The End of a Golden Age for Oil Producers

The search for other types of revenue will accelerate

For decades Arab oil producers have been caught in a quandary. When prices fall, they pledge to wean their economies off the black stuff. But low prices mean they cannot afford costly reforms. Then output falls, demand climbs and prices begin their inevitable rebound. Treasuries are once again flush, and the pressure to reform disappears.

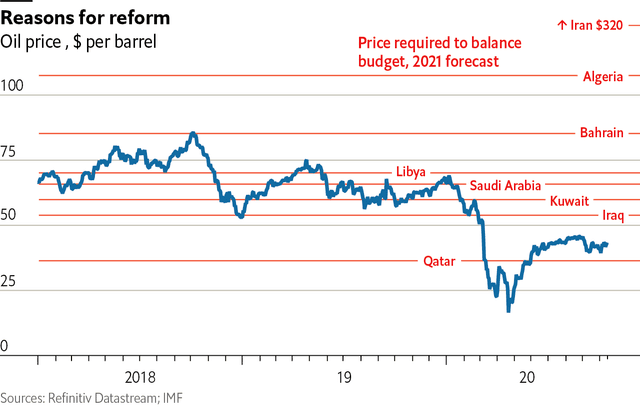

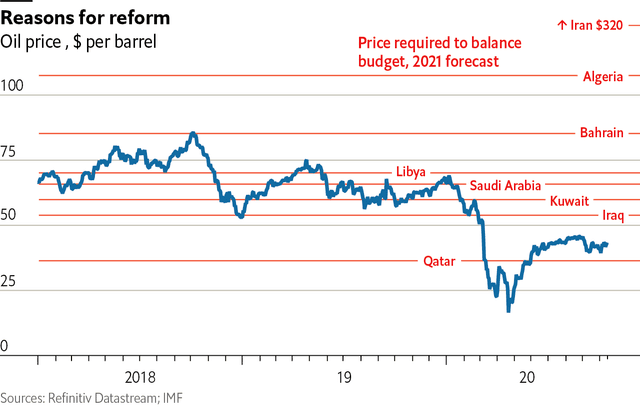

Privately, some officials now wonder if this cycle is over, making the needed reforms unavoidable. The drop in demand caused by covid-19 sent Brent crude as low as $21 a barrel in 2020. Prices will recover a bit in 2021, perhaps crossing the $50 mark. They will not go much higher, though. Most oil states in the Middle East will still be unable to balance their budgets.

Also Read: Second Wave Coronavirus Lockdowns: Major Oil Producers Want Output Cuts Extended Into 2021

Saudi Arabia, the region’s biggest producer, will push on with its search for non-oil revenue. Last year it tripled value-added tax to 15%. Saudis who hoped the rise was temporary will be frustrated to learn it was not. Still, the deficit will widen. Contractors will struggle with late payments for public-sector work. Yet the kingdom will plough ahead with its biggest megaprojects, such as Neom, a $500bn high-tech city in the north-western desert, and a planned Red Sea resort larger than some European countries. It will also force more migrants out of the labour market, freeing up jobs, albeit low-paying ones, for its citizens.

Meanwhile, a drive-through Dubai at night will be eerie: towering apartment blocks and opulent villas will sit dark and empty. The United Arab Emirates will lose about 1m migrants, one-tenth of its population. Some will return home, having lost their jobs. Others, having had their salaries cut, will send their families back and move into smaller flats to cut costs. New construction will cause a further drop in property prices, which fell by 10% in 2020. Dubai will at least get a delayed boost from the launch of the World Expo in October 2021.

Also Read: Higher Energy Prices Encourage Producers To Increase Drilling

Kuwait will tap bond markets to plug a deficit that could run to 15% of GDP, saddling future generations with more debt to pay for an outsized public sector. Bahrain and Oman, already rated junk, will have a harder time borrowing. Outside the Gulf, the picture looks bleaker still. Iraq will cut spending to cover its bloated payroll. Algeria’s foreign reserves, an impressive $200bn in 2014, will slide below $40bn.

There will be no relief in sight. Demand for oil will stay depressed. On the supply side, OPEC+ members that adhered to strict production caps in 2020 will pump more in a bid for market share. Joe Biden’s new Iran policy will send more crude trickling into the market. Kings and ministers will finally realise that they need to restructure their economies. They will also wonder if it is too late.

This article was culled from The Economist.