The Nigerian stock market continued its measured advance on 7 October 2025, with total turnover climbing to ₦24.29 billion across 507.4 million shares in 30,681 deals, according to Cowry Asset data.

The All-Share Index closed at 144,995.26 points, up 0.12 percent, while market capitalisation inched to ₦92.03 trillion, extending the year-to-date gain to 40.9 percent.

Although the number of deals fell 13.6 percent, the 66.9 percent rise in trade value suggests heavier institutional blocks dominated activity.

That pattern fits broader 2025 trends, the market’s total capitalisation had expanded 21 percent by mid-year, according to PwC’s Nigerian Capital Market Update, buoyed by bank recapitalisation and renewed foreign participation, which reached ₦1.14 trillion (about 27 percent of total equity turnover).

Among the top performers were Cornerstone Insurance (+9.92 %), Conoil (+9.52 %), Chams (+9.22 %), and Mansard (+7.32 %), a diverse group spanning energy, fintech, and insurance.

The pattern suggests a tilt toward companies with visible balance-sheet improvements or clear regulatory backing.

On the downside, LivingTrust (–10 %), Austin Laz & Co (–9.74 %), and Juli (–9.60 %) were among the steepest fallers, underscoring the vulnerability of smaller firms to liquidity swings.

The trading leaderboard told another story: AccessCorp, Ellah Lakes, UBA, and Aradel Holdings accounted for the day’s largest volumes, nearly 118 million shares combined. That concentration of flow in a few names points to targeted institutional interest rather than a broad-based rally.

Macro and Market Signals

Nigeria’s Monetary Policy Rate at 27 % and August inflation at 20.1 % continue to shape risk appetite.

The combination keeps fixed-income yields high, but equities now offer competitive real returns: blue-chip dividend yields average 6–8 percent, while many large-cap valuations remain in single-digit price-earnings multiples.

The ₦24 billion turnover therefore signals more than day-trading momentum. It reflects selective accumulation in sectors likely to benefit from bank recapitalisation and energy reforms.

As foreign flows return cautiously and inflation steadies, the October session may mark a pivot from recovery to re-rating, a stage where liquidity begins to price in structural confidence rather than short-term bets.

Nigeria’s capital market is also wary over concerns of an impending 25% Capital Gains Tax (CGT) on share disposals set to take effect in January 2026.

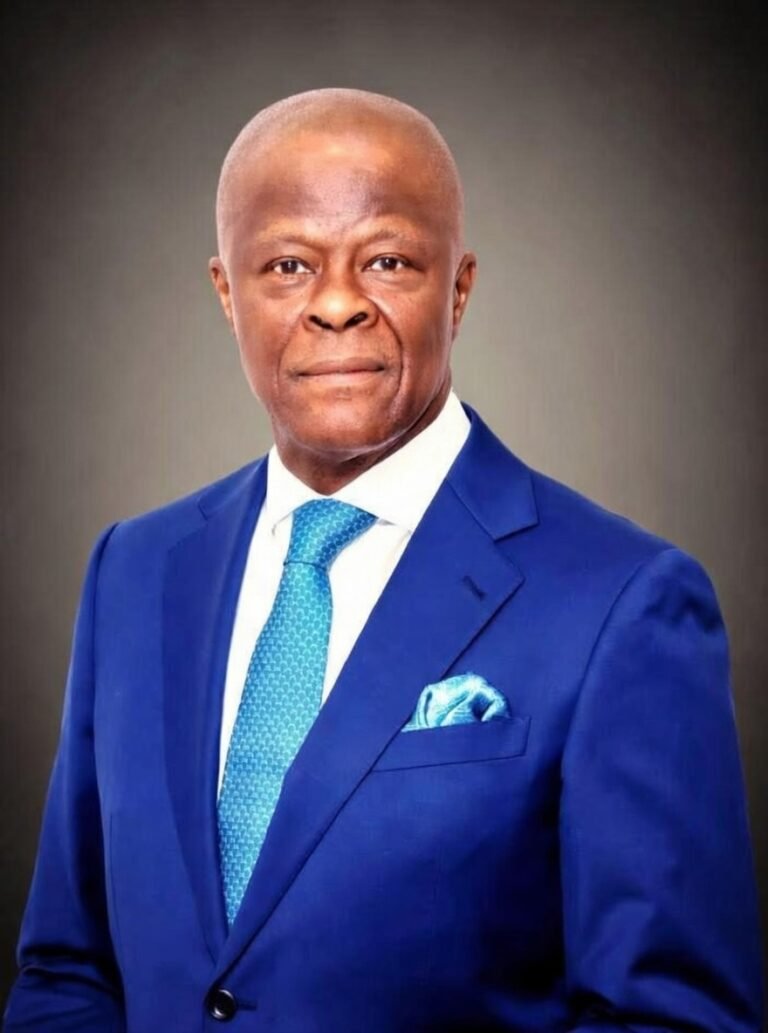

Taiwo Oyedele, Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, clarified this during an engagement organized by the Nigerian Exchange Group (NGX) last month.

He explained that under the new rule, investors who dispose shares and reinvest it in fixed-income securities or other non-equity assets will be subject to a 25% CGT.

He, however, noted that retail investors will largely be unaffected, as the N150 million annual exemption threshold effectively shields majority of market players.