“Mr. Ekeh’s words strongly suggest that Mrs. George is not acting within the terms of the agreement with Alta Sempta, probably because she did not engage or listen to “good quality law firms”.

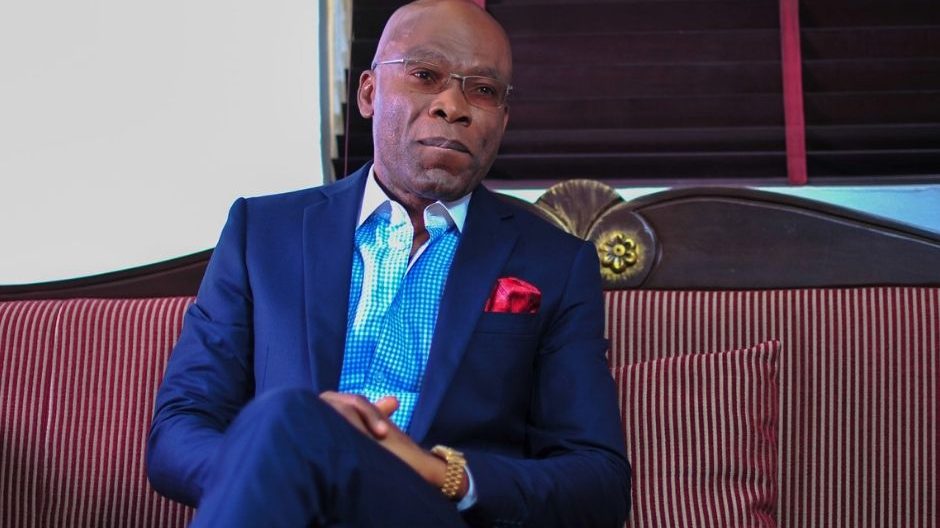

Leo Stan Eke, Chairman of Zinox Computers, has in a conversation with Nairametrics, strongly denied that he is behind the move by the London-based private equity group, Alta Semper Capital, to take over management of HealthPlus, Nigeria’s leading pharmacy chain which was founded by Mrs. Bukky George .

The PE firm, which describes itself as “a dedicated frontier-markets private equity firm investing flexible and strategic capital in healthcare and consumer opportunities across African growth markets”, had acquired 53.8% of the shares of HealthPlus for $18 million with Mrs. Bukky George retaining 46.2% of the shares.

| IN CONTEXT Alta Semper moved to remove Mrs. Bukky George as CEO after, according to a statement by the PE firm, a “long and drawn-out engagement” failed to satisfactorily “address multiple issues concerning the way the company was being managed”. It would seem that Alta Semper was acting within its rights as majority shareholder to appoint a “Transformation Officer” to “optimize day-to-day management” of the business and improve profitability. But Mrs. George has challenged this move to replace her with Chidi Okoro, Founder/Executive Consultant of Drugs and Medicaments Nigeria Limited, a wholesale drugs supplier, on the grounds that Alta Semper had invested only $10 million of the $18 million it has agreed to invest. Mrs. George alleges that this was a deliberate ploy to starve HealthPlus of funds required to expand and meet targets, so Alta Semper could take over the underperforming business. She said during an interview, “They come, they pledge, give you some money, and stop. When the business dies, they buy at peanut (sic).” She said she has had to raise money from banks to fund HealthPlus, using her house as collateral. Also Read: Fighting off Covid-19: A Survivor’s Detailed Battle Plan This sentiment was echoed at an “interactive session” held by Business Founders Coalition (BFC) in Lagos which called for government policies to protect Nigerian entrepreneurs from foreign private equity firms who have become “major threats to the well-being of Nigerian entrepreneurs and their businesses”. The event seems to have been packaged by the Lagos public relations firm, CMC Connect, to influence public opinion as Mrs. Bukki George fights to prevent Alta Semper Capital from replacing her as CEO with Chidi Okoro. Both Mrs. George and the Managing Director of CMC Connect, Mr. Yomi Badejo-Okusanya, spoke at the event. The Founder of Business Founders Coalition, Dr. Richardson Ajayi, the founder of the medical laboratory, Synlab (formerly Pathcare), accused private equity firms of “preying” on Nigerian businesses, and plotting to push founders out, summing up that, “Our experiences have largely been tales of woe… We are also hoping that through this coalition, government can enact policies and laws that will correct that apparent lop-sidedness.” Private equity investment is an opportunity for Nigerian companies to tap into extremely liquid foreign capital markets. In 2019, European private equity firms invested a total €262 billion in companies within Europe. They have $,2,500 billion under management and “dry capital” i.e. idle funds waiting for an opportunity for profitable investment is an increasing problem. The value of all the companies on the Nigerian Stock Exchange, a market for public capital, was in 2019 $ 43.92 billion, compared with a global average of $632.33 billion, based on the average the market capitalisation of stock exchanges in 61 countries in the world. |

While Mr. Leo Stan Ekeh expressed admiration for Mrs. George’s business acumen, describing her as “extremely brilliant with great energy and passion to succeed in her sector …”, his views about her conflict with Alta Sempta Capital are very clear.

They are very boldly written, meant to be read quite easily between the proverbial lines. Mr. Ekeh’s words strongly suggest that Mrs. George is not acting within the terms of the agreement with Alta Sempta, probably because she did not engage or listen to “good quality law firms”.

Also Read: Business File Today: UNICEF Contributes Medical Supplies In Collaboration with IHS Nigeria

The tech entrepreneur said in the interview, “Looking for foreign investors is like taking a bank loan locally. You must keep your promises. When you talk about knowledge economy, it means you should be knowledgeable enough to understand what you are going into or pay quality corporate law firms to advise you, but you must listen to them”.

Mr. Stan Eke expressed the opinion that foreign investors help companies put in place good corporate governance structures and make more money than they would have ever made, stating, “They help you alter your destiny.” He described his experience with foreign investors in his business as “rewarding”, saying he has remained friends with them.

Suspicion that the technology entrepreneur may be behind Alta Sempta Capital’s attempt to wrestle management control of HealthPlus from Mrs. Bukky George may arise from rumoured investment in Mr. Chidi Okoro’s Drugs and Medicaments Nigeria Limited. Mr. Eke denies having any funds in Alta Sempta or HealthPlus.

No matter the facts of the case, Mr. Leo Stan Eke’s intervention will give comfort to actual and potential investors in Nigeria. An event organized by the Business Founders Coalition at which Mrs. Bukky George spoke, mostly portrayed foreign investors as threats to business owners and Nigerian jobs, seeking government intervention to curtail their activities in Nigeria. Such rhetoric may worsen investors’ perception of Nigeria as a country where contracts count for little and where well-connected local businessmen may manipulate the government to intervene in private transactions. Nigeria already has a reputation for unpredictability and hyper-regulation.