The Federal Inland Revenue Service (FIRS) has directed banks, stockbrokers, and other financial institutions to begin deducting a 10% withholding tax on interest earned from short-term securities.

This represents a major policy change, as such instruments were previously tax-exempt to encourage investor participation in the financial markets.

Scope of the New Rule

The tax applies to interest payments on:

- Treasury bills

- Corporate bonds

- Promissory notes

- Bills of exchange

According to the circular issued by FIRS, the tax will be deducted at the point of payment.

Exemptions and Investor Impact

The agency clarified that interest on federal government bonds remains exempt from the new levy. Investors will, however, be entitled to tax credits for any amounts withheld unless the deduction is treated as a final tax.

Short-term securities have traditionally been attractive to investors seeking high yields and quick maturities. The introduction of the withholding tax could therefore affect investment decisions and reduce returns on these instruments.

Compliance and Enforcement

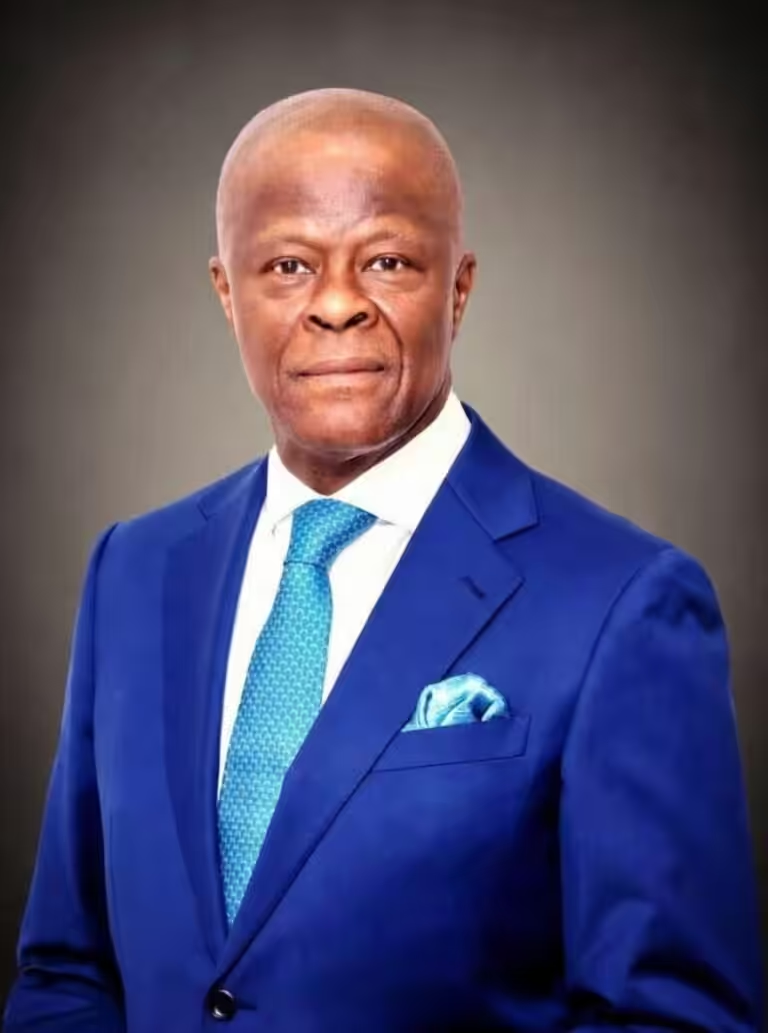

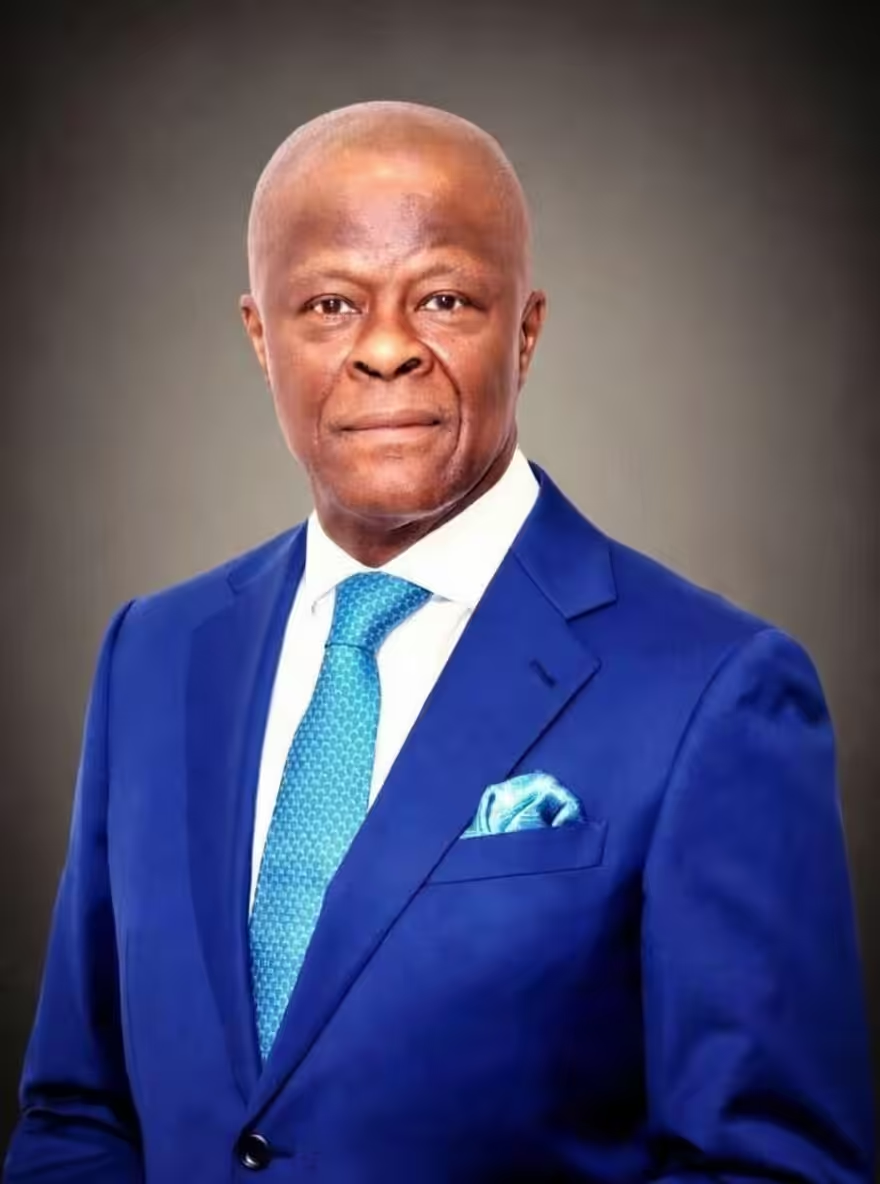

FIRS Executive Chairman Zacch Adedeji stressed the need for full compliance, warning that institutions failing to adhere to the directive would face penalties and interest charges as provided under tax law.

The agency did not disclose any revenue projections from the measure, but it is expected to broaden Nigeria’s tax base and boost government revenue from fixed-income investments.