Nigerian Treasury bills are experiencing a significant rally as average yields dropped 12 basis points in the secondary market, driven by exceptional liquidity conditions and robust investor appetite for naira-denominated assets.

The financial system is currently flush with excess liquidity that peaked at N7.1 trillion last week, creating favorable conditions for fixed-income investors seeking opportunities across various maturities.

Market sentiment has turned decidedly bullish as participants anticipate the fourth quarter auction cycle while positioning strategically around liquidity-driven opportunities.

Also Read:

- FG to Raise N1.76trn in Q3 2025 Through Treasury Bills

- Investor's Sentiment Soars as CBN Records 283.42% Oversubscription for 364-Day Treasury Bills

- Nigeria's Treasury Bills Sees N2.4 trillion In Subscription Amid Lower Rates and Shifting…

- Strong demand for long-dated treasury bills drives N756bn sale by CBN

According to Cowry Asset Limited analysts, investors aggressively pursued short, mid, and long-tenor instruments, pushing average market yields down to 17.93% week-on-week as demand spilled across the entire yield curve.

The Central Bank of Nigeria demonstrated measured restraint during its latest Open Market Operations auction, receiving overwhelming subscriptions totaling N3.32 trillion but allocating only N98 billion—significantly below the N600 billion on offer.

This conservative approach signals the apex bank’s careful strategy to manage excess liquidity without overextending issuance, even as the system remains awash with cash.

OMO bills cleared at elevated levels, with 102-day and 123-day maturities settling at 20.49% and 20.61% respectively, while the 88-day maturity remained untouched.

The selective allotment reinforces the Bank’s preference for gradual liquidity management despite intense market demand.

The monetary policy easing cycle initiated in September has reshaped market expectations, with investors anticipating the CBN will reprice Treasury bill offerings accordingly.

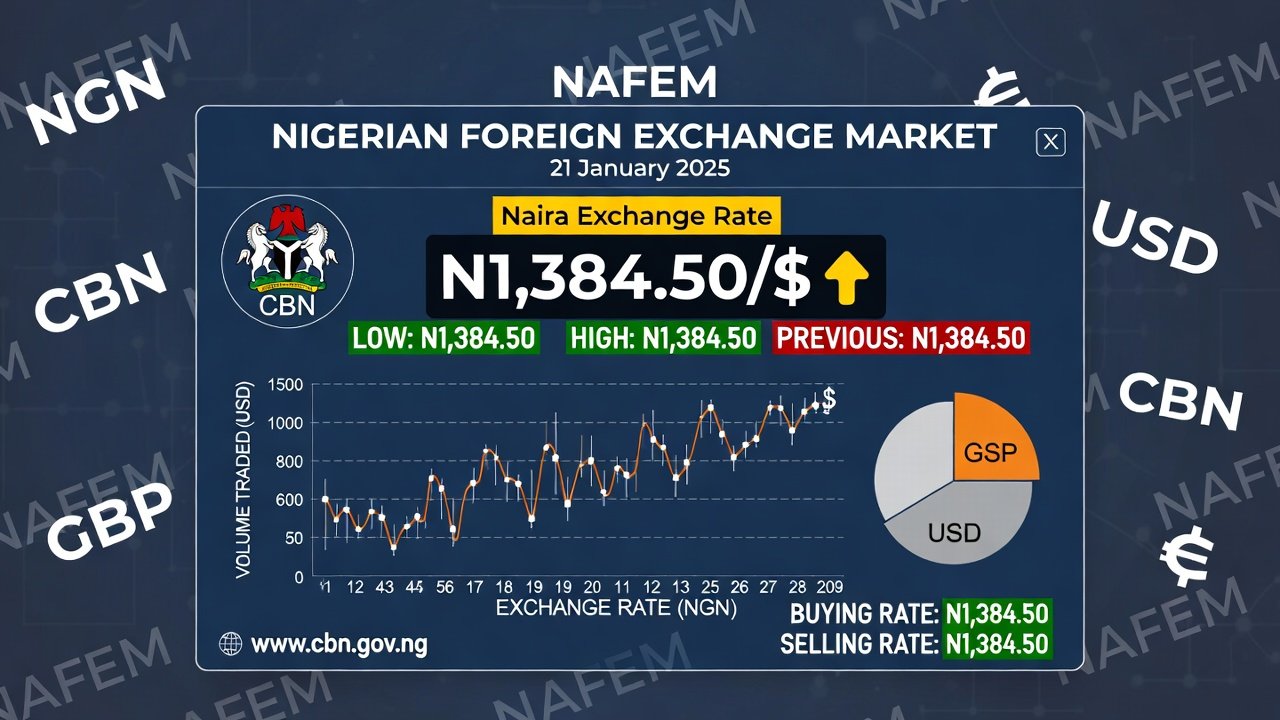

Yields have been declining steadily, supported by disinflation trends and a strengthening naira that have prompted widespread rate adjustments on naira assets.

Long-dated papers demonstrated the shift in market dynamics, with the 03-Sep-2026 and 17-Sep-2026 instruments closing at 15.80% and 15.35% respectively after midweek sentiment turned sharply bullish.

Initial sell-offs on select maturities, including the 03-Sep-2026 paper which saw yields rise 18 basis points, quickly reversed as robust system liquidity reasserted its influence.

Trading activity remains selective as investors await clearer signals from the Central Bank’s short-term liquidity management approach.

Light trading was observed on 16-Dec, 3-Mar, and 2-Jun bills on Friday, suggesting market participants are holding positions rather than aggressively repositioning.

The declining yields validate broad appetite for fixed-income assets in this highly liquid environment, though the CBN’s cautious auction behavior indicates authorities remain vigilant about monetary conditions.

With excess liquidity continuing to run strong, the trajectory of Treasury bill yields will largely depend on how aggressively the apex bank moves to absorb surplus funds while balancing market stability concerns.