Nigeria’s recent currency stability may face a mild test before the end of 2026. BMI, the research arm of Fitch Solutions, projects that while the naira has strengthened in early 2026, the rally is unlikely to hold through the year. In its latest Sub-Saharan Africa foreign exchange outlook, the firm forecasts a gradual depreciation to around N1,550/$ by December.

The naira closed the week at N1,358/$, extending its recovery and building on a 5.8% gain so far this year on the official market. That follows a 7.0% appreciation recorded in 2025 — the first annual strengthening of the currency in over a decade.

But BMI believes the momentum may moderate.

Also Read:

- Dollar to Naira: "Naira to Stabilise at N1,555 to the Dollar," Rewane projects

- I Prefer Dollar Investments to Naira Assets Because I Have a Dollar Salary

- 7.5% Interest on $1,000: Afrinvest Launches Dollar Asset for Nigerian Investors

- The Dollar Mallam Who Couldn’t Afford University but Now Has 3-Bedroom House

Why BMI Expects a Mild Pullback

The firm argues that Nigeria’s easing inflation trajectory could paradoxically increase pressure on the currency. As inflation falls — projected to decline from an average of 23.3% in 2025 to about 14.5% in 2026 — domestic demand is likely to strengthen. Higher consumption and investment activity would raise foreign exchange demand, especially for imports.

BMI also flagged renewed divergence between official and parallel market rates. With the naira trading roughly 6–7% weaker on the black market, analysts interpret this as an early sign of underlying FX pressures and possible slight overvaluation at official levels.

Even so, the report does not foresee a repeat of the disorderly depreciations of recent years. Any adjustment, BMI suggests, would be modest relative to the volatility experienced between 2023 and 2024.

The Cushion: Reserves and Yield Advantage

Supporting factors remain in place. Nigeria’s foreign reserves have climbed above $47bn — their highest level in roughly eight years. Gross reserves recently reached $47.025bn, the strongest level since August 2018. BMI estimates that reserves stood at about $45.5bn in December 2025, covering roughly nine months of imports.

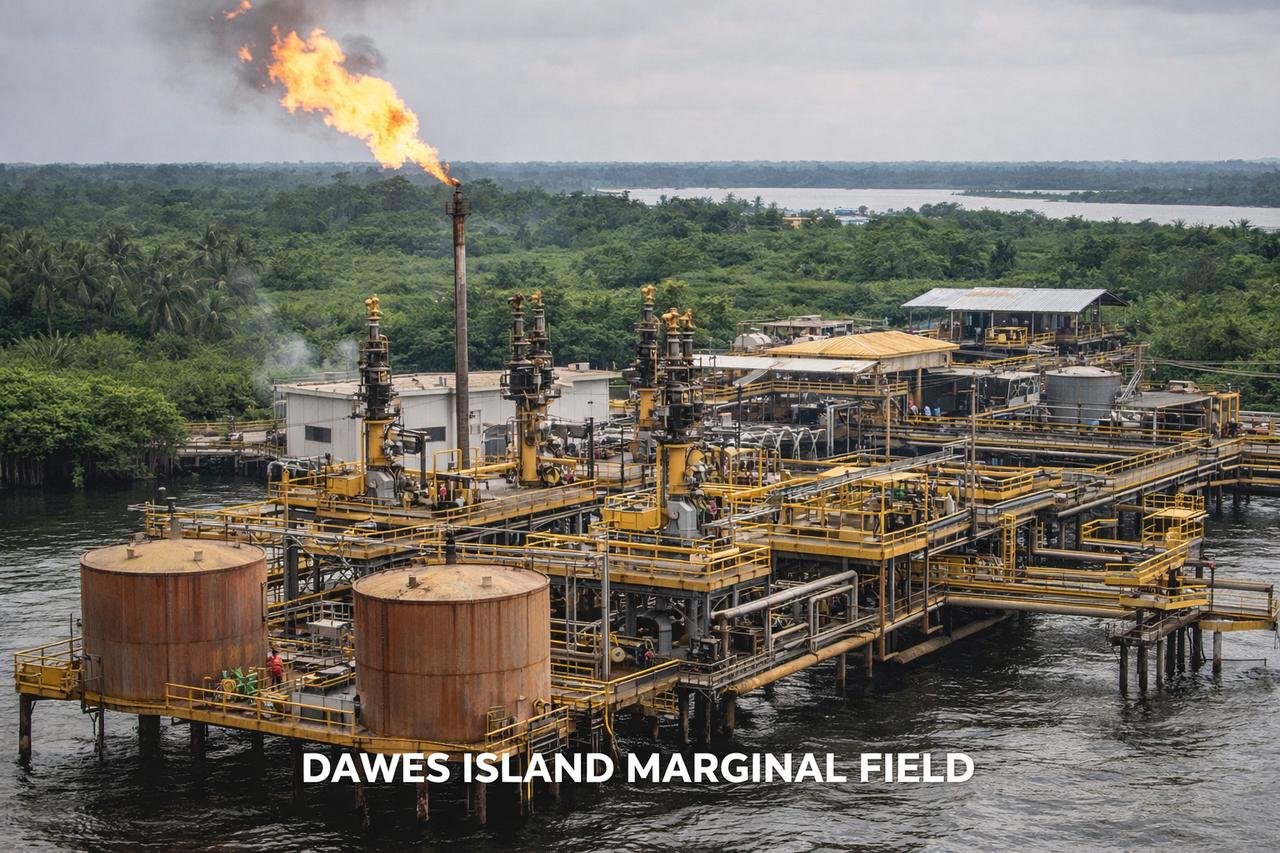

The improvement reflects stronger capital inflows, reform momentum and structurally lower fuel imports, aided by expanded domestic refining capacity — notably output from the Dangote refinery. Additionally, Nigeria maintains a wide interest rate differential relative to many frontier markets. Elevated yields continue to attract portfolio flows, helping to offset FX demand pressures.

A Different Year for African Currencies

BMI’s broader outlook for Sub-Saharan Africa is comparatively constructive. The firm expects 2026 to be a year of relative stability for major regional currencies. Year-to-date performance reflects this trend: the Zambian kwacha has gained about 16% against the dollar, the naira nearly 6%, and the South African rand just over 4%.

Global conditions remain broadly supportive. BMI expects the US Dollar Index (DXY) to trade within the 95–100 range, suggesting limited safe-haven demand for the dollar. Appetite for higher-yielding emerging and frontier market assets also remains firm, as reflected in early 2026 strength in EM FX risk indicators.

The Backdrop: A Historic Turnaround in 2025

The naira ended 2025 at N1,429/$ — a 7.4% appreciation from N1,535/$ at the end of 2024. It was the currency’s first annual gain since 2012. Between 2013 and 2024, the naira recorded persistent annual depreciation.

After touching N1,602/$ in April 2025 — its weakest level of the year — the currency began a gradual recovery from May, finishing the year on a stronger footing. The improvement marked a significant shift in sentiment after several years of exchange-rate turbulence.

Nigerian Market to Remain Attractive to Investors

The message from BMI is not one of alarm, but of recalibration. The naira’s gains in early 2026 reflect improved fundamentals — stronger reserves, reform credibility and supportive global conditions. However, easing inflation and rising domestic demand may increase FX needs later in the year.

The forecast of N1,550/$ suggests controlled depreciation rather than crisis — a far cry from the abrupt adjustments seen in previous cycles. For policymakers, the key test will be sustaining credibility. For investors, the theme remains one of conditional stability: improved buffers and reforms have reduced tail risk, but underlying FX demand dynamics have not disappeared. In 2026, the naira’s story may be less about collapse or stress — and more about balance.