First Bank of Nigeria has successfully redeemed its $350 million Eurobond upon maturity on October 27, 2025. The Eurobond, issued in October 2020 as Senior Notes at an 8.625% coupon rate, had semi-annual interest payments. Notably, it was 70% oversubscribed at issuance.

According to the Group, proceeds from the 2020 issuance were used to fund strategic customer projects. They also financed national development initiatives, reaffirming FirstBank’s long-standing contribution to Nigeria’s economic growth.

With this redemption, FirstBank has now repaid a total of $1.275 billion across four Eurobond maturities since its inaugural issuance in 2007, strengthening its position as a consistent and credible player in the global capital markets.

Global Recognition

Fitch Ratings recently affirmed the Long-Term Issuer Default Ratings (IDRs) of both FirstHoldCo and FirstBank at ‘B’. They also upgraded their National Long-Term Ratings to ‘A+(nga)’ from ‘A(nga)’, with a Stable Outlook. Similarly, S&P Global Ratings reaffirmed the entities’ ratings at ‘B-/Stable’.

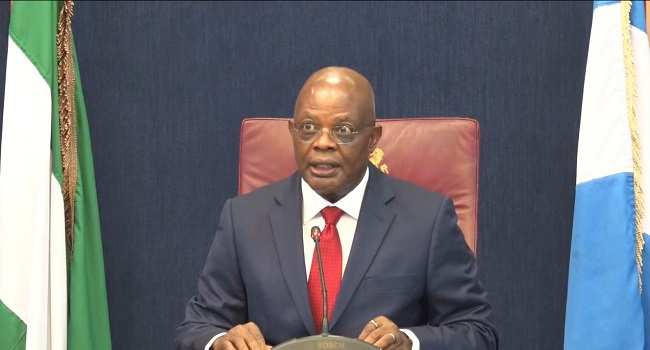

Commenting on the successful bond redemption, Olusegun Alebiosu, CEO of FirstBank Group, said:“This redemption is entirely from the Bank’s balance sheet, reflecting FirstBank’s superior asset and liability management, unrivalled franchise strength, and the sustained confidence that the investment community has in FirstBank.”