Femi Otedola has increased his ownership stake in First HoldCo Plc to 18.12%, deepening his position as the group’s most influential individual shareholder as Nigeria’s banking recapitalisation drive reshapes ownership across the sector.

The increase was disclosed in First HoldCo’s unaudited consolidated and separate financial statements for the year ended December 31, 2025, released on Friday. The accounts show that Otedola now controls 8.02 billion shares, combining both direct and indirect holdings.

How the Stake Was Built

According to the shareholding breakdown, Otedola’s ownership is split between:

-

Direct holding: 3.25 billion shares (7.31%)

-

Indirect holding: 4.8 billion shares (10.81%)

This represents a sharp increase from 11.8% at the end of the 2024 financial year, underscoring an aggressive accumulation strategy since Otedola assumed the chairmanship of the group.

In December 2025 alone, the billionaire investor acquired additional First HoldCo shares valued at approximately ₦14.8 billion, according to the disclosure.

Share Capital Expansion and Dilution Dynamics

First HoldCo’s total issued share capital expanded significantly over the year, rising to 44.45 billion shares as of December 31, 2025, from 35.9 billion shares at the end of 2024. The increase reflects capital actions linked to the sector-wide recapitalisation programme.

Despite the larger share base, Otedola not only avoided dilution but increased his percentage holding—an outcome that signals both financial capacity and strategic intent at a time when many shareholders have struggled to keep pace with fresh capital requirements.

Who Controls the Rest?

While Otedola is the largest individual shareholder, the single largest block remains with RC Investment Management Limited, which holds 10.43 billion shares, representing 23.47% of the company.

The structure highlights a pattern increasingly visible across Nigeria’s tier-one banks: a small number of powerful anchor shareholders exercising decisive influence, even as institutions remain formally widely held.

Free Float Narrows, But Remains Compliant

The expansion in insider and strategic holdings has narrowed First HoldCo’s free float. As of the end of 2025, free float stood at 58.34%, valued at approximately ₦1.24 trillion, down from 79.46% (₦800.07 billion) a year earlier.

The company said the free float level remains fully compliant with Nigerian Exchange requirements for companies listed on the Premium Board.

Rising Trend of Concentration

Otedola’s rising stake places First HoldCo firmly within a broader trend reshaping Nigerian banking: ownership concentration driven by recapitalisation.

As regulatory capital thresholds rise and weaker shareholders are diluted, deep-pocketed investors with strong balance sheets are consolidating influence. For First HoldCo, Otedola’s accumulation provides capital certainty and boardroom stability—but it also raises familiar governance questions around concentration, succession, and the long-term balance between dominant shareholders and institutional oversight.

Where Otedola Now Sits Among Nigeria’s Bank Power Brokers

Otedola’s near-20% position places him in a small and influential group of dominant shareholders reshaping Nigerian banking ownership.

At United Bank for Africa, Tony Elumelu controls just over 20%, making him the single largest individual shareholder in any Nigerian bank. At Zenith Bank Plc, founder Jim Ovia owns approximately 14–15% of the bank’s issued share capital, through a combination of direct and indirect holdings. Meanwhile, at Access Holdings Plc, Aigboje Aig‑Imoukhuede remains the most influential shareholder with a stake just under 10% following recent recapitalisation-driven dilution.

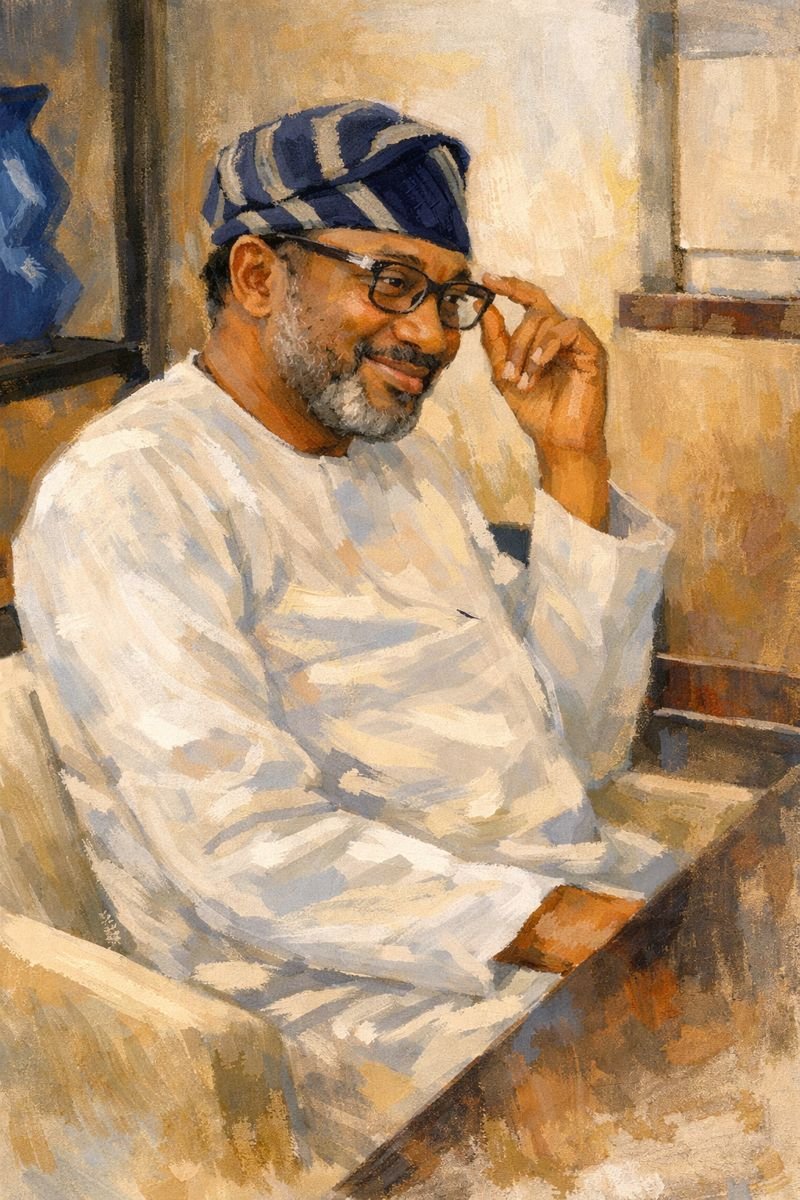

What sets Otedola apart from this group is not only the scale of his ownership, but his background. Unlike Elumelu, Ovia, or Aig-Imoukhuede—each of whom built their fortunes within banking—Otedola is the only major shareholder in Nigeria’s tier-one banks who neither founded a bank nor built his career in the financial system. His wealth was created in commodities, energy, and industrial investing, making his rise at First HoldCo a rare case of an external industrialist acquiring deep influence in a sector long dominated by banking insiders.

As Nigeria’s recapitalisation programme rewards balance-sheet strength over legacy ownership, that distinction matters. Otedola’s accumulation at First HoldCo signals a quiet but consequential shift: control in Nigerian banking is no longer anchored to founders alone, but to capital.