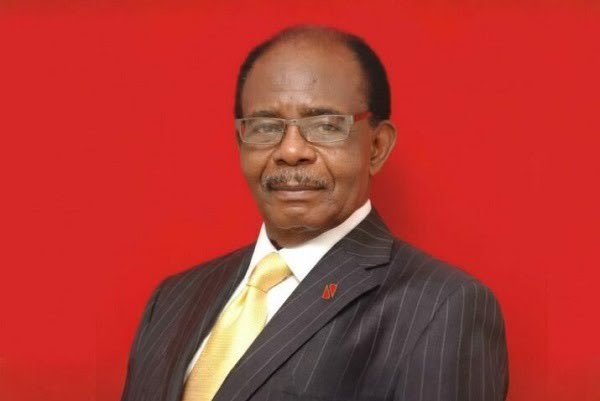

As Akinwumi Adesina prepares to exit his role as President of the African Development Bank (AfDB) after a transformative decade, he proudly highlights growing the institution’s capital from $93 billion in 2015 to an impressive $325 billion.

Speaking at the AfDB Annual Meetings in Abidjan, Côte d’Ivoire, on May 27, 2025, Adesina, the first Nigerian to lead the bank, emphasized how this unprecedented financial leap reflects his relentless drive to position AfDB as a globally respected powerhouse.

His flagship High 5s strategy, focused on lighting up Africa, feeding the continent, industrializing economies, integrating regions, and improving lives, has touched 565 million people with measurable gains in healthcare, food security, transport, electricity, and water access.

Adesina’s tenure saw 128 million Africans gain access to improved health services, 121 million to better transport, 104 million to food security, 63 million to potable water, 34 million to sanitation, and 28 million to electricity.

The Mission 300 Energy Summit, launched with the World Bank and partners in Dar es Salaam, targets electricity for 300 million more Africans by 2030, turning statistics into realized futures. When the Russia-Ukraine war disrupted global food chains, Adesina led AfDB to deploy a $1.5 billion Emergency Food Production Facility, supporting 13 million farmers across 29 countries to produce 44 million metric tons of food, 116% above target, valued at $17.3 billion.

The bank’s capital, initially reported at $318 billion, was recently adjusted to $325 billion due to currency fluctuations, a figure confirmed by AfDB’s vice president of finance. Adesina also secured a historic $8.9 billion for the African Development Fund’s (ADF) 16th replenishment, the highest in its history, aiding Africa’s poorest nations. He takes pride in shaping AfDB into the world’s best multilateral financial institution, a ranking it earned under his leadership, while defending Africa’s interests globally.

However, challenges loom as Adesina steps down, with the U.S. government, under the Trump administration, proposing a $555 million cut to AfDB and ADF funding, threatening support for vulnerable countries.

The next AfDB president, to be elected on May 29, 2025, during the annual meeting, will face the urgent task of securing alternative funding, potentially from China, Gulf nations like Saudi Arabia and the UAE, or increased African contributions. The winner must garner 50.01% of votes from 54 African member states and, in a second round, approval from all 81 members, including G7 nations like the U.S. and Japan, who co-own the bank alongside Nigeria, its largest shareholder.

Five candidates from South Africa, Senegal, Zambia, Chad, and Mauritania are in the race, with Senegal’s Amadou Hott emerging as a key contender alongside Mauritania’s Sidi Ould Tah and Zambia’s Samuel Maimbo. Hott, a former AfDB vice president and Senegal’s economy minister, advocates tapping Africa’s $4.5 trillion in domestic wealth $2.5 trillion held by individuals and $2 trillion by pension funds, sovereign wealth funds, and insurers, to reduce reliance on expensive foreign borrowing. He argues that unlocking this capital could bridge the gap between AfDB’s $10 billion annual lending and the continent’s $100 billion development needs.

Hott also supports an African credit rating agency, set to launch in 2025, to provide a local perspective and lower borrowing costs, which he notes are up to 400 basis points higher for African nations compared to peers elsewhere. By strengthening local currency lending, he aims to shield governments from exchange rate shocks tied to Eurobond reliance, enhancing financial resilience. His vision aligns with Adesina’s call for bold leadership to advance Africa’s interests over the next decade.

Looking ahead, AfDB aims to prioritize boosting electricity connections, ramping up food production, fostering industrial growth, integrating economies, and raising living standards across Africa. The incoming president will inherit a bank with a $325 billion capital base but must navigate a shifting global economy, including U.S. import tariffs and diverted Western aid, to sustain its momentum. The ADF’s next replenishment in November 2025 targets $25 billion, a steep climb from $8.9 billion, underscoring the funding stakes.

Adesina, whose hair turned grey from a decade of tireless effort, advises his successor to build on this foundation, gaze into the future, and muster the courage to champion Africa’s voice globally. He cautions against “Mickey Mouse projects” and popularity-driven leadership, urging a focus on substantive impact over superficial wins. With excellent staff and institutional support, the next leader must confront philosophies that hinder Africa’s progress, a role Adesina insists requires backbone, not just diplomacy.

As Africa’s largest development finance institution, owned by 54 African states and global powers, AfDB stands at a crossroads with Adesina’s exit in September 2025 after two five-year terms. His legacy, capital growth, transformative strategies, and a global presence—sets a high bar for the next president, who must steer the bank through funding cuts and rising needs in infrastructure, health, and climate adaptation. The annual meeting in Abidjan, one of Africa’s biggest finance gatherings, marks a pivotal moment as heavily indebted governments seek new financing pathways, with Adesina’s decade of impact as both inspiration and challenge.