The United States economy added 130,000 jobs in January, comfortably beating expectations and offering fresh evidence that the American labour market may be stabilising after months of softer data.

Economists polled by Bloomberg had expected roughly 68,000 jobs. The previous month’s figure, meanwhile, was revised down to 48,000 — part of a broader recalibration by the Bureau of Labor Statistics (BLS) that significantly reduced last year’s employment estimates.

The unemployment rate edged down slightly to 4.3%. At first glance, the headline number suggests resilience. But beneath the surface, the labour market narrative is more complicated.

A Market That Is Holding — Not Accelerating

January’s gains were driven largely by healthcare, social assistance and construction. Utilities, leisure and hospitality, and other services also posted modest increases.

However, employment declined in several sectors, including financial activities and the federal government. Mining, logging, transportation, information services, manufacturing, wholesale trade and retail have all recorded year-on-year declines.

Total non-farm employment rose just 0.2% month-on-month — hardly indicative of a strong acceleration.

More striking was the scale of BLS revisions. Job gains over the course of last year were revised down sharply — from 584,000 to 181,000. The employment level for March 2025 was also lowered by 898,000 on a seasonally adjusted basis.

These revisions reinforce a key point: hiring momentum slowed significantly in 2025 after years of robust post-pandemic growth.

Markets Reprice Rate Expectations

The data immediately reverberated through financial markets.

US Treasury yields rose as traders reduced expectations of aggressive interest-rate cuts this year. The two-year Treasury yield particularly sensitive to monetary policy jumped 0.08 percentage points to 3.55 per cent.

Futures markets, which had previously priced in between two and three rate cuts by December, now reflect expectations of just two.

For Federal Reserve chair Jay Powell, the report strengthens the argument that the labour market is showing “evidence of stabilisation” — providing justification for the central bank’s decision to pause its rate-cutting cycle last month.

The message from markets is clear: the Fed may have more room to wait.

Structural Cooling, Not Collapse

A volley of recent labour-market indicators had pointed to deterioration, including rising lay-offs and declining job openings. Against that backdrop, January’s headline number offers relief.

But stabilisation should not be confused with renewed expansion.

Several cyclical sectors remain under pressure. Financial services typically sensitive to interest-rate dynamics continues to shed jobs. Government employment has also softened, partly reflecting fiscal constraints and earlier shutdown-related distortions.

The broader picture suggests a labour market that is cooling in a controlled manner rather than contracting sharply. For policymakers, that distinction is critical.

Why This Matters for Nigeria

For Nigeria and other emerging markets, US labour data carries outsized importance.

A stronger-than-expected US jobs print tends to:

•Push Treasury yields higher

•Strengthen the US dollar

•Reduce the probability of near-term Fed rate cuts

•Tighten global financial conditions

For frontier and emerging economies reliant on portfolio flows, Eurobond issuance, or foreign exchange stability, a “higher-for-longer” US rate environment complicates external financing conditions.

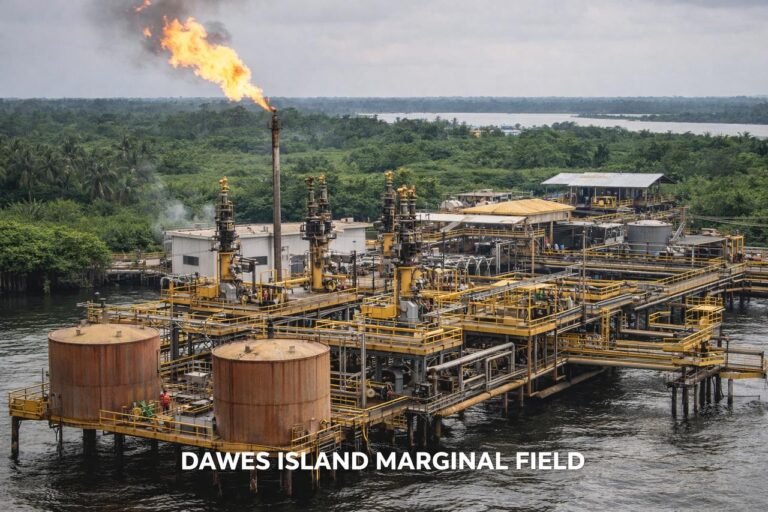

Conversely, a sharp US slowdown would risk weaker global demand, including for commodities such as oil — Nigeria’s primary export earner.

January’s data points to neither extreme. Instead, it suggests a US economy slowing gradually but avoiding recession — a scenario that stabilises global markets without triggering panic.