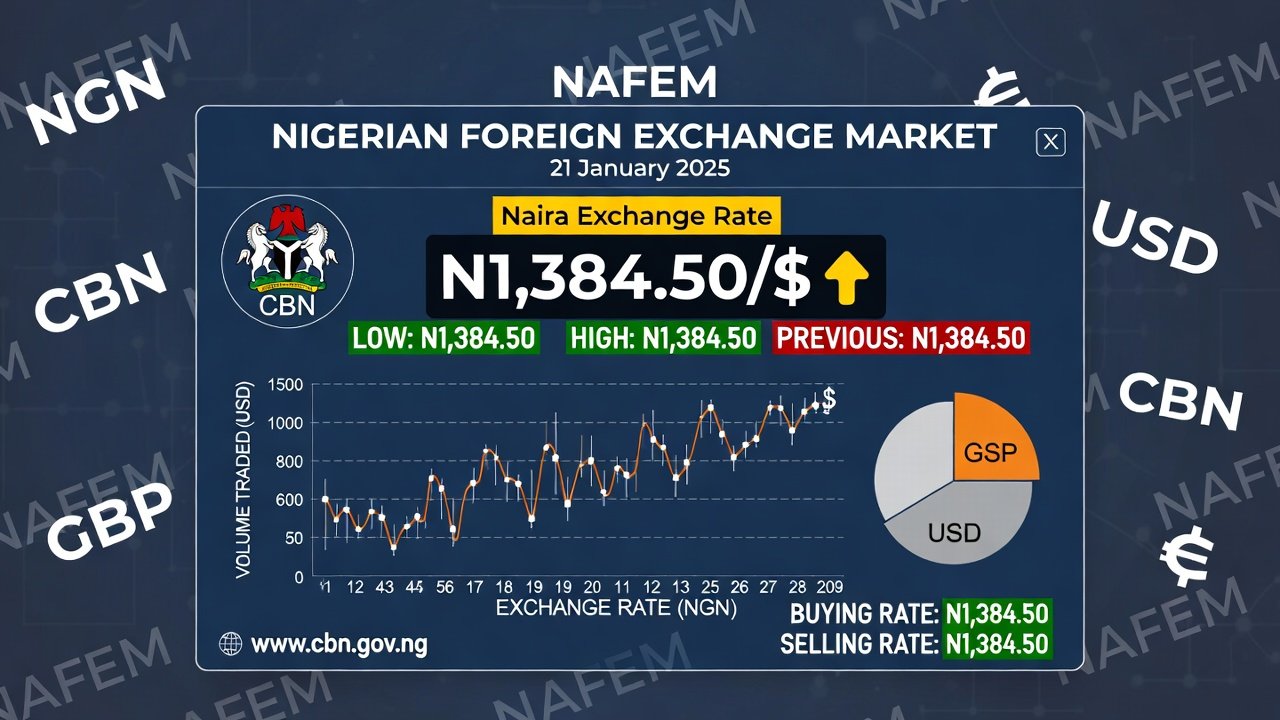

The Nigerian naira posted modest gains against the US dollar at the official foreign exchange market on February 3, 2026, appreciating to N1,384.50, while International Money Transfer Operator (IMTO) rates and other market indicators reflected mixed movements.

Official Market Shows Mild Appreciation

Data from the Central Bank of Nigeria (CBN) showed that the naira strengthened slightly at the Nigerian Autonomous Foreign Exchange Market (NAFEM), closing at ₦1,384.50 per dollar on February 2, 2026, with settlements reflected in February 3 trading.

This represents an appreciation of approximately 0.47%, or ₦6.50, compared with the previous close of ₦1,391/$1.

Also Read:

- Naira-Dollar Rate (January 9 2025): Naira Closes Flat at N1,421/$ in Official Window, Firms…

- Dollar-Naira Exchange Rate Today (January 19, 2026): Naira Continues Appreciation Against…

- Dollar to Naira: "Naira to Stabilise at N1,555 to the Dollar," Rewane projects

- Naira to dollar: Naira gains 0.6% in official market as turnover drops

IMTO Rates Show Mixed Trends

International money transfer rates showed divergent movements across major currencies, reflecting varying diaspora remittance pricing and broader market sentiment.

- USD IMTO rate weakened slightly, settling at ₦1,445/$ on February 3, representing a 0.55% decline in the naira compared with ₦1,453/$ the previous day.

- GBP IMTO rate strengthened to ₦1,981/£, a gain of 1.16% or roughly ₦23, from ₦1,958/£.

- EUR IMTO rate improved marginally to ₦1,705/€, reflecting a 0.41% appreciation and a ₦7 gain.

- CAD IMTO rate moved to ₦1,060/CAD, indicating a 0.94% weakening of the naira, though still up nominally from ₦1,050/CAD.

External Reserves Cross $46 Billion

Nigeria’s external reserves rose further to $46.280 billion as of January 30, 2026, according to the latest CBN data. This reflects a 0.23% increase from $46.176 billion recorded the previous day.

The sustained build-up in reserves now at levels last seen nearly eight years ago continues to strengthen Nigeria’s external buffers and supports the CBN’s medium-term objective of pushing reserves toward $51 billion by the end of 2026.