We Can’t Breathe: How Africans Suffocate Themselves With Debt

Economic activities have taken a massive clobbering from the measures in place all over the world to curtail the spread of the new coronavirus. According to the International Monetary Fund’s World Economic Outlook Update, June 2020, global economic output will shrink by 4.9% in 2020, 1.9% lower than the IMF’s April 2020 forecast. For African economies as all others in the world, this means not only job losses but lost incomes from exports and reduced tax revenues. But while governments in other regions have rolled out billions of dollars in fiscal interventions to stimulate economic activities and /or support the jobless, African Governments have to look for $44 billion to service debts in 2020. Even before the economic ravage of the new coronavirus, many African countries spent more money servicing debt in 2019 than they spent on healthcare.

The IMF June 2020 Update forecasts a 3.2% decline in economic growth for Sub-Saharan Africa with output in the regional economic powerhouses, Nigeria and South Africa declining by 5.4% and 8.0% respectively. Without debt relief, Nigeria will use 96% of its income to service debt in 2020. Contrasting the plight of African countries with their western counterparts, Ken Ofori-Atta, the Minister of Finance of Ghana, exclaimed at a Centre of African Studies, University of Harvard webinar on June 3, 2020 “You really feel like shouting ‘I can’t breathe’ “. The G20 nations have agreed to let African debtors defer $20 billion debt payment until the end of 2020. But this applies mostly to debts owed to Western and other G20 governments.

Why Debt Relief Now Offers Very Little Comfort

The debts which burdened African economies in the 1980s and 1990s were predominantly contracted through Export Credit Agencies of Western Governments which guaranteed payments by African countries for goods and services their (private) companies exported to Africa. (The debts were not owed to the World Bank or IMF as is widely believed). In 1990, 83% of Africa’s debt stock i.e. $255 billion was owed to official creditors while only $28 billion was owed to private creditors. In the last ten years African Governments have expanded their search for credit and financing beyond western export credit and aid agencies and multilateral development agencies like the World Bank, IMF, and the African Development Bank which are significantly funded and controlled by western nations. They started to borrow from western investors by issuing bonds in London and New York just like western governments. According to 2020 data compiled by the World Bank, Africa owes $493.6 billion in long-term debt 33% of which consists of commercial debts, specifically bonds.

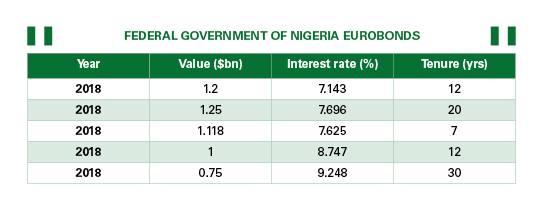

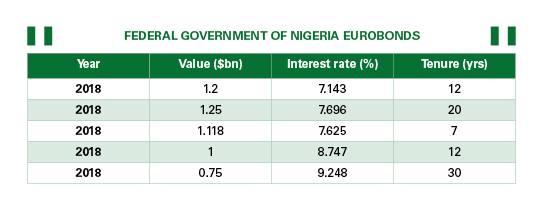

According to The Economist, 8 African countries issued 30-year bonds in 2018. This growing trend of commercial borrowing is problematic for two reasons. First, investors in the bonds are completely profit-oriented and are much less persuaded by arguments that not granting debt relief would hamstring economies and increase poverty. Also, unlike development agencies’ lending which is usually priced between 1% and 3% and is payment-free for the initial 3 or 5 years, commercial lending is very expensive and thus contributes to raising Africa’s debt burden. The interest on the 30-year Nigerian Euro bond is 9.248%, compared to the 0.031% interest rate on 30-year German bonds. Nigerian Government officials used to celebrate the fact that Nigerian Eurobonds were oversubscribed i.e. there were more investors than bonds to sell. This is almost like leaving wads of dollars on the street and being surprised to see many people pocketing them. The higher price Nigeria pays to borrow is a reflection of the perceived risk of default; Germany has AAA credit rating with all the major 3 credit rating agencies.

Bonds are purchased by hundreds of investors; any decision on debt relief or restructuring or deferring interest payment has to be collectively agreed upon. It is notoriously difficult to agree on terms of debt restructuring amongst investors. Nigeria spent $771 million on interest on its Eurobonds in 2019, more than double the $329 million it paid to multilateral creditors. Like other African newcomers to commercial debt, Nigeria is wary of asking bondholders for debt restructuring. While it isn’t certain that the request would be granted, the mere act of asking would automatically result in a credit rating downgrade and complicate issuing Eurobonds in the future.

Commercial Debt: An Act of Financial Self-Suffocation

When poor countries’ governments experience fiscal crises, often as a result of the collapse of commodity prices, and debtors demand they hand over the limited funds they have to fund schools and hospitals, they resort to emotional blackmail such as complaining that they can’t breathe or that they are being encircled by financial vultures. Their citizens and supporters in the West seldom examine their own complicity in creating the lock hold.

The former IMF Managing Director, Christine Lagarde visited Nigeria in January 2016 to discuss how the institution could assist Nigeria to cope with the loss of $11 billion due to the fall in oil prices. She made it clear that the IMF could lend to Nigeria at 1%. Nigeria rejected the offer for 7 to 8% commercial debt (through issuing Eurobonds). IMF loans come with conditions. Nigeria would have had to undertake policy reforms that enable it to use its own resources more productively, diversify its economy, and thus make its economy less susceptible to external shocks. IMF conditions would have included requesting that Nigeria spent more on healthcare and education or on roads rather than on fuel subsidy. The IMF would also have asked that Nigeria collapsed its multiple exchange rates, in effect a devaluation, which would have prevented the Central Bank of Nigeria from using more than $40 billion of its reserves to defend the naira over 3 years.

According to Franklin Cudjoe, President of the Accra-based Imani, one of Africa’s foremost economic policy think tanks, Ghana has issued Eurobonds mostly for infrastructure projects “that do not necessarily return value in the short to medium term”. In an interview with Arbiterz, Cudjoe expressed the opinion that investment in freight-carrying railway would have aided Ghana to reduce non-tariff barriers to regional trade; the passenger trains that Ghana has invested in cannot compete with road transport. Cudjoe also believes that Eurobond proceeds should not be invested in healthcare as the public sector is “just inefficient at maintenance and offering proper care”. He advises that Ghana and the rest of Africa use a mix of private sector investment and management of hospitals and private health insurance firms to “provide tiered but humane healthcare coverage.” Similarly Misheck Mutize of the Graduate School of Business (GSB), University of Cape Town noted that African countries use Eurobonds to finance loss-making projects like the Kenyan Standard Gauge Railway (SGR) which do not generate new economic activity and/or are not self-sustaining.

Investors in Eurobonds are interested in getting handsome returns rather than poverty alleviation or sustainable monetary policies, so their lending comes with no conditions on improving economic policies. Funds from commercial lending are “fungible” i.e. African countries are often able to divert the funds to uses other than those stated for issuing Eurobonds. Commercial loans clearly have allowed many African countries to avoid critical reforms that would have boosted economic growth and contributed to reducing poverty, diversifying, and insulating their economies from external shocks. Now they have to hand over billions of dollars to service the loans.

The Director-General of Nigeria’s Debt Management Office, Patience Oniha, said at an investor conference on 23 June 2020 that Nigeria will until further notice borrow locally and seek international concessional lending rather than issue Eurobonds. This self-denial is very conveniently timed. There is simply no investor appetite for Nigerian Eurobonds in financial markets scarred by the new coronavirus pandemic; Nigeria had to scrap plans to issue yet another $3.3 billion Eurobond in March 2020. It is safe to conclude that Nigeria, for now, prefers the exorbitant privilege of commercial borrowing over reforms that would unleash genuine and sustainable economic growth. The country is likely to start issuing Eurobonds again once global economic conditions improve and financial markets regain their risk appetite.

Should Africa avoid the Vultures?

The poor quality of economic policy and institutions are the primary explanations for Africa’s underdevelopment and poverty rather than the lack of capital for public investment. But efficient mobilisation and investment of capital will significantly improve economic outcomes as well as the quality of economic policy.

Africa’s severe shortage of infrastructure is a barrier to investment and productivity and improving livelihoods. According to the World Bank, Africa needs to invest $90 billion every year in infrastructure but faces a $31-$40 billion shortfall. African countries should hence endeavour to access all available sources of capital to boost public investment, especially the very liquid western bond markets where western governments raise capital for their vastly greater public investment. In 2018, the value of outstanding bonds in the global bond market was $102.8 trillion, compared to $74.7 billion capitalization of the global equity market. In 2018, members of the Organisation of Economic Cooperation in Europe, a club for the world’s richest economies, issued bonds worth $10.7 trillion, far more money than Africa has ever received in development aid since independence. African countries are determined to preserve access to this market precisely because they are aware it could easily finance their comparatively modest investment needs. The question is how to ensure that access to western bond markets assists in closing Africa’s infrastructure gaps rather than primarily to deliver supernormal profits to investors.

Africa will not transform the legacy of poor governance overnight. But it is quite possible to improve significantly policy and governance around an oasis of infrastructure projects which African Governments aim to finance with Eurobonds. The prospectuses of African countries are often vague about the intended specific uses of proceeds of Eurobonds. Simple things like initiating policies that ensure that proceeds from Eurobonds could only be invested in the infrastructure projects for which the bond was issued would not only enable African countries negotiate lower interest rates but would also enhance economic growth and thus the capacity to repay debt. African governments should aim to finance infrastructure for which there is a clear economic need and for which economic user fees could be charged with their new Eurobonds whenever it becomes possible again to approach the market.

Selective Regional Integration and External Agencies of Restraint

All politicians would prefer short-term fiscal choices that enable them deliver free or subsidised healthcare, education and infrastructure services and avoid hard choices about sustainability while storing up economic crises and failure. In developed economies, think-tanks, the media, opposition political parties, legislatures, etc. act as, according to the Oxford economist Paul Collier, “agencies of restraint” on governments’ fiscal choices. In most African countries, “epistemic communities” i.e. academics, policy experts, and journalists that research, generate and diffuse knowledge about the consequences of fiscal or economic policy choices are very poorly resourced and have little influence. And political institutions, including legislatures, tend to serve as “agencies of distribution” in African politics rather than of restraint because the political argument over fiscal policies in ethnically divided African politics is more about the identity of beneficiaries and less about economic impact or sustainability.

The Cameroonian economist and Head of the United Nations Economic Commission for Africa, Vera Songwe, has suggested the creation of a new institution that could issue bonds for African countries at much lower interest rates by guarantying repayment. This is a very good idea worth exploring. But only western governments or the development finance institutions they control could offer investors the required level of comfort required to sufficiently de-risk African debt. African integration initiatives tend to converge around the lowest common denominator rather than set high standards for “upwards” policy convergence. Unlike the European Union, for instance, economic integration processes in Africa do not act as an external restraint on domestic policy choices.

African governments who have been happy to use access to very expensively priced bonds in order to avoid fiscal and economic reforms are very unlikely to act together to create a credible structure that would enable them borrow at lower interest rates. (Leaving aside having the funds or creditworthiness to guarantee repayment of debt if countries issuing bonds default). External actors like the European Union which through the European Development Fund has had a multilateral instrument for conducting development policy negotiations with African countries (alongside Caribbean and Pacific nations) for decades is well-positioned to create an institution for helping Africa tap bond markets at much lower interest rates (ideally not higher than 2.5%). The new structure has to work on the principle of “selective integration” i.e. open to only countries who want to use Eurobonds to finance economically viable projects even if European funders have to invest in selling it to African governments and citizens. Europe would be doing for Africa what America did for it after the Second World War through the Marshall Plan when the Yankees’ European Cooperation Administration (ECA) produced a large publicity campaign comprising pamphlets, posters, radio broadcasts, traveling puppet shows, and over 250 films between 1949-1953 to convince Europeans of the wisdom to adopt American methods of managerial and economic organisation. The technical arguments about how to lower the interest African pay to issue debt on western bond markets are unassailable, the problem is selling them to African citizens and their governments.

This is so grim. Anybody who can see will know that we are in really terrible times right now. I wonder what sort of financial security an average Nigerian can embark on in the face of this looming catastrophe.

Why don’t we just do the sane thing of policy, infrastructure, and governance reforms that will actually better the economy rather than borrowing and incurring more debts and never using the loans wisely.

We are in trouble in this country.

African Leaders have poverty thinking value system, which is the major reason there is failure to create opportunities for revenue generation that can foster economic growth. For Nigeria as a Nation to do exceedingly well it has to do alot of decentralisation of economy monopoly in certain states and embark on well meaningful project that will have positive impact in the nation’s economic platforms.

Recently, the Nigerian Government flagged off billions of dollars pipeline project called AKK all in the name of Northern Nigeria industrialization, an environment that is not favorable for such massive project. In retrospect to other massive projects that has failed in the north and can’t fathom the fact that Northern Nigeria can’t be industrialised.

Bad government policy, poor education system and ineffective government reforms has been Africa Nations biggest problem.

Therefore there is need for a new breed of Leadership structures, government and economic policies.