- Interest rates have moved up significantly from 2020’s low, with positive implications for banks’ margins

- We note the banks best positioned to gain based on their ability to reprice loans, securities and keep funding costs low

- But rising rates also create room for lower trading gains. A number of banks are thus accumulating short positions

Nigeria’s macroeconomic picture remains bleak, with high inflation and unemployment, sub-par real GDP growth and a weakened local currency. These issues, alongside a difficult regulatory environment, have had negative implications on banks, as well as their heavily discounted valuation. In this report, we look at how the rising rate environment is a double-edged sword for Nigeria banks, as it provides the opportunity to expand NIMs, but minimises room to book large trading gains. This is part of a series of reports where we present the key themes – involving interest rates, asset quality, liquidity and loan growth opportunities – for the performance of the Nigerian banking sector in 2021. We will conclude the series with a valuation update and investment summary of our coverage banks.

The rising rates conundrum

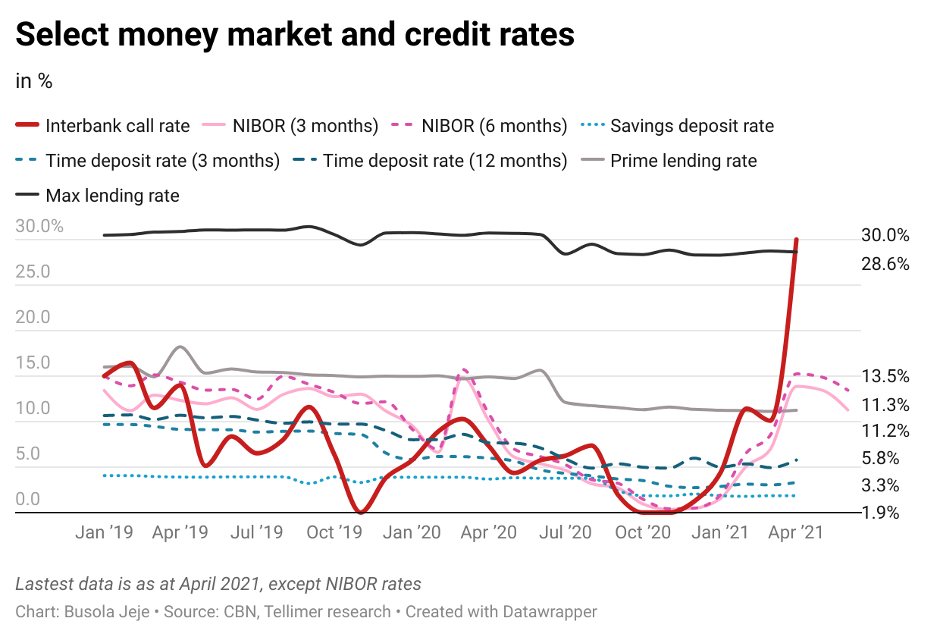

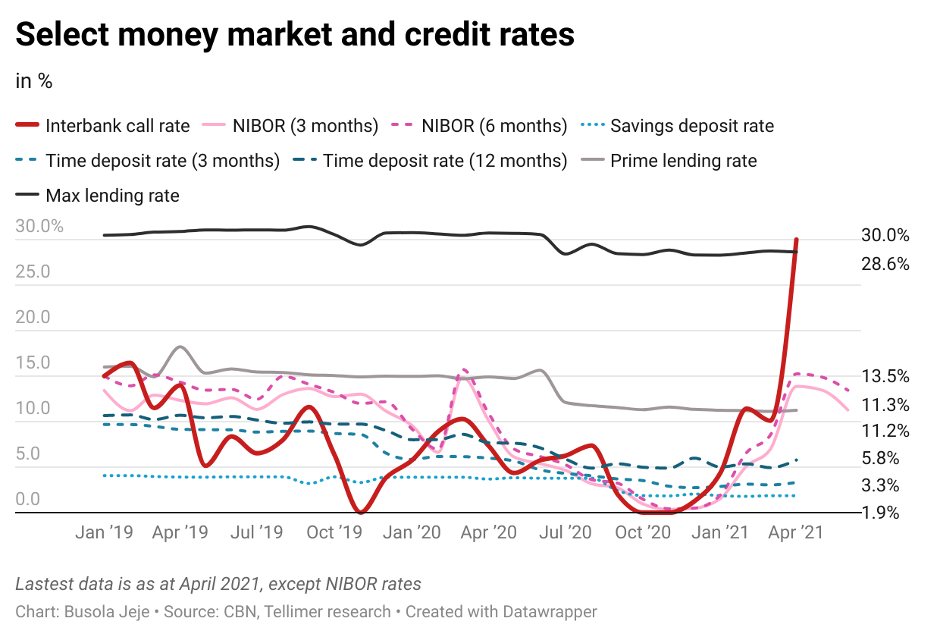

2020 was characterised with low interest rates for Nigeria banks. There was excess liquidity, fueled by the decision of the Central Bank of Nigeria (CBN) to bar local non-bank investors from buying Open Market Operations (OMO) bills in late 2019. OMO bills held by these investors (worth NGN8tn at that point) subsequently matured, flooded other financial markets, and depressed yields. The CBN also cut its policy rate and decreased rates on intervention funds (funds set up by the CBN and the Federal Government to provide subsidised loans to key sectors via the banks). In addition, the need to meet the CBN’s 65% minimum loan to deposit ratio, saw banks drop lending rates to attract quality borrowers.

Also Read: Financing Nigeria: Unlocking Liquidity Crucial to Fueling Development – Dr. Ayo Teriba

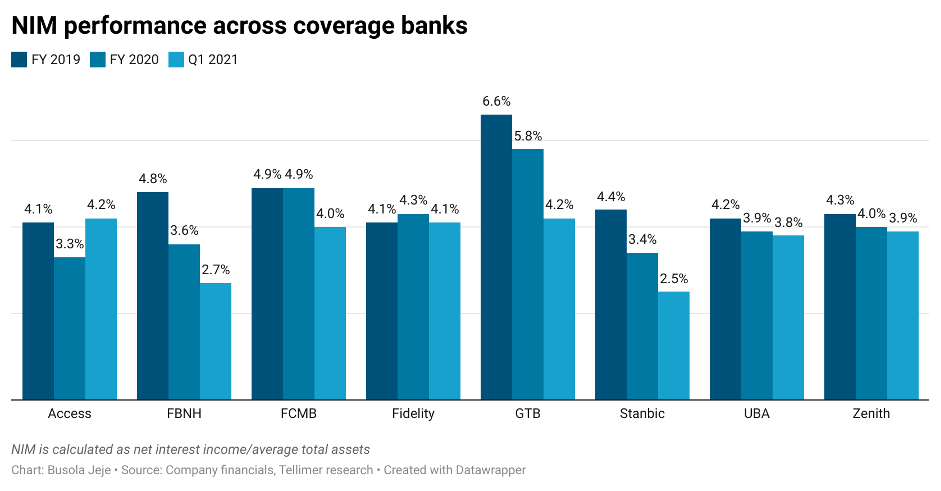

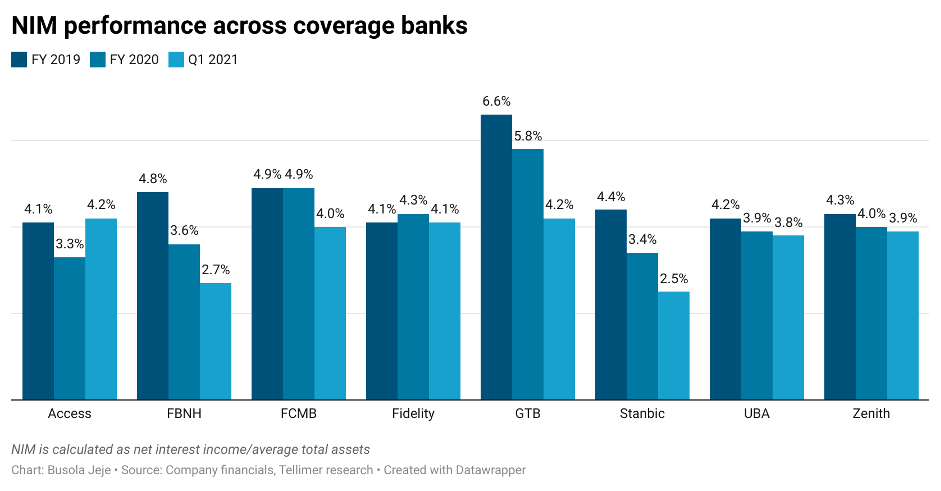

As a result, net interest margins (NIMs) compressed, declining by 53bps yoy on average for our coverage banks in FY 20. This was despite the improved funding costs from cheaper deposits (owing both to excess liquidity and a regulatory-induced decrease in savings deposit rates). Banks like Fidelity Bank also took the opportunity to raise cheaper borrowing in the form of local bonds.

The challenges of low rates and compressed NIMs continued in Q1 21. Among our coverage banks, only Access Bank recorded an expansion in NIM (0.9ppts yoy), due to increased income from interbank lending and debt securities. The CBN’s special bills were of no help, further compressing NIMs, as the banks’ interest-earning assets ballooned with the addition of these bills, while they attracted an interest of 0.5%. All our coverage banks except Access Bank recorded a yoy decrease in interest income from debt securities. Only Zenith, GTB and FCMB disclosed their holdings of special bills as of Q1 21, at NGN670bn, NGN556bn and NGN178bn, respectively, making 26%, 47% and 59% of their total investment securities.

Rates have now taken a U-turn and are trending upwards

Currently, yields have climbed new highs, with rates on OMO bills, Nigerian treasury bills and bonds expanding 600-800bps on average from 2020’s low. This is because the excess liquidity has decreased significantly, thanks to the exhaustion of inflows from OMO bill maturities belonging to locals. Also, the CBN’s persistent cash reserve requirement (CRR) debits as well as increased domestic borrowing by the government, have contributed to the rate increase.

In H2 21, rates are expected to increase or, at worst, stay at current levels, as the CBN continues to use CRR debits to control liquidity and influence interest rates. Having said that, the rising rates environment is a double-edged sword for banks, as it gives the opportunity to expand NIMs but minimises room to book large trading gains. We dig deeper into these topics below.

Higher rates offer opportunity to expand margins

The rising rate environment will be beneficial to the banks that can increase their asset yields faster than funding costs rise. However, this dynamic depends on a number of factors including their ability to reprice loans, the length of their investment securities and their funding mix.

Ability to reprice loans

A number of banks noted in their FY 20 investor calls that they are experiencing higher demand for rates on term deposits, and committed to repricing their loans accordingly. We believe several factors influence the ability for the banks to reprice their loans:

- Currency denomination of their loan book: Nigeria banks have a good proportion of their loans in foreign currency (majorly US$), which is no surprise given the prominence of the oil and gas sector. However, these loans are largely immune to the rising rate environment in Nigeria. Across our coverage, Access Bank, Fidelity Bank and FCMB Group have the bulk of their loans in naira, implying more sensitivity of their loan yields to the rising interest rate environment in Nigeria.

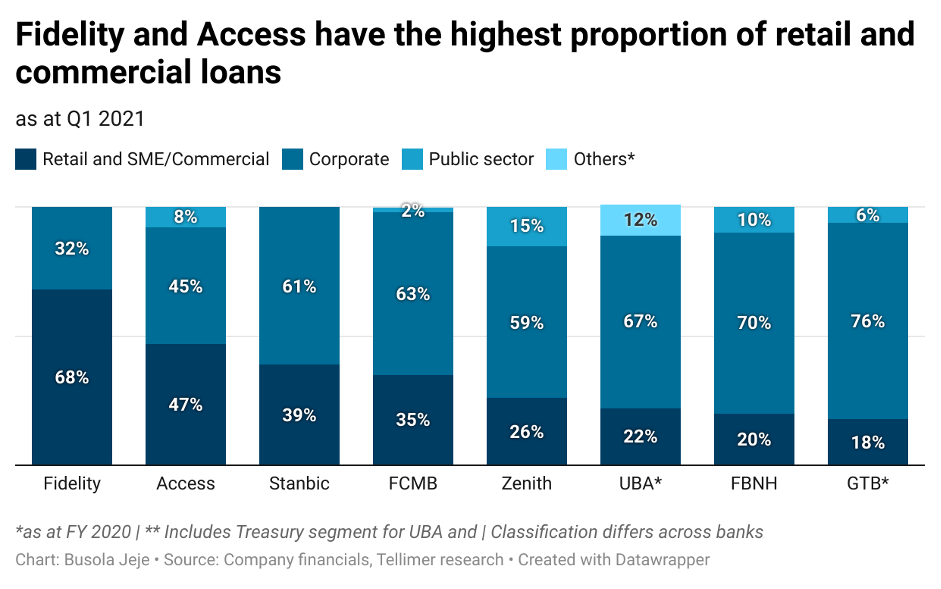

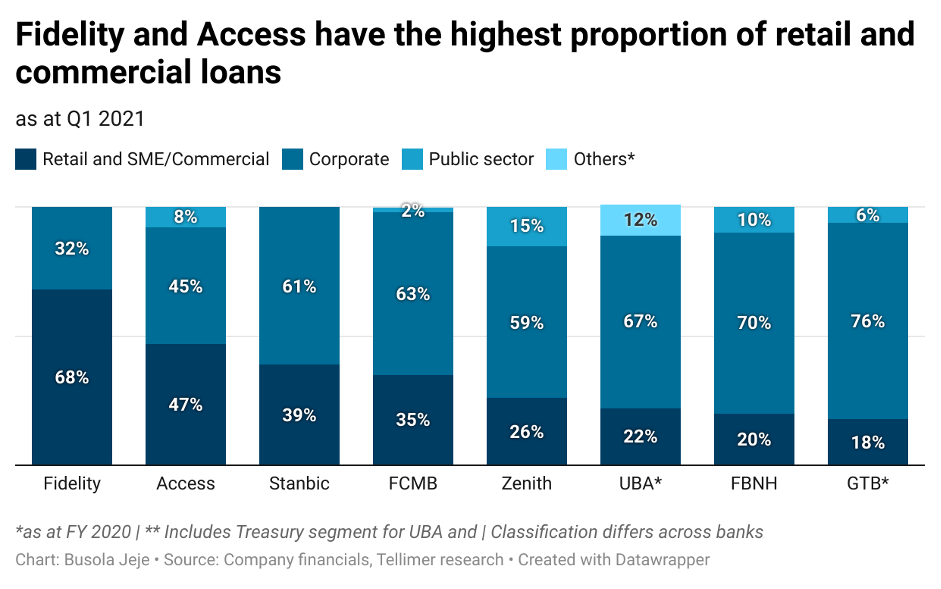

2. Distribution of loans across banking customers: Banks have a better chance at increasing loan rates to retail and SMEs/commercial customers, compared to large-scale corporates. This is because corporate customers have a higher bargaining chip in terms of better credit profiles, and often have more alternatives for financing. Across the banks that disclosed distribution of loans, Access Bank and Stanbic had a higher proportion of their loans in retail and SME/commercial borrowers in Q1 21.

- Maturity profile and interest rate structure of loans: Thirdly, the banks with the highest exposure to short-term loans, have the greatest ability to set new loan terms in tandem with the rising rate environment. This is particularly favourable for UBA and Stanbic, which had the highest number of loans maturing within 1 year in FY 20, at 50% and 47% of their loan book, respectively. Although the maturity profile is important, long-term loans can also be repriced if they attract floating rates (floating rate naira loans are usually pegged to reference rates such as the NIBOR and MPR). In FY 20, Access Bank and FBNH had a bulk of their loans as floating rate structures, at 99% and 95%, respectively.

Also Read: Nigeria: Outlook on Key Industries in 2021

- Exposure to interbank placements: The banks actively involved in interbank lending will benefit, given the declining liquidity and the sensitivity of interbank rates to tightened liquidity. Interestingly, interbank call rates touched a high of 30% in April, from 1.3% in December 2020. As expected, the larger and more liquid tier-1 names have a higher proportion of their assets in interbank placements in Q1 21 – these include Access Bank (10.4%), FBNH (9.9%) and GTB (7.7%).

- Exposure to intervention funds:Banks with large exposures to intervention loans, which still attract an interest rate of 5% compared with 9% pre-pandemic, would see their NIMs remained pressured. In FY 20, Zenith had the highest exposure to intervention facilities at 19% of its gross loan book, followed by FCMB (13%), Access Bank (11%), FBNH (6%), GTB (6%) and Stanbic (4%).

Busola Jeje is a Junior Research Analyst at Tellimer Research

Read more at https://tellimer.com/article/how-nigeria-banks-will-thrive-in-the-face-of