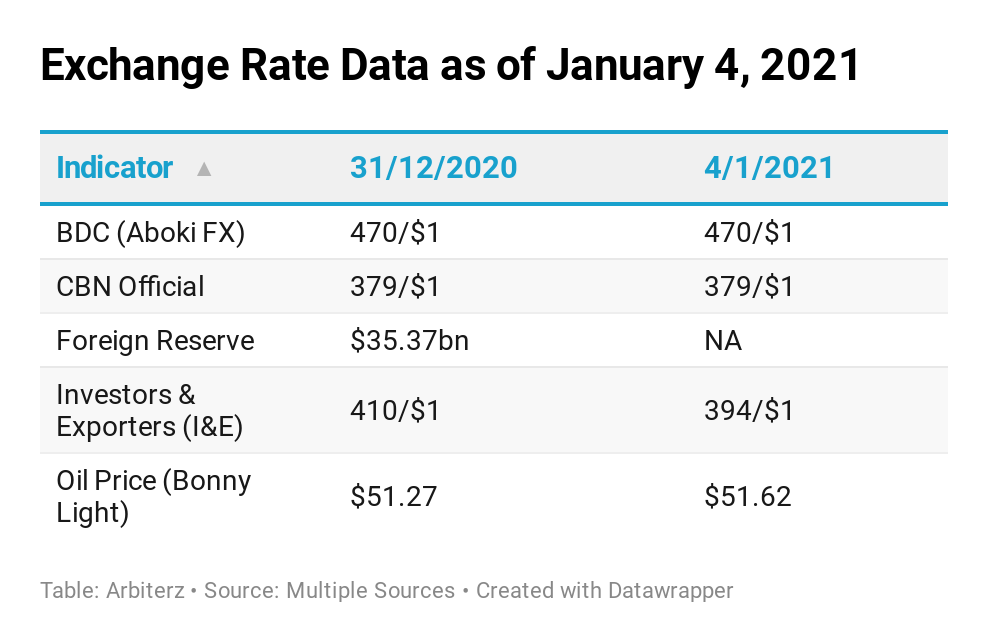

The exchange rate at the Nigerian Investors and Exporters’ (I&E) Window closed at N394/$1 on Monday, January 4, 2021, following the latest in a series of strong interventions by the Central Bank of Nigeria (CBN) to defend the naira.

Available information on the FMDQ website showed that the Naira appreciated and closed stronger against the greenback after it previously fell to N410/$1 last week, generating speculations that the central bank was speeding up a unification of the exchange rates.

Such hopes were quenched quickly as the local unit closed stronger at N394.30/$1 on Monday on the back of strong intervention by the apex bank. Meanwhile, the exchange rate at the parallel market/Bureau De Change (BDC) window closed the day at N470/$1. The CBN official exchange rate was at N379/$1 as of press time on Tuesday.

Investors and analysts have been left dumbfounded by the CBN move, which is a clear departure from the recommendation of the International Monetary Fund (IMF) on the unification of the country’s exchange rate and many have termed it as worrisome.

An analyst, Ibrahim Okubena questioned the sustainability of the CBN intervention in an economy that has oil as the major source of forex revenue and an “uncompetitive productive base.”

“CBN cannot continue to defend the naira with forex from a volatile commodity and restrict access to dollars for importation while your productive base is uncompetitive. It is simply unsustainable,” Ibrahim said.

“During the holiday, I got a bag of foreign rice at N18,000 while locally-produced rice was sold at N25,000. As a result, the preference for foreign rice (which is legally banned) by local consumers will impact on demand for dollars or foreign exchange at the black market and pile more pressure on the official rate.”

Ibrahim added that with oil prices (i.e. bonny light) hovering at $51 per barrel, the CBN interventions in the forex market is unsustainable and would only have further negative impacts on the economy.

“The latest intervention by the apex bank makes it clear that the government will continue strongly with the managed-float approach, and that will only further encourage FX market arbitrage, round-tripping, and corruption, with consequences on declining foreign reserves, while deterring capital inflow and investment,” he said.