s broader effort to deepen domestic capital markets and curb state dominance in commercial enterprises.

Treasury officials say a listing would enforce stronger corporate governance and attract private capital for maintenance and expansion of energy infrastructure.

The IPO is also expected to include retail share allocations and employee share-ownership plans, echoing the inclusive model used in past landmark listings such as Safaricom.

Although the new timeline extends into early 2026, officials insist the delay reflects process discipline, not drift. “We’d rather deliver a clean transaction than a rushed one,” a senior finance official told Arbiterz, speaking on background.

Kenya’s Energy and Petroleum Sector

Kenya’s petroleum value chain remains tightly integrated: Regulation — EPRA oversees pricing, licensing and safety. Infrastructure — Kipevu Oil Terminal handles imports; the former Kenya Petroleum Refineries Ltd now serves mainly as a storage facility.

Distribution — Oil marketing companies (OMCs) deliver to retail and industrial users. Power sector links — KenGen and Kenya Power (KPLC) dominate electricity generation and distribution, sharing the reform spotlight.

Fuel demand continues to rise 5–6 percent annually, driven by industrial growth and regional exports—making KPC’s logistics reliability economically vital.

Risks and Investor Considerations

Valuation uncertainty — Throughput volumes, maintenance capex and debt servicing will influence pricing.

Legacy liabilities — Pending claims and disputes—such as Makueni County compensation and Line V contracts—could affect valuation.

Regulatory risk — Pipeline tariffs set by EPRA determine KPC’s revenue base.

Market absorption — The NSE must absorb one of its largest ever floats without crowding out private issuers.

Political challenges — Opposition lawmakers and civil-society groups have threatened legal review of the sale process.

Path to the IPO

1) Appointment of transaction advisers (financial, legal, technical).

2) Comprehensive audits of assets and liabilities.

3) Drafting of prospectus and review by the Capital Markets Authority.

4) Investor roadshows and book-building.

5) Expected listing by March 31, 2026, subject to market conditions.

The government views KPC as the flagship deal that will pave the way for subsequent listings of state-owned enterprises across energy, transport and hospitality.

A Defining Test for Kenya’s Market Reform

If successful, the KPC IPO would be Kenya’s most consequential listing since Safaricom’s 2008 debut, signalling that Nairobi can still mobilise large-scale domestic and foreign investment through transparent privatisation.

For the Ruto administration, the transaction is a test of credibility: can Kenya balance fiscal needs with good governance while keeping strategic assets accessible to its citizens?

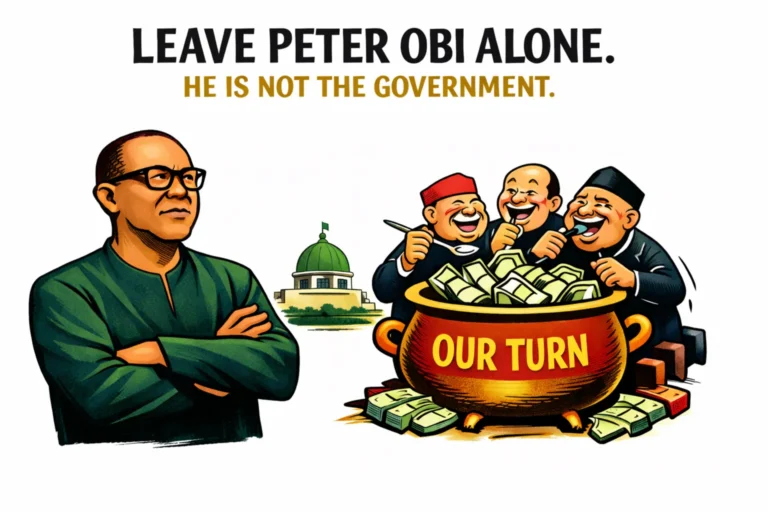

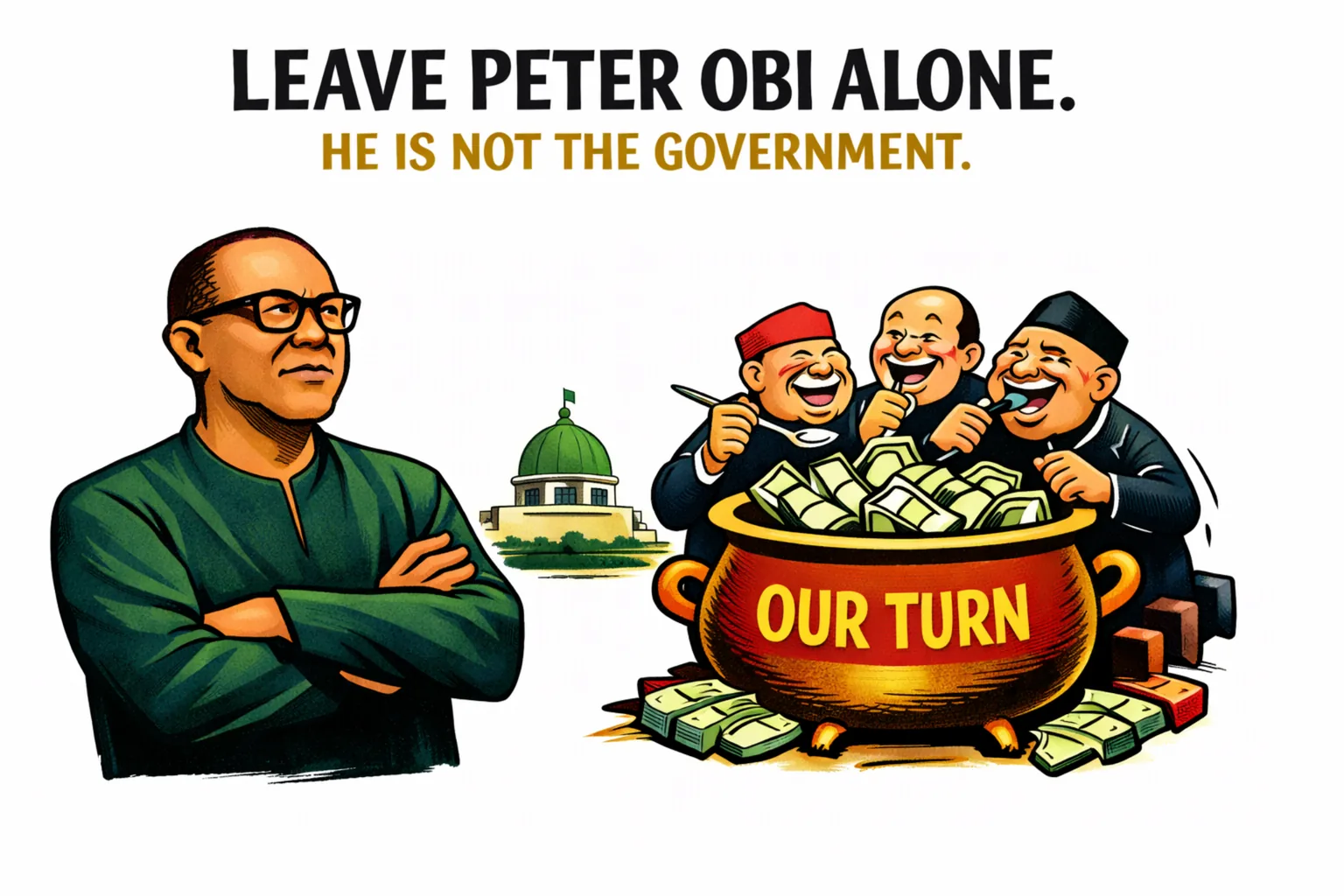

How Kenya’s Approach Contrasts with Nigeria’s Pipeline Policy

Kenya is steering a market-based route by partially privatising its midstream operator (KPC) via an IPO, anchoring the process in a new privatisation law and a published timetable.

Nigeria has taken a different path: pipelines remain under the state-owned NNPC Limited through its subsidiary, the Nigerian Pipelines and Storage Company (NPSC).

Nigeria’s 5,000–5,120 km multi-product pipeline grid has suffered years of vandalism and theft, prompting an emphasis on security operations, surveillance, and rehabilitation programmes—including stated plans to replace or rehabilitate large portions of the network through public–private collaborations.

Recent official communications highlight improved security and reduced losses, but Nigeria’s focus remains on state ownership and operational turnaround rather than public listing.