The chairmen of TotalEnergies and Galp held a high-level meeting with Namibia’s president on Thursday, underscoring their long-term commitment to the country as it edges closer to becoming a significant oil and gas producer.

Patrick Pouyanné, Chairman and CEO of TotalEnergies, and Paula Amorim, Chairman of Galp, briefed the presidency on progress following their recently announced partnership covering key offshore licences in Namibia’s Orange Basin.

The partnership will see TotalEnergies assume operatorship of Petroleum Exploration Licence (PEL) 83, which hosts the Mopane discoveries, while Galp enters PEL 56 and PEL 91, home to the Venus discovery—one of the most closely watched deepwater finds off southern Africa.

What the companies told the Presidency

According to the companies, discussions focused on:

The mechanics and timing of the operatorship transition

Planned exploration, appraisal and development milestones

Expected contributions to employment, skills transfer and local industry participation

The importance of stable and supportive regulation as projects move into capital-intensive phases

For the Venus project, partners said a clearly defined development concept is already in place, with work ongoing to secure the remaining conditions required for a potential final investment decision (FID) in 2026.

At Mopane, a three-well exploration and appraisal campaign is scheduled to begin in 2026, aimed at further delineating resources and advancing the project towards development.

Executive signals

Pouyanné said the alignment between the two companies across both Venus and Mopane marked a turning point for Namibia’s offshore ambitions.

“Together, we are committed to developing the country’s deepwater potential responsibly and efficiently, while building long-term value for Namibia and other stakeholders,” he said, adding that the partnership was laying the foundations for a new regional energy hub.

Amorim described Mopane as “transformational” for Galp and said partnering with a global deepwater operator significantly reduced execution risk.

“Our commitment to Namibia has never been stronger. We are confident that this geography will emerge as a relevant future global energy ecosystem,” she said.

Profile: Galp’s growing footprint in Namibia

Galp is a Lisbon-headquartered integrated energy company with roots dating back to Portugal’s state oil monopoly, Petrogal, before its transformation and partial privatisation in the late 1990s. Today, it is one of southern Europe’s leading energy groups, with upstream, midstream and renewable assets spanning Europe, Africa and the Americas.

In Namibia, Galp has positioned itself as a core upstream player rather than a passive financial investor. Galp Namibia is a joint venture led by Galp Energia, which holds an 80% stake in Petroleum Exploration Licence (PEL) 83. The company is the primary operator and majority owner of its Namibian assets, with partners participating through minority interests under joint operating and participation agreements.

TotalEnergies holds a 10% participating interest in PEL 56 and has partnered with Galp across Namibia’s offshore acreage, reflecting a collaborative model that combines Galp’s early-mover exploration exposure with the technical and balance-sheet depth of a global supermajor.

Other international oil companies have also expressed interest in the basin. Chevron is among those bidding for a 40% operating stake in the Mopane discovery, underlining the growing competitive interest in Namibia’s deepwater blocks as the resource base becomes clearer.

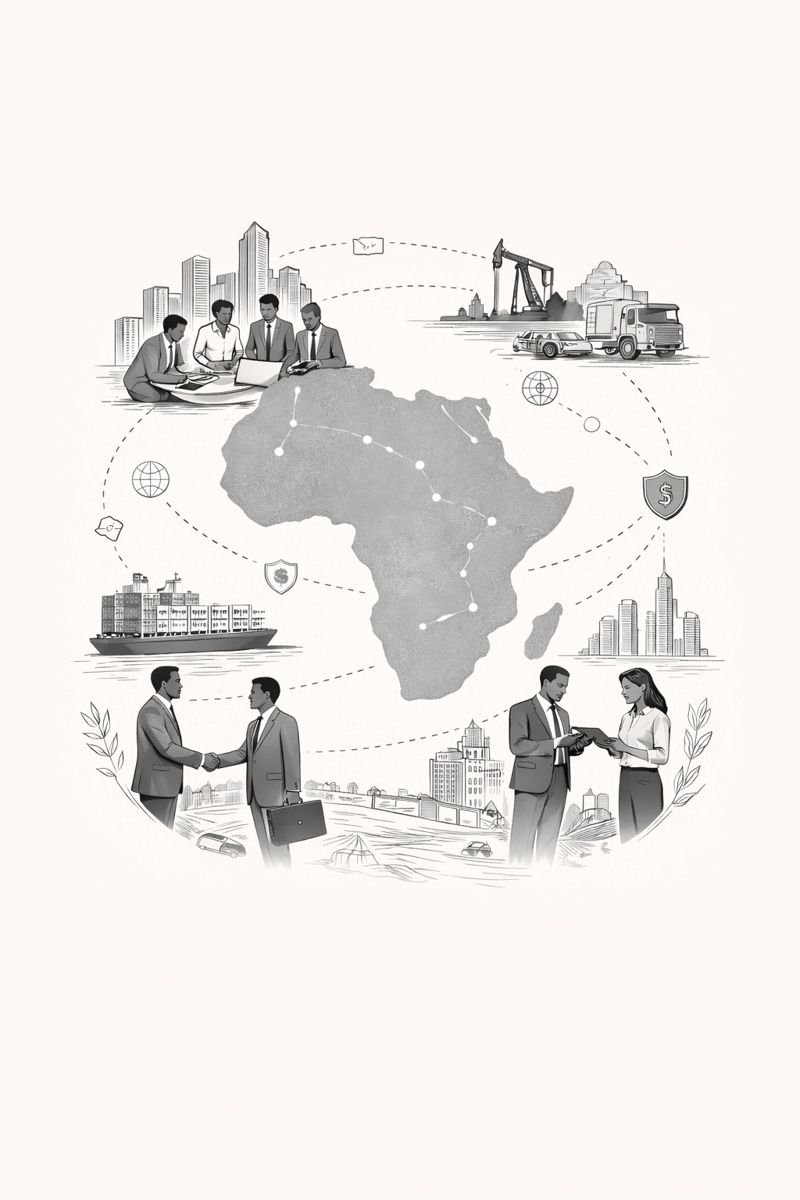

Why Namibia has become highly attractive to investors

Namibia’s offshore sector has gained rapid investor attention over the past three years, driven by a combination of world-class discoveries in the Orange Basin and a policy environment viewed as comparatively predictable by global capital. Clear licensing frameworks, competitive fiscal terms, respect for contract sanctity, and constructive engagement between regulators and operators have helped reduce above-ground risk.

Equally important has been the government’s openness to early dialogue on project structures, local content expectations and development sequencing—giving investors greater confidence that large, capital-intensive deepwater projects can move efficiently from discovery to production.

Nigeria: signs of regulatory momentum

Nigeria, long viewed as a more complex jurisdiction, has in the last two years begun to close the gap. Faster regulatory approvals for asset transfers, clearer guidance on operatorship changes, and targeted policy incentives—particularly for deepwater and gas—have helped unlock stalled transactions and investments.

The result has been a renewed flow of deals and financing activity, as investors gain confidence that approvals can now be secured within predictable timelines, stimulating fresh investment across the upstream sector.

Namibia has quickly emerged as one of the world’s most promising new offshore frontiers, but translating discoveries into production will require disciplined execution, regulatory clarity and access to large-scale capital.

The joint engagement by TotalEnergies and Galp at presidential level signals both long-term intent and confidence that Namibia can navigate the complex transition from exploration success to first oil—potentially reshaping the country’s economic trajectory and the energy map of southern Africa.